Accounts payable is a method that represents the money a company owes to its suppliers for the products and services that they have received on credit but haven’t been paid for yet.

In the world of business, managing money effectively is a core element for growth. Further, a fundamental aspect of this financial management is accounts payable. Now you might be wondering, what is accounts payable?

The accounts payable refer to the full amount of debt that is owed by the company to its suppliers and vendors. This process ensures a strong customer-buyer relationship while optimizing the cash flow.

To give you a better perspective on this idea, we have accumulated everything from accounts payable definition to accounts receivable vs. payable and even how it works in this write-up. So read mindfully!

Introduction to What is Accounts Payable

Accounts payable (AP) is an accounting term used to describe the money owed to vendors for the products and services purchased on credit. In other words, it is a short-term debt that needs to be paid within a specific financial period to the supplier by the company.

Now, this might trigger the question of ‘Is accounts payable a liability?’ To which the answer is yes, as liability represents an obligation or debt that hasn’t been paid yet.

The accounts payable signifies the company’s promise to pay for the materials they have already received. Moreover, AP is represented as a current liability on the balance sheets, meaning a transaction that is yet to happen within a 12-month span.

For example, a clothing manufacturer receives a shipment of new dresses from their raw material supplier. The supplier includes an invoice for $2000, which is due in 30 days. So the manufacturer is permitted to make use of the goods; however, they need to pay the amount by the interval of 30 days.

Additionally, the particular invoice amount is listed under current liability in the manufacturer’s balance sheet until they pay off the money.

How Does Accounts Payable Work in Business?

The flow of goods and services is constant in every business, and it comes with the responsibility of managing payments to the suppliers. In this mix comes the role of accounts payable, which is a systematic process of taking shipments on credit.

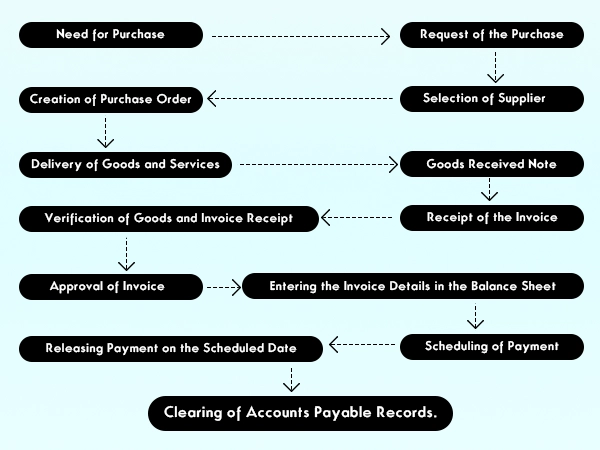

To offer a better overview, we have broken down a case study along with a graphical outline of this accounting process.

| Case Study: Let’s say XYZ is a tech-based company that deals in custom software programs. They recently needed to purchase an internal server to handle their increased data processing queries. For this reason, their purchase department releases a purchase order to the ABC organization for new servers, specifying their model, quantity, price, and payment term, which is 45 days. When ABC delivers the materials to the XYZ company, XYZ’s receiving department confirms and checks the condition of the server, further generating a goods received note (GRN). Once this is processed, ABC sends an invoice for the total paid to XYZ’s finance department. The finance team then performs a three-way match, where they compare the original purchase, the goods received note, and the invoice. After these are matched, the invoice gets electronically routed to the person in charge of the purchase and to the finance team. Once all parties involved approve the purchase, the payment is listed under the balance sheet and marked as a current liability and scheduled for a term of 45 days. On the 43rd day, XYZ initiates a fund transfer in the electronic mode to the ABC company. At last, the payment reduces XYZ’s cash balance while simultaneously reducing its accounts payable liability to the ABC organization on XYZ’s balance sheet. |

As per the above-mentioned case study, the flowchart of the accounts payable would be

Accounts payable is a multi-step process that extends beyond the simple bill payment. From the initial need of a product to the final disbursement of cash, the entire method is important for maintaining financial integrity.

Accounts Payable on Balance Sheet

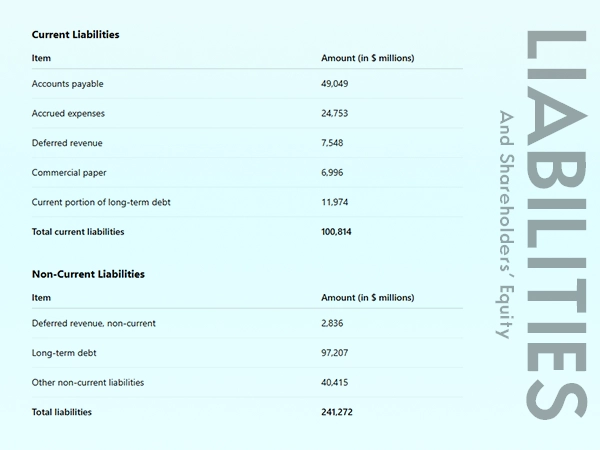

A balance sheet of a company offers a list of its financial position at a specific point in time. The accounts payable is a statement that holds a prominent place under the section for current liabilities. Further, it is a direct indicator of all the pending payments that are yet to be disbursed by the company’s end.

