I’ve been a major part of the cryptocurrency industry in Poland for quite a while now, and I can tell you that obtaining a crypto exchange license is not an easy thing. But it’s not impossible.

There are various steps that you have to follow and things that can’t be avoided if you legally want to be part of this business. Keeping everything in mind, I’m giving you this guide on obtaining a crypto license in Poland.

I will mention all the procedures, essential requirement,s and regulatory framework. So be attentive and read carefully.

Why Is Poland a Crypto-Friendly Country?

This jurisdiction is not widely known as a digital security hub, like Estonia, Latvia, or Switzerland. Indeed, several decades ago, most European jurisdictions were very suspicious about cryptos of all kinds – Poland was not an exception.

However, following the examples of the mentioned states, the Polish government has also enacted legislation sufficient to regulate Bitcoin’s activities. Now, it is clear and transparent for foreign investors how to register a company, formalize documents, and pay taxes from their digital coin deals.

Cryptocurrencies and NFTs have the precise status of virtual assets and can be traded freely. These agreements already bring a significant portion of income to the Polish budget. That is why Poland can be considered as another crypto-friendly EU jurisdiction already.

Why Get a Crypto Exchange License Exactly in Poland

There are numerous reasons in favor of getting a cryptocurrency permit in Poland:

- European registration with all the benefits associated with the free movement of capital and workforce available within the EU.

- Zero restrictions on the residence of foreign investors.

- Easy procedure of organizational formation that doesn’t require astronomic costs to enter the market.

- There is no need to have a physical presence to open a Polish startup.

- Wide range of reputable Polish banks to open accounts and operate worldwide.

- Certain tax preferences are available.

- Easy accounting and reporting standards to follow.

Types of Crypto Licenses in Poland

This is said very conditionally for a reason. Polish legislation doesn’t envisage separate types of authorizations or registrations for different electronic cash companies. A virtual asset service provider (VASP) may be authorized to carry out the following activities:

- deals with artificial currencies;

- cooperates with electronic and fiat currencies;

- brokering in dealings.

It is necessary to prepare all the must-have AML manuals and, if the policies suffice, create a respective record in the VASP register to start operating freely. This procedure is quite straightforward, provided that it is done in full compliance with the applicable regulatory standards.

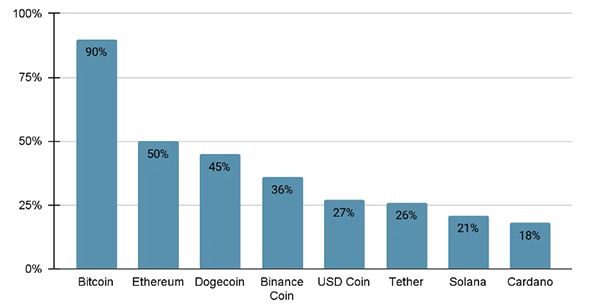

Contact professional advisors to know more on the matter. And if we talk about which digital currency has been performing the best it’s Bitcoin, but what other currencies are following up? Take a look at these stats.

Major Requirements for Obtaining a Crypto License in Poland

The list of requirements for the investors to meet is among the simplest in the entire EU:

- No criminal record. One of the most important compliance standards for the Polish crypto trading firm is that its directors and authorized persons wouldn’t have any criminal records.

- Sufficient knowledge and experience in the area of digital assets. Authorized persons of the technological establishment should also have extensive knowledge and experience in handling digital assets. They should also undergo training backed by the confirmation documents.

- Initial capital is needed. There are no specific requirements with regard to the statutory deposit amount for the crypto company. For comparison, the minimal funding requirements in Estonia are €100,000 for currency conversions and €250,000 for virtual currency transfers. This is another illustration of how Poland is loyal to crypto startups.

Getting a Crypto Exchange License in Poland: Procedure at a Glance

Even if the procedure of setting up a specific crypto project may vary on a case-by-case basis, the must-have steps are as follows:

- Founding a new entity in the form of a limited liability association (sp. z o.o.).

- Arranging a local business address with a ZIP code (a physical office is not required).

- Opening a bank account for a virtual currency startup in a local bank.

- Collecting and arranging the information about the company’s authorized persons – directors, shareholders, and secretaries.

- Registering a local brand.

- Preparing the official internal documents for the startup, AML/CFT policies, and KYC, to mention a few must-haves.

- Collecting the data and statements confirming the legal origin of funds.

- Registering with the Polish Tax Service.

These are only general steps on the way to getting a digital coin brokerage license in Poland, a few extra ones may be added, depending on the specifics of a concrete case. Share the details with the professional advisors to get a personalized registration plan and assistance.

Taxation for Crypto Companies in Poland

When a crypto investor starts a firm in Poland, he becomes eligible to pay the following taxes:

- Corporate tax – 19%

- Capital gains tax – 19%

- VAT (standard rate) – 23%

Contact professional advisors to calculate approximately the amount of taxes due, keeping in mind the supposed scale of your startup.

DID YOU KNOW?

Cryptocurrency was created in 2008 by Satoshi Nakamoto, at the time 1 bitcoin only cost $0.00099!

Bottom Line

Hope that this guide will be helpful while making your choice of the destination for your electronic currency project. If you are struggling with making the right one, contact professional advisors to get personalized and detailed help with starting things to work smoothly.

Minimize your risks and maximize the opportunities for getting profits while entering the Polish or any other market with your crypto products. Digital currencies have the power to make you rich, but you have to be careful with them.Learn more about obtaining a Poland Crypto License to ensure your business operates legally and securely.