It is rightly said that “Happy customers are your biggest advocates and can become your most successful sales team.”

Businesses and companies these days are looking for strategies that make their businesses more customer-centric and improve their relationship with customers. Customer relationship management or CRM is one of the ways to do so.

A customer relationship management system is a vital tool to enhance customer experience and facilitate several key tasks such as sales management, customer data management, team interaction, and account management.

If you wish to learn more about CRM and how it impacts financial businesses, this article is for you, so stay tuned till the end.

The Role of CRM in Finance

A customer relationship management system plays a significant role in the finance industry. It assists financial organizations manage their customer interactions, accounts, and data. Some major functions and benefits of CRM in the finance industry are –

- Facilitates communication – CRM opens many communication channels for customers. It allows customers to communicate their concerns and organizations to act on customer complaints effectively, enhancing customer satisfaction.

- Providing Customer Insights – CRM systems analyze customer activities, providing insights into customers’ preferences and behaviors. This helps the institutions to provide a better-personalized experience to the customers.

- Relationship Management –Maintaining a healthy relationship with the customer provides immense benefits to organizations. Implementing loyalty solutions helps reinforce this connection and supports long-term customer retention.

- Regulatory compliance – CRM systems also include features that help in tracking customer interactions and keep check of necessary documentation.

- Streamlined operations – CRM systems automate routine tasks and streamline processes such as account management, and compliance tracking.

CRM in Banking: How Can it Help?

More and more banks nowadays are implementing customer management relationships. It enables them to optimize internal tasks and enhance customer experience, resulting in growth and a rise in profits. Some of the tasks CRM contributes to are –

Customer Data Is Protected And Secure

CRM strengthens data security and safeguards customer data by –

- Encrypting data in rest and transit.

- Controlling role-based access and preventing unauthorized access.

- Anonymizing the data and reducing the risk of exposing personally identifiable information.

- Information during analysis and reporting.

- Regularly monitoring systems to detect potential security breaches.

- Complying with strict rules and regulations.

Personalized Customer Experience

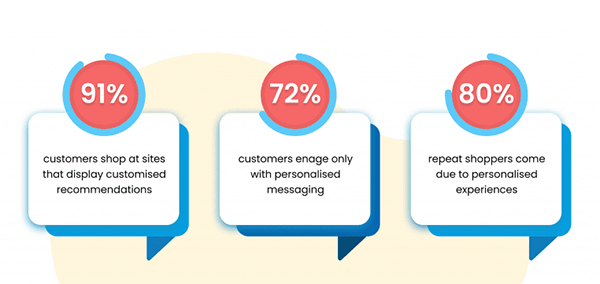

Providing a personalized experience increases the customer retention rate and helps the bank build long-term relationships with the customers. CRM can be used to offer better-personalized experiences to customers in the following ways –

- Data analysis – Customer relationship management systems are excellent at analyzing huge amounts of data and gathering information on specific customers, their past interactions, and their behavior with the bank. This aids the banks in catering a personalized experience to the customers.

- Categorizing customers – Analyzing customer history can help banks segment them into groups and create targeted marketing campaigns that resonate with specific groups.

- Personalized systems – CRM systems help institutions send personalized messages, emails, notifications, and offers based on the customer’s preferences.

Many reports provide evidence of the importance of customization and personalization in a business.

You can Integrate with Third Parties

Integrating third parties with your customer relationship management system automates actions, promotes the system to run smoothly, and allows you to create a 360 view of customer activity. It also eliminates the need to alternate between different systems.

It enhances collaboration by allowing different teams and departments of an organization to access and share required data.

Work Processes are Automated

AI is a powerful tool that is being used in various industries including the financial industry

AI-powered CRM systems promote the automation of routine tasks by artificial intelligence tools.

Automation of Work operations like lead management, customer service, customer onboarding, and account management saves time that can be used in managing more complex functions that require attention.

Financial institutions can also use an AI ppt maker to create informative presentations that effectively showcase insights derived from data analysis.

Not only time and effort, but automation of work also reduces the chances of error.

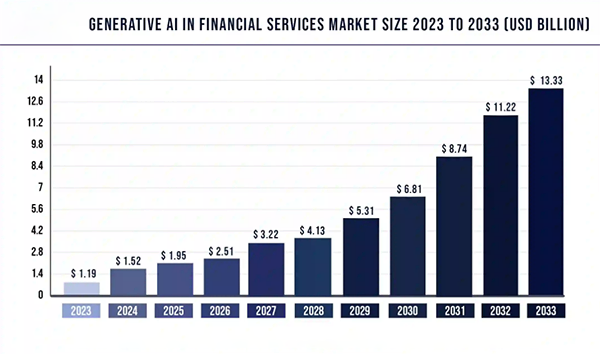

All these factors help significantly in enhancing the efficacy of work processes, leading to a rise in the use of AI in banking. The use of generative AI in the financial services market is expected to show a surge in the upcoming years.

You can Turn Leads into Real Customers

CRM system tracks leads throughout the sales funnel and analyzes their activities to provide them with personalized and relevant messages that keep them interested and engaged.

CRM notably facilitates timely communication by automating follow-up emails, messages, and notifications.

You’re on the Right Track with Sales

CRM is crucial for managing sales affairs in the banks as it improves the sales cycle. It tracks communication with prospective buyers and leads, then sorts, analyzes, and prioritizes sales leads for the sales team to focus on.

You Meet Regulatory Requirements

CRM systems assist banks in meeting their regulatory requirements by securely managing the data through role-based access, It maintains documentation and provides audit trails to ensure compliance with rules and regulations.

Some CRM systems include resources and training models to educate about compliance requirements and elevate your financial game.

DO YOU KNOW? Banks that have shifted to CRM systems have reported seeing up to 30% improvement in their sales. Some banks also reported improvement in customer retention rates by up to 25% after implementing robust CRM systems.

Conclusion

CRM significantly enhances operational efficiency in the banking industry. It helps in various tasks such as providing better customer service, account management, analysis of data, and many more.

All this leads to customer satisfaction and customer retention. Not only this, but it also ensures regulatory compliance.

So, we can conclude that effective use of CRM systems can significantly help a business grow, regardless of its field and sector.