Additionally, it impacts the working capital and liquidity. Here is how these aspects influence.

Impact on working capital: To calculate the working capital, we’d have to deduct the amount of current liabilities from current assets. The accounts payable increases the overall accounts payable; further, it raises current liabilities. This strategy allows for holding cash longer while providing interest-free short-term financing. After the payment is processed, the amount of the current liabilities decreases.

Impact on liquidity: Liquidity can be described as a company’s ability to meet its short-term obligations. In this, the accounts payable acts like a management tool for negotiating longer terms for payments with suppliers, further allowing the organization to capitalize on the funds that are already in their bank accounts.

By paying the accounts payable, the company sees an immediate reduction in immediate cash liquidity. Moreover, it allows them to take advantage of the discounts on making payments earlier than promised.

Accounts Payable vs. Accounts Receivable

Two core accounting concepts that hold great value and are totally poles apart are the accounts payable and accounts receivable. While one is the money owed to the suppliers, the other one is the money the vendors owe to an organization.

In this section, we have listed a table displaying accounts payable vs. accounts receivable to help you understand both concepts more comprehensively.

| KEY ASPECTS | ACCOUNTS PAYABLE (AP) | ACCOUNTS RECEIVABLE (AR) |

| Definition | Money an organization owes on credit. | Money owed to a company by its vendors. |

| Nature | Outgoing funds. | Incoming funds. |

| Classification Balance Sheet | Short-term debt or current liability | Current asset or short-term claim |

| Represents | The obligations to pay for the purchases made. | The claims (in terms of money) to receive for the sales made. |

| Role in Business | Manages what the company has to pay. | Manages what the company has to collect. |

| Increase in Balance | Occurs when the company receives an invoice from suppliers. | Occurs when the company sells goods or services on credit to a customer. |

| Decrease in Balance | It happens when the payment is made to the vendor. | It happens when a company receives a payment. |

| Normal Balance | Credit balance. | Debit balance. |

| Parties Involved | The buyer | The customer |

| Primary Document | Supplier’s invoice | Sales invoice |

| Key Goal of Management | Ensuring timely payments.Avoiding late fees.Maintaining supplier relationships.Preventing fraud. Optimizing the payment terms. | Ensuring the timely collection of payment.Minimizing the risk of debt.Improving cash flows.Maintaining customer relationships. |

| Risk Associated | Late payment fees.Strains in vendor relationships. Damage to creditworthiness. Potential for fraudulent activities. | Uncollected payments.Shortages in cash flows.Need for collection efforts. |

| Department Involved | Accounts payable department. | Accounts receivable department. |

| Example | A bakery buying flour from the supplier on credit. The amount owed to the flour vendor is accounts payable. | A bakery sells a custom cake to a corporate client on credit. The amount is owed by the client, and it is under accounts receivable. |

You can tell by this accounts payable vs. accounts receivable table how both of these are core components, having vast differences between the two.

Examples of Accounts Payable Transactions

The accounts payable transactions happen whenever a business receives goods and services from a supplier on a credit basis, making the payment status due for later. In this part, we have explained this process with some examples from various fields.

| NATURE OF PURCHASE | EXAMPLE |

| Inventory | A store dealing in clothing receives a package of raw materials from the supplier. They also receive an invoice with the amount ($250) and the term of payment (60 days) mentioned. Accounts Payable Amount: $250 |

| Subcontractor Services | A digital marketing company hires content writers for content creation. After receiving a certain number of blogs, the writers send an invoice for $2200 which is due in 8 days. Accounts Payable Amount: $2200 |

| Office Supplies | The KLM company puts an order for new paper, pens, and printer cartridges from a supply company. Upon delivery of the products, they receive an invoice for $400, to be paid within 30 days. Accounts Payable Amount: $400 |

| Utility Bills | A manufacturing plant receives its electricity bill for $6200. This was a monthly bill for the electricity consumed over the period of the month. Moreover, the bill is due by the end of the next month. Accounts Payable Amount: $6200 |

| Marketing Services | WXY is a software company that has just hired a freelance graphic designer for the creation of their new logo. Once the logo is delivered, the designer sends a receipt for $740, due in a period of 7 days. Accounts Payable Amount: $740 |

| Payment for Lease | LMV is a logistics company that leases out delivery trucks for their work. They receive a monthly invoice for $680, which is always due on the 15th of every month. Accounts Payable Amount: $680 |

| Reimbursement of Employee | An employee submits an expense report for $160 for the meals covered during traveling for business. After approval, the company owes an additional $160 to the employee. Accounts Payable Amount: $160 |

These were some scenarios where companies take supplies on the terms of accounts payable.

