Because a private association, not the county, collects the money. The IRS treats those dues as personal upkeep, just like cable, internet, or lawn care.

Florida condo fees average $230 a month, nearly double the national median, so it’s natural to ask: Are those dues tax-deductible? No, if the condo is your primary residence, the IRS treats the payment as a personal expense. The silver lining: landlords, true home-office users, and a handful of niche scenarios can still claim a break. This guide maps every exception, explains Florida’s new reserve-fund rules, and shows smarter moves that could shrink your 2026 bill.

Condo Fees 101: What They Cover And Why Everyone Assumes They’re Deductible

Every Florida condo owner pays a mandatory monthly fee that keeps hallway lights on, trims landscaping, funds the association’s insurance policy, pays on-site staff, and builds the reserve fund for major repairs.

Because missing a payment can trigger a lien or even foreclosure, the fee feels like a tax. Skip it, and you could lose your home, so many owners assume the IRS treats the charge like property taxes.

Here’s the key difference: property taxes flow to a city or county for public services, while condo dues go to a private board that maintains your building. To the IRS, that distinction makes the payment a personal living cost, no different from your electric bill.

Florida’s condo culture amplifies the confusion. The state hosts nearly 49,000 homeowner and condo associations, covering about 9.6 million residents, and myths travel fast at poolside chats and community forums. If you’re buying a condo, review HOA budgets and reserve studies before making an offer.

Your Home, Your Condo Fee, And The IRS Wall Of “No”

The IRS is blunt: “Homeowners’ association assessments are not deductible if the property is your residence.” IRS Publication 530

Why? The agency treats condo dues like paying the electric bill or repainting the bedroom, routine upkeep that supports daily life rather than a tax or income-producing cost.

Example: Suppose you own a Miami condo you occupy all year and pay $300 a month in dues. The $3,600 you spend in 2026 is personal spending. It appears on zero lines of Form 1040, so there is no Schedule A and no Schedule E entry.

The rule often surprises Floridians, especially when fees cover trash pickup, security, or shared insurance. Intent outweighs service; because a private board, not city hall, imposes the charge, the payment stays on your side of the ledger.

Bottom line: When the condo is your home, the monthly fee sits beside groceries, streaming subscriptions, and lawn care in the bucket labeled nondeductible. Keep that principle handy as we explore the exceptions that can tip the scales in your favor.

When Condo Fees Do Become Deductible

1. Rental Property: Turning Dues Into A Business Write-Off

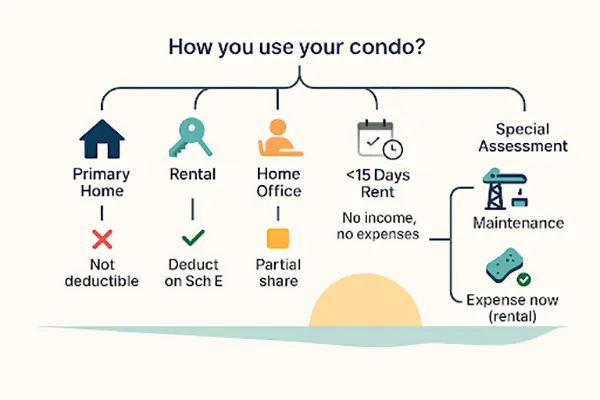

Convert your Florida condo from personal haven to income source, and the IRS flips the switch: association dues become an ordinary and necessary rental expense you can claim on Schedule E.

Rent the unit all year and deduct 100% of the fees. If you rent for only part of the year, prorate by days. For instance, annual dues of $4,200 and 180 rental days translate to about $2,058 in deductible expense (180 ÷ 365 × $4,200).

Short-term landlords need to remember the fourteen-day rule: rent the dwelling fewer than fifteen days in a year, and you report no income and deduct no expenses.

Keep HOA statements and lease records; list the amount under “Other expenses” on Schedule E to breeze through an audit.

2. Home-Office Carve-Out: Claiming A Slice Of The Fee For Work

If you are self-employed and use a room regularly and exclusively for business, you may deduct the matching share of condo dues. Measure the office, divide by total square footage, and apply that percentage to annual fees. A 10% office on $3,600 in dues yields a $360 deduction. Figure the amount on Form 8829 and carry it to Schedule C.

Employees on a W-2 cannot claim this break until at least 2026, when the suspended miscellaneous deductions are scheduled to return. In the meantime, solid documentation such as a floor plan, square-footage notes, and HOA statements will turn any future IRS query into a quick check rather than a migraine.

Special Assessments And Reserve Hikes: Why The Big Bills Still Miss The Tax Cut

Florida’s post-Surfside safety laws now require hefty reserve funding, and some associations have levied one-time special assessments of $20,000 – $100,000 per unit, according to IRS Form 4562 instructions.

