Firms should understand cryptocurrencies, stablecoins, central bank digital currencies, and tokenized securities.

The financial landscape is undergoing a profound transformation, significantly influenced by the rapid rise of digital assets, from cryptocurrencies the tokenized securities. What once seemed a niche invention has quickly become an integral, albeit complex, part of the financial world.

This evolution presents both opportunities and substantial challenges for accounting firms, especially when it comes to reporting. In fact, due to the sensitive nature of the data they handle, accounting firms have seen a staggering 300% increase in cyberattacks since the start of the COVID-19 pandemic (Source: PureCyber).

The dramatic surge underscores the critical need for robust security measures in handling digital assets. Navigating this new, volatile, and highly sensitive territory requires accounting firms to go above and beyond to ensure clients’ digital assets are reported properly and securely.

While it’s a challenging task, it’s certainly not insurmountable. Thankfully, there are clear, actionable steps every accounting firm can take to make this complex process as seamless and secure as possible.

Let’s learn in this article!

KEY TAKEAWAYS

- Firms must thoroughly understand various digital asset types and blockchain basics before offering reporting services.

- Utilize specialized tools and technological advancements designed to safeguard systems and detect potential issues, ensuring smooth and secure operations.

- Implement robust network and hardware security, employ encrypted communication, and provide mandatory team training on wallet handling, phishing risks, and password security.

- Stay updated and compliant with evolving digital asset regulations, including tax reporting, AML/KYC requirements, FASB/IFRS guidelines, and regional rules.

- Don’t hesitate to seek advice from blockchain experts or hire a compliance officer specializing in digital asset regulations to navigate the complexities.

How Well Do You Know The Digital Asset World?

To master something, you primarily need to understand how it works. Before you even begin presenting digital asset reporting services, you first must be familiar with every inch of this landscape. For starters, you should:

- Get familiar with various sorts of assets, like Cryptocurrencies, stablecoins, central bank digital currencies, etc.

- Learn the basics concerning blockchain, such as public blockchain, private blockchain, wallets, and others.

- Since digital assets can be very volatile and liquid, it’s of immense importance to know how to value them the right way.

If you think that you’re not able to pull off all of this on your own, then you can regularly go through some thorough training or consult blockchain connoisseurs. They’ll be able to provide you with some helpful information when it comes to this.

Consider Resorting To Useful Tools

Things can be very uncertain in the digital world, and you can never tell if something bad is going to occur, which may lead to catastrophic consequences. Luckily, several tools are designed to reduce the damage as much as possible if your system (for whatever reason) “decides” to fail you.

If you’re not familiar with what we’re talking about, just visit their website, and you’ll see how specific solutions can safeguard your systems and, concurrently, ensure smooth and safe operation in these instances. Always keep in mind that these technological advancements are intended to identify any potential issues on time. At the same time, make sure every part of your system is kept safe and functions as normally as it can under the given circumstances.

Cybersecurity Must Never Be Overlooked

Security isn’t a duty that you may or may not prioritize. That’s one of the things that must come first, because, at the end of the day, digital asset management encompasses cash flow data that’s extremely sensitive, along with the cryptographic wallet keys.

If, by any chance, someone tried to steal that data, you’d encounter serious problems. Therefore, as a responsible accounting firm, you need to:

- Establish resilient network and hardware security, which typically combines things like antivirus protection, intrusion detection systems, firewalls, virtual private network, etc.

- Set up encrypted communication and identity verification solutions to ensure safe client onboarding.

- Make sure every member of your team obtains the right training, as far as this is concerned, because a single mistake (regardless of how seemingly benign it may be) can lead to an awful aftermath. Train your workforce on wallet safety, all kinds of phishing risks, and how to create passwords that are difficult to crack.

INTERESTING FACT

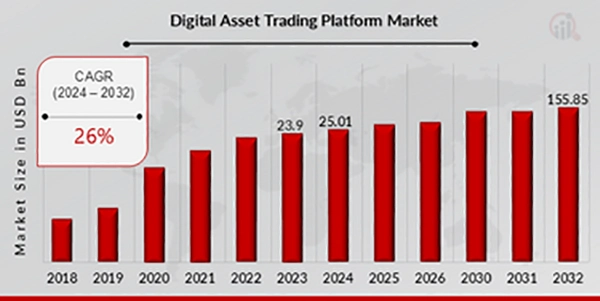

“The global digital asset trading platform market, a key component of the digital asset ecosystem, was valued at USD 2.49 billion in 2023 and is projected to reach USD 10.99 billion by 2033, growing at a CAGR of 16.01%”

The Importance Of Being Compliant

Different regulatory bodies and governments are constantly trying to keep up with all the alterations that unfold in the digital asset world. As a professional accounting firm, you are also required to do whatever is necessary to catch up with all these changes, and most importantly, always remain compliant with whatever rules and regulations you encounter. This refers to:

- Tax reporting duties, like IRS Form 8949 (this generally applies to those who live in the United States)

- Anti-Money Laundering and Know Your Customer requirements

- The Financial Accounting Standards Board is here to provide you with an insight into crypto asset classification

- MiCA, which is intended for those within the European Union

- International Financial Reporting Standards, keep back for digital assets

It also wouldn’t hurt to have a compliance officer in your corner who has lots of insight and expertise when it comes to digital asset regulations.

Those who have struggled with digital asset reporting will tell you that it’s far from smooth sailing, because there are different aspects of it that you must learn to properly manage. Since safety is the number one priority, it would be appropriate to take the aforementioned steps to ensure it.