Ready to take control of your retirement future?

I’m the type of person who forgets about the past, takes care of the present, and plans for the future. I’m not so old, but I have an Idea of how my life will be after retirement. I will be touring around the world. Wait, you think that’s impossible? Well, guess what, an annuity can make this possible.

They can be explained as Life annuities – financial products that help individuals convert a lump-sum of wealth into a guaranteed life-long income stream – have an important role to play in providing a secure source of retirement income. (ResearchGate: Financial Education and Annuities).

So, on to our main topic, in this article, I will tell you about annuity basics, how they work, and why they matter for your retirement. So if you want to secure your future, pay attention and read till the end.

Crediting Methods

The first thing to know about fixed annuities, which is a popular type, is that for the first period at the very least, they credit interest at a guaranteed rate. You must take time to understand crediting methods whenever you open an insurance policy because they determine how your annuity’s interest is credited.

In other words, crediting methods impact your returns. Certain crediting methods give greater returns during good years, while others are more stable and consistent throughout, but the returns are never massive, even in good years.

Consistent Income

The thing that makes annuities such a popular investment for people, especially retirees, is that they provide a consistent, steady flow of income. Money is hard to come by for a lot of people right now, so investing the earnings you do have into retirement accounts can be a great way to ensure that in the future, you are financially protected.

While lump-sum payments might not be enough to live off of, they can still be a fantastic source of capital and can yield profits for years to come. Make sure to research annuities and shop around so you can get the best one for you.

DID YOU KNOW?

Annuities have been issued since the Roman Empire, but the earliest record dates back to the United States in 1720!

Protecting Principal

Unlike other investments, some annuities provide withdrawal protection, which means that even if there are losses in the markets you have invested in, your retirement funds won’t lose their value. When there are gains, however, they will be added to your annuity’s initial amount.

If you want the least risky rental contract you can get, find one that offers upfront protection. By protecting your principal, you will be able to ensure that your account only increases in value, and never decreases. There are still risks to other types of financing that you should educate yourself on before taking one out.

Greater Flexibility

Annuities are a highly flexible form of investment, mainly because you can choose how much revenue you start within your account and increase it as you see fit. You’re also given numerous investment choices, so you can make effective decisions relative to where and how you put your money.

You also get guaranteed periods that can last for several decades, which means that if you die before your period ends, your income will still be paid, which can provide relief to your loved ones in the event of your death.

Talk to an investment planner prior to taking an annuity out, just so you can be sure you get the right one for you.

Retiring Comfortably

Retirement is something that a lot of young people do not think about. However, there is inevitably a point in a person’s life when they can no longer work. Annuities are a great type of deposit for people who are planning for the future because payments can be spread out over a long period.

It’s important to choose the best annuity, and an appropriate financial advisor for you, however. The contractor you ultimately work with can have a massive impact on your trading experience.

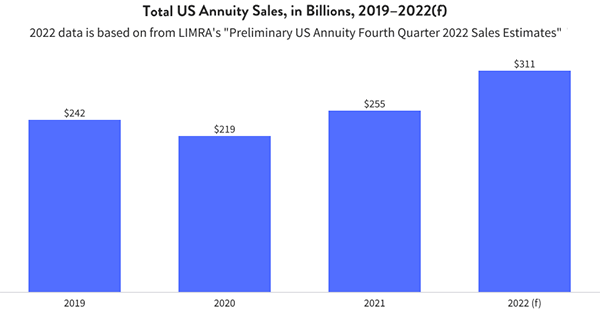

There are many different lenders operating today, so you need to shop around and find the perfect one for you. If we look at previous records in 2022 over $311 billion was issued under annuity.

Selecting a Provider

Selecting an insurance sponsor isn’t easy if it’s not something you have had to do before. If you are interested in opening an annuity account, the first thing you need to know is that reviews are everything.

A provider’s reviews can give you a lot of insight into what working with them is like. As well as reviews, you need to make sure that your investments are protected with the service firm you plan on working with.

By protected, this post means protected from the provider’s business failing, not market changes. You can’t always predict and protect against market losses, but that is the nature of investing.

The only way to protect against losses is, as mentioned above, to open an account that provides principal protection. Even then, you can still lose profits if markets underperform.

Such contracts are a popular, profitable form of speculation. If you are looking for places to put your money to secure a comfortable retirement, perhaps now’s the time to look into them. Hopefully, this article has given you some insight into the benefits of annuities and what they offer compared to other savings accounts.