Personal residence. Pay that lump sum on a condo you live in, and the IRS treats it as a capital improvement, not a tax deduction. Keep the receipt; the amount adds to your basis under IRS Publication 551 and can trim future capital-gains tax.

Rental property.

- Routine maintenance (for example, repainting common halls) — deduct right away on Schedule E.

- Capital upgrades (for example, a new roof or elevator) — add to basis and depreciate over 27.5 years as residential rental property per IRS Publication 527.

Reserve contributions folded into monthly dues follow the same logic: no break for personal use; deduct or depreciate when the condo is a rental.

Bottom line: Writing a large check stings today. Landlords recover the cost through depreciation, and homeowners usually recoup it when they sell, so do not expect a quick April refund.

Florida-Specific Pitfalls Every Condo Owner Should Know

Florida levies no state income tax, so your HOA dues never appear on a state return. The federal rules we have covered remain your only guide.

Homestead Exemption savings can disappear. Florida’s Homestead Exemption can subtract up to $50,000 from assessed value and save hundreds of dollars each year, according to the Florida Department of Revenue. Rent the unit for more than 30 days per year in two straight years, and the state views that move as abandoning the homestead under Florida Statute 196.061. Lose the exemption, and any Schedule E write-off may be canceled out by higher property taxes.

Insurance is often baked into dues. Many coastal associations fold hurricane or flood coverage into the monthly fee. Bundling does not change deductibility: personal owners still cannot claim it, while landlords place the full HOA payment, including embedded insurance, on Schedule E.

Budgets will keep climbing. Rising sea levels, stricter reserve laws, and costlier reinsurance deals push fees higher each year. Before you buy, or vote on the next large project, ask the board for reserve studies, inspection timelines, and projected dues so you can judge whether a rental or home-office strategy still makes sense.

As you price options, listings from the South Florida real estate brokerage like SquareFoot Homes include the monthly HOA or condo fee for each property, which helps you budget total housing costs.

What You Can Deduct Instead: Real Breaks Still On The Table

Condo dues may be nondeductible, but plenty of homeowner costs still shrink your tax bill.

- Mortgage interest. Itemizers may deduct interest on up to $750,000 of home-acquisition debt for loans taken after December 15, 2017. The limit is scheduled to revert to $1 million in 2026, per IRS Topic 505 and the Form 1098 instructions.

- Property taxes. State and local taxes, including property levies, are capped at $10,000 per return. The SALT ceiling expires after December 31, 2025.

- Energy-efficiency upgrades. Under the Energy Efficient Home Improvement Credit, you may claim up to $1,200 per year (30 percent of costs) for items such as windows or insulation. The separate Residential Clean Energy Credit equals 30 percent of the cost of solar, battery, or geothermal systems, with no annual dollar limit through 2032, according to the IRS.

- Landlord bonuses. When the condo is a rental, you may also deduct insurance, repairs, advertising, and 27.5 years of depreciation on the building, often wiping out taxable income without stretching any rule.

- Bottom line: skipping the HOA deduction is not the end of your refund. Aim your planning at breaks Congress already endorses and keep more of every Florida sunshine dollar.

Rapid-Fire FAQ: Busting The Biggest Myths

Looking Ahead To 2026: Plan Now, Win Later

Most individual provisions of the Tax Cuts and Jobs Act (TCJA) expire after December 31, 2025, according to the Congressional Research Service. Two changes matter most for condo owners:

- Miscellaneous itemized deductions may revive or remain frozen. TCJA §67(g) suspended deductions such as unreimbursed employee expenses, including employee home-office costs, through 2025. Unless Congress extends the freeze, W-2 workers with a qualifying office could claim a share of HOA dues starting with 2026 returns. Track square footage, and keep dues statements in case the break reopens.

- The $10,000 SALT cap is scheduled to vanish. TCJA §164(b)(6) limits the deduction for state and local taxes to $10,000 per return through 2025. Florida has no income tax, yet property taxes and special-assessment add-ons can still sting. If the cap lapses, larger property-tax write-offs may push more owners into itemizing.

Neither rule directly changes condo-fee deductibility, yet each reshapes the broader strategy. Run projections in mid-2025, time a rental conversion, or finish energy upgrades before rates shift. Owners who revisit the plan each fall avoid the April scramble.

- Condo Fees 101: What They Cover And Why Everyone Assumes They’re Deductible

- Your Home, Your Condo Fee, And The IRS Wall Of “No”

- When Condo Fees Do Become Deductible

- 1. Rental Property: Turning Dues Into A Business Write-Off

- 2. Home-Office Carve-Out: Claiming A Slice Of The Fee For Work

- Special Assessments And Reserve Hikes: Why The Big Bills Still Miss The Tax Cut

- Florida-Specific Pitfalls Every Condo Owner Should Know

- What You Can Deduct Instead: Real Breaks Still On The Table

- Rapid-Fire FAQ: Busting The Biggest Myths

- Looking Ahead To 2026: Plan Now, Win Later