Why Does Efficient Accounts Payable Matter?

Accounts payable is a strategic scheme and a way for a company to manage its operational efficiency while maintaining a competitive edge. From directly influencing the cash flow to safeguarding it against financial risks, this financial thing can do it all.

Below mentioned are a few pointers on why having efficient accounts payable matters.

- Optimizes the flow of cash, making it stay longer with the organization.

- Improves liquidity by ensuring the short-term obligations are met.

- Prevents costly interest rates and avoids late fees.

- Directly boosts profitability by reducing costs on early payments.

- Strengthens supplier relations and creates goodwill.

- Maintains reliable access across the supply chain for stability.

- Increases accuracy in all the financial statements.

- Offers clear insights and supports budgeting.

- Streamlines audits by making the verification process easier.

- Prevents controls over illicit payments and fraudulent activities.

- Avoids the risk of errors through robust checking.

- Helps in strategy building and making informed financial planning.

- Reduces the risk of human errors and mistakes.

- Enhances reputation and projects a positive image.

Other than these, this accounting process assists the accounts in adhering to the accounting standards and tax regulations.

Common Challenges in Accounts Payable

Despite being a crucial component for managing a business’s financial operations, the entire working of the accounts payable is very difficult to comprehend and manage. Here are a few challenges associated with the workings and process of accounts payable.

- Heavy reliance on manual processes and paper invoices.

- Insufficient technology to streamline an effortless workflow.

- Slow processing and delays in obtaining approvals.

- Issues with matching the products and invoices.

- An overwhelming number of invoices are being handled every day.

- Mistakes in data entries and calculations.

- Information is scattered across multiple spreadsheets.

- Difficulty in tracking the real-time status of payments.

- Vulnerability to duplicate payments or fraudulent invoices.

- Poor communication channels with suppliers.

- Issues with ensuring payments to avoid penalties and discounts.

- Compliance with adherence to tax regulations.

- Difficulties with handling increased amounts of volume.

- Excessive operational costs due to inefficient processes.

- Protects sensitive financial information from breaches.

- Failing to capitalize on early payment discounts.

By understanding these common issues firsthand, it allows for streamlined and effective accounts payable functions.

Modernizing with Accounts Payable Automation

Accounts payable automation is the process of utilizing technology to digitize, streamline, and automate various tasks within the accounts payable strategy. This part of the accounting begins from the moment an invoice is received to when the payment is made and recorded.

Moreover, this process effectively replaces manual, paper-based, and often error-prone operations with intelligent and end-to-end digital workflow. The primary goal is to enhance efficiency while reducing costs and enhancing the chances for financial visibility.

To get a better perspective, here is a breakdown of the benefits offered by the automation process for accounts payable.

- Significant reduction of processing costs.

- Increased capture of early payment discounts.

- Avoids the chances of late fee payments.

- Faster invoice processing and approval cycles.

- Eliminates the chances of human errors.

- Reduces the overall time of matching invoices and receipts.

- Strategic management of the timing of payments.

- Leverages the possibilities of early payment discounts.

- Enables the foundation of trust while giving better terms for negotiation.

- Allows handling a wide number of invoices across the dashboard.

- Adapts to the changing business needs.

- Compliance with the tax regulations.

- Simplifies the process of auditing and saves time.

- Removes the repetition of similar work.

- Reduces the stress and frustration involved with manual processes.

As you can tell, the process of accounts payable automation is ideal for scaling businesses by handling the increased amount of invoices without any increase in staff numbers.

Wrapping Up

Accounts payable is a broader concept that exceeds the boundaries of outgoing payments. It makes use of an accurate management system that optimizes cash flow and enhances liquidity while maintaining strong relations with suppliers. Further, with the advent of AP automation, your organization offers transformative benefits like fraud prevention, scalability of business, and reduction of costs.

Frequently Asked Questions

- Introduction to What is Accounts Payable

- How Does Accounts Payable Work in Business?

- Accounts Payable on Balance Sheet

- Accounts Payable vs. Accounts Receivable

- Examples of Accounts Payable Transactions

- Why Does Efficient Accounts Payable Matter?

- Common Challenges in Accounts Payable

- Modernizing with Accounts Payable Automation

- Wrapping Up

- Frequently Asked Questions