Everyone dreams of having a successful business someday, and only some can make that dream come true. When you open a business, and it is working well but when you decide to expand it you realize you are short on money.

You have a great business, but now money is an issue, what would you do? Close it? Obviously no, at such time you will try to get investors by offering private equity. Right?

One of the great American investors, Jim Rogers, once said, “I think this is also a great time to invest in private equity, helping companies grow from the ground up.” His statement made it that clear private financiers can help companies grow.

But is your business ready for private equity investment? In this article, we’ll tell you everything you should know before giving your business private equity.

Assess Your Business Growth Potential

Before you should even contemplate whether you need more cash to grow, your initial steps should be to assess the potential your company has to grow. There is no use in putting the horse before the cart, and if you perform this research and find out that the segment you own has limited room for growth.

You may discover that you aren’t as desirable for private investors as you might have believed. Conversely, if the market is wide open, and you have the chops to see a plan through, this route will suddenly emerge as far more interesting to all parties involved.

According to these Minnesota private equity firms, the idea is to form a partnership that secures a consistent, long-term approach to growth that ensures you can meet demand effectively without overheating your business. Once you have assessed your growth potential, you can move on to the next steps.

Evaluate Current Financial Health Metrics

No private equity business will want to invest in you if your investments are less than desirable. There is a bit of a caveat in this: if your company has ambitions but is currently floundering for whatever reason, private investors may choose to look at the overall picture and make a bet based on the idea of turning things around.

However, that caveat would also mean that you will probably have to give up more money to cover the risk the investors are taking, and you may also be required to replace your existing board with those chosen by investors, putting pressure on you to place in those they deem more capable of carrying through any reforms required.

Identify Competitive Advantages And Disadvantages

Although searching for competitive barriers may seem a little odd if you’re seeking capital from outside courses, they can play into your strengths. For instance, if you already know that your opponent has you beaten in several ways, you can begin devising strategies to remedy this situation.

You can also note in your report how the additional funding you’re seeking could help you reach this point. By knowing where your shortcomings lie and that you have a plan to fix them, you can prove to your financiers that you are ready to invest their capital and your time into generating more revenue by following through on your plan.

Moreover, if a disadvantage happens to be that you are spending too much, you can figure out ways to reduce spending, thereby increasing your bottom line. Something very desirable to investors. When it comes to advantages, this is simply a way to show how valuable your company is based on a range of factors.

This could be the number of customers and their requisite approval, the fact that you are only one of few businesses in a local area offering a product or service, or anything else that can put you and your business in a good light.

DID YOU KNOW?

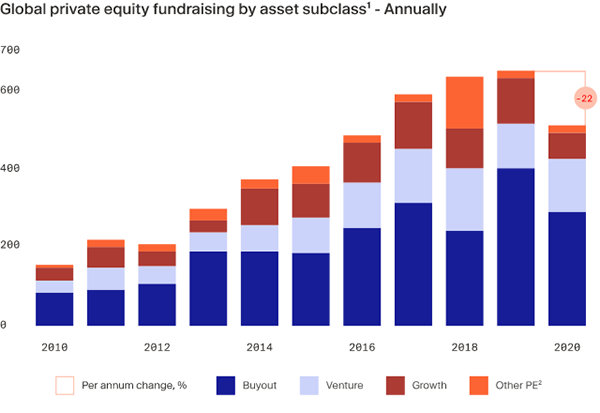

So far in 2024, the global Private Equity market is valued at $540.72 billion.

Gauge Customer Base Stability And Loyalty

Your customers are ultimately the ones who are buying your products and creating profit and prosperity. Before accepting a funding round, it’s wise to gather data on who your customers are, and whether they’re stable.

If they are loyal or are only spending money on your business because none other exists. Once you have this data, you can explore ways to either boost loyalty or offer them more incentives to keep shopping with you.

Consider Potential Exit Strategies For You And Your Investors

You need to be confident enough to know that opting for a finding round from a private securities company will force you to give away an often significant amount of equity in the very thing you have built up over the years. Therefore, it’s a good idea to look at how you or your investors might exit the deal.

This could be propelling the businesses to new heights and then selling the remainder of your share to the owner’s company or seeing if there is any chance that you could buy them out when things start taking off. Knowing whether you’re ready to accept third-party equity funding is not something to be taken lightly, and it requires a deep dive into all your daily activities.

However, if you feel that you’re ready and are trustworthy enough for investors to trust their money with you, you can find this cash injection allows you to turbocharge operations and build up bigger and stronger.