Financial services or, say, accounting services can be of great help if you are having some trouble with your business’s funds. I recently opted for a financial service to manage my business’s accounts. Fortunately, the service provider was experienced enough to provide me with deep insights into how my company funds are doing.

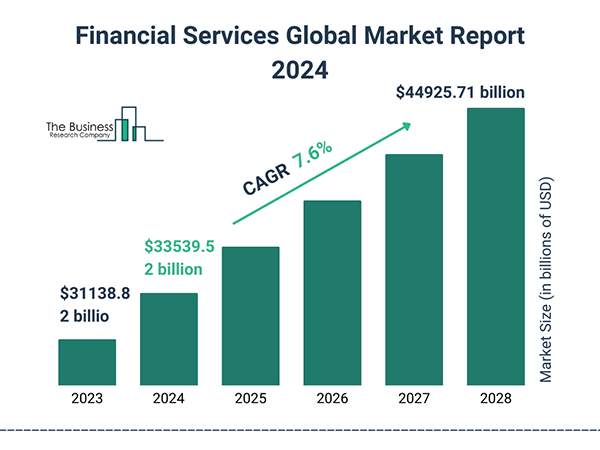

Speaking of the market, the financial service market is already valued at $33539.52 billion in 2024 and is growing exponentially with a rate of 7.7% CAGR (The Business Research Company).

These services are indeed fruitful for your business, but choosing the right service provider is a task in itself.

Hence, I am writing this article with experience, and to guide you through some basic principles when selecting a financial service.

Understand Your Needs

Your business may face different challenges from mine, and you may have different expectations from it. Likely, the year-end accounts and CT returns services and financial experts at your enterprise must be capable of shaping a master plan that can help your enterprise achieve that goal.

These goals can be reducing miscellaneous expenses, increasing business investments, etc.

For that, you must go for a service with experience and insights. If your company lacks someone with deep knowledge of money, there are various outsourced cfo service options that can do the job for you.

Cryptocurrency investment is becoming a significant sector within financial services. When considering options for securing and growing your retirement savings, crypto IRAs offer unique advantages by combining tax benefits with the growth potential of cryptocurrencies. For example, identifying the best crypto IRA companies can significantly impact your investment portfolio’s success. By choosing a leading provider, you incorporate security, diverse cryptocurrency options, and competitive fees tailored to your financial goals.

Research Provider Credentials

Once you identify your needs and expectations from the firm, it’s time to enter the world of service providers and look for one for yourself. Like any other product, you must research when you explore different options.

If you have already found the one that suits your needs, look for its online reviews and the experiences of its customers. These service providers also share some of their client testimonies and real-life case studies that they have worked on.

If everything looks good to you and the reviews are also positive, that service provider might be the right choice for you.

Consider Transparency in Fees

Now that you have finally found a service that is the best fit for your goals and needs, it’s time to negotiate of the prices that your firm is going to pay. It is the best idea to negotiate the pricing in advance to save on the budget and misunderstandings in the future.

You must have a formal fee schedule on your side so that everything is recorded in real time and each payment is legitimate with real-time updates.

Evaluate Communication and Support

Communication is important at all stages. A business that thinks that its work is done once the sale is made, is not looking for long-term operations. For a business, customer relations is an utmost priority, and for that, communication and support must be provided throughout the journey.

Hence, since you are going to be the client of the service provider, make sure that they provide a smooth exchange of dialogues with their client. They should also offer an optimum amount of support throughout the term you are operating with them.

Assess Technology Capability

With all the fintech revolution, managing accounts has become way easier and more precise than ever before. Also, modern software made it significantly quick to do all the calculations and equations.

INTERESTING FACT

The US fintech market is already valued at 25.18 Million in 2024, and is projected to grow to USD 644.6 Million by 2029.

Make sure the service you are going for leverages this software effectively. Even with modern AI and ML algorithms, accounts are managed with ease. There are just a few areas where it still takes some logical reasoning and decision-making. For that, the expert employees are there to help.

Not only it will make operations quicker, but will also help you to make quick and viable financial decisions.

Look for a Personal Connection

Finally, all these principles are just technicalities of the industry that need to be taken into note. However, the most significant principle that you must focus on is the relationship with your service provider. This connection can be in any service, like outstanding AP and AR service.

If there are no fruitful relations between the service provider and the client, there will be no fruitful outcome. Hence, focus on picking the right service and making the right moves along with them.