You need to add all the cash inflow and outflow for business operations.

How money moves in and out tells a lot about the business’s position. Not having the proper idea of it can put your business in danger. What’s the way out, then? Preparing a cash flow statement is your solution. It keeps a check on the liquidity, i.e., the exact cash you have.

Well, this might sound quite complex, but you can easily learn it. We have covered a money flow definition along with a financial statement example that will help you make one for your company too.

Read this blog carefully and note the important points.

What is a Cash Flow Statement?

Having a clear idea of the concept is critical. So here’s the simple definition:

This financial statement tracks the money coming in and going out. It looks over the transactions done through operations, investments, and financing activities within a specified timeframe. You can calculate the cash flow based on weekly, monthly, or quarterly inputs. Unlike the balance sheet and income statement, which display different aspects of financial information, the cash flow statement focuses solely on one aspect.

How much money/cash do you have in hand to keep the company running? Think of it this way: As tax consulting and filing are important for your business’s success, so is the cash flow statement.

Importance of Cash Flow Statement

Managing the cash flow statements holds a big significance in accounting services as it keeps the business up and performs better in the future. It is also one of the contributing factors while scaling or expanding the company.

Here are more points signifying the importance of a cash flow statement:

- Insights into Liquidity: It shows the real money that can be used for expenses, investments, or debt payments. Understanding your available funds is essential for both everyday tasks and future strategy formation.

- Financial Overview of the Business: It adds up to the income statement and balance sheet by noting all non-cash transactions, providing a more accurate view of your financial status.

- Predicting and strategizing: Businesses can use previous cash flow information to predict future trends. As a result, more deliberate business financial planning and resource distribution will take place.

- Loan and Investor Requirements: A cash flow statement is usually necessary for lenders and investors when determining the capability of repaying loans or generating returns.

These are the points that prove the cash flow statement is essential for every business owner.

Cash Flow Statement vs. Other Financial Statements

Just like this cash statement, other financial statements play an important role in the accounts segment of the company. People often confuse the terms and overlook the cash flow reports. Here’s a clear projection of how the cash statement stands with other financial reports.

Cash Flow Statement vs. Balance Sheets

| Cash Flow Statement | Balance Sheets |

| Gives a clear idea of cash activities over a period. It describes the operational, investment, and other cash movements. | Gives a clear depiction of assets, liabilities, and equity of a particular period. |

Cash Flow Statement vs. Income Statement

| Cash Flow Statement | Income Sheets |

| It looks over the account statement and keeps a check on accurate cash availability. | It records the income and expenses of the account which might not be related to the cash available. |

All these reports give a brief of different aspects of finances. Thus, you must not overlook any of them while auditing.

Components of Cash Flow Statements

These statements are made primarily based on these three components:

Operating Activities

This section reflects how the cash is generated through the services or products of the business. It simply tracks the cash received or spent during regular operation.

- Revenue from sales.

- Income tax payments.

- Paying off the suppliers and vendors.

- Salaries and wages of the employees.

- Loan statement, debt, and equity records.

Investing Activities

This section reflects on the investments made. Be it, purchasing tools, giving loans to vendors, money received from customers, or investments made in cash.

- Buying equipment.

- Selling assets.

- Acquiring other businesses.

Financing Activities

It reflects the sources of cash from investors and banks. It includes dividers, repurchases of stocks, or money related to funding.

- Loan amount.

- Equity funds.

- Debt repayments.

This is what makes up the whole cash flow statement. Moving ahead, let’s look at the types of preparation methods in the next section.

Types of Methods to Prepare Cash Flow Statement

There are two methods to prepare the cash flow report. One is Direct, and the other is the Indirect method. Let’s understand each of them here:

- Direct Method: It records cash transactions as they occur. One needs to record all cash receipts and payments. This one gives a more detailed view but is more time-consuming.

- Indirect Method: It is a simpler version of the direct method. It consists of an income statement and records for non-cash transactions and changes in working capital. This one works best for small businesses.

Both of the methods are equally reliable, so you choose whichever works best for your business. Moving ahead, let’s learn how you can create it in the next section.

How to Create a Cash Flow Statement?

This document is an essential tool for your business as it will record all the transactions and monitor its financial health. Here are the steps to create the cash flow record:

Step 1: Know the Purpose

Decide if the statement is about the cash spent, received, or for any funding you have received. It is good to have different track records where you can view the financials.

Step 2: Gather the Information

Keep track of revenue, expenses, assets, liabilities, and interest rates, and write it all down. Make sure to categorize each transaction into different categories.

Step 3: Choose a method

Select the method of calculation. Choose between Indirect and Direct methods.

Step 4: Organize cash flow activities

Use the formula: Cash Flow from Operating Activities + Cash Flow from Investing Activities + Cash Flow from Financing Activities = Net Cash Flow.

Step 5: Calculate and identify the statement

Using the cash flow formula, calculate to get the solution. Upon analyzing the result, understand your financial health:

- Positive Cash Flow: Has liquidity and shows the ability to invest and pay off debts.

- Negative Cash Flow: A negative balance requires adjusting expenses and might need funding.

That’s it, by following the above-written steps, you can create a cash flow statement easily.

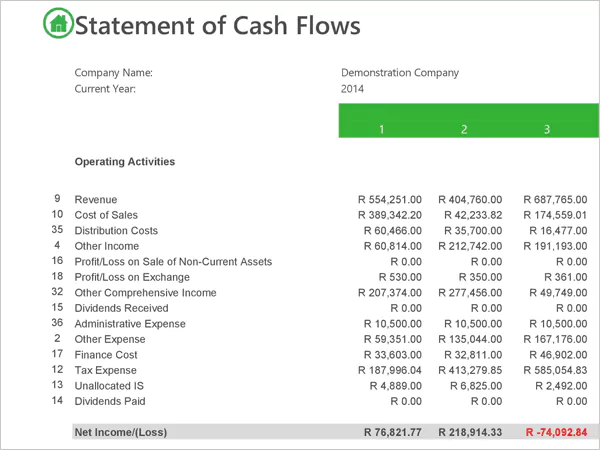

Financial Statement Example

To understand how to create a financial statement, let’s take an example. Suppose you have to make a report for the brand name: Shelly Exports for January.

| Category | Amount |

| Operating Activities | |

| Net Income Depreciation Increase in Inventory Cash Flow from Operating | ₹50,000 ₹5,000 (₹10,000) ₹45,000 |

| Investing Activities | |

| Purchase of Equipment Cash Flow from Investing | (₹15,000) (₹15,000) |

| Financing Activities | |

| Loan Proceeds Loan Repayments Cash Flow from Financing | ₹20,000 (₹5,000) ₹15,000 |

| Net Cash Flow | ₹45,000 |

You can use online tools to calculate the cash flow reports. Doing this regularly will help you identify the situation of your business.

Limitations of Cash Flow Statements

Even though these financial reports work best to monitor the ash flow of your company, there are some limitations to it that you must know about. Here we have written all of them:

- It can not work as a substitute for a balance sheet or income sheet. So it is an added workload and a lot of calculations.

- The answer may differ depending on the data you put and may cause errors. Thus, you can not rely on it completely to know the company’s liquidity.

- These formulas and methods have never been updated and are somehow not compatible to keep up with new business methods.

You can not refer to these financial statements to judge the profitability of your business.

These are the few challenges of cash flow statements that you need to note.

So this was all about money flow simple definition, how to create one, benefits, and drawbacks, methods, and how to use it for your business. As we have explained everything, we hope this blog will guide you to keep track of your company’s financial health.