“Accounting is not just numbers, but a solution to all business problems.”

— Anuj Jasani (Founder of BudgetOK)

My small business journey started in 2022. In these three years, I made various mistakes that put my venture at risk, but all these mistakes taught me a lot.

For me, accounting was that one factor that was all Greek to me. In the initial stages, I did not have an accounting expert on board, which not-so-surprisingly led to numerous blunders. So much so that at a certain point I started doubting all my decisions.

Well, this is common for small businesses. In fact, 22% of ventures fail in their first year, and this number reaches 50% by the fifth year. (Hostinger Tutorials: Small Business Statistics)

So, what are these common mistakes that should be avoided to ensure long-term success for businesses? Read on and find out as I tell you everything about it from my own experience.

Combining Personal and Business Finances

Keeping the professional and personal finances separate was always my goal, but somewhere between the business operations, I lost track of it, which ended up with my professional and personal finances getting mixed up.

This created unnecessary confusion, tax issues, inaccurate financial statements, and disruptions. In some extreme cases, it can even lead to legal complications.

To untangle this mess, I organized my system and opened a separate bank account exclusively for business purposes.

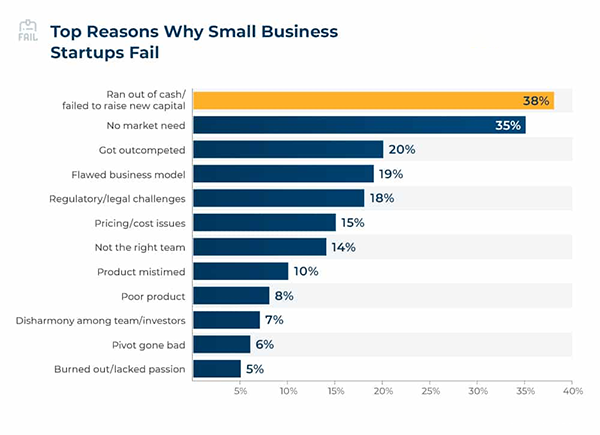

On that note, financial challenges are one of the biggest reasons for startups failing, as you can observe from the graph below.

Prioritizing Immediate Goals Only

Focusing on the latest goal led to several wrong choices, impacting future growth. By spending without planning and prioritizing the latest issues, I found myself in a critical situation, struggling with finances. That is when I turned to My Canada Payday for help. With their support, I saved my venture from failing and rise again.

Now that I am well aware of what such actions can cause, I plan in advance for all my business operations and also create a year-round tax strategy, which helps me stay ahead and ensure long-term success.

Ignoring Documentation and Receipts

Keeping track of documentation and receipts is essential for good accounting practices. Lacking adequate record-keeping brought several difficulties for my business, such as mismanagement of finances, poor decision-making, unnecessary complexities, and even missed opportunities for tax deductions.

Changing my approach and shifting to better solutions like using accounting software, storing digital copies of recipes and documentation, and regular reconciliation helped me track my documents and receipts better, positively impacting other accounting operations as well.

Avoiding Expert Financial Advice

Thinking that hiring a professional would be an expensive option, I decided not to consult an expert and manage accounting operations on my own. Needless to say, it wasn’t the smartest decision I’ve made concerning my business.

A professional can effectively guide you and provide you with the best solutions based on your situation. I lost huge amounts due to not having that knowledge and expert advice during such crucial times.

Realizing this mistake, I got a professional on board, and now I do not have to worry about missed opportunities and misjudgments under their guidance.

INTERESTING TIDBIT

60% of small business owners feel they aren’t knowledgeable when it comes to accounting.

Failing to Monitor Business Expenses Precisely

Understanding the income and expenses is important for business owners and for that effective accounting and bookkeeping is a must. In the initial stages of my venture, my teams often failed to monitor and record our expenses precisely. Which not only led to bookkeeping errors but also had a negative impact on our tax filings.

Now that I have installed and implemented effective monitoring systems, I observed that my teams now make improved accounting decisions about future projects and monetary processes are carried out more smoothly.

Poor Billing Management

Poor billing management was another accounting blunder that threatened the survival of my business. Inadequate billing management can result in customer dissatisfaction, loss of trust, operational inefficiencies, and lost revenue from credited amounts.

These can have a major impact on a business’s performance, as according to Statista, these are some of the major reasons that contribute to failures.

To optimize and improve our billing system, we introduced modern solutions that automate these processes and save us from such worries.

EndNote

Being a small business owner can be extremely challenging. Especially, when you start with limited resources, knowledge, and experience.

Managing accounting processes is a common struggle for numerous small businesses. After all, not everyone is well-equipped with the adequate knowledge to handle these procedures, which often results in errors.

Some common accounting errors include blurring the lines between professional and personal finances, prioritizing immediate goals, ignoring documentation, ignoring professional advice, inefficient billing management, and not monitoring the expenses precisely. These mistakes can turn into huge problems for your business and pose a threat to your venture’s survival.

I hope that the experience I shared in this article, helped you understand the impact of these errors and find the right approach to tackle them as well.