Data routing concerns compliance, data security, system performance, and financial reporting and therefore is a finance issue, not just an IT issue.

KEY TAKEAWAYS

- Data routing directly impacts finance operations, compliance, and risk management.

- Internal and external routing must both be secure and fully documented.

- Proxies help with compliance and performance, but need careful monitoring.

- Finance teams should ask vendors key routing questions to avoid exposure.

A recent report from IBM for 2023 has found that the average financial services sector data breach costs an eye-watering $5.17 million.

When we talk about entity movements, we are saying more than a physical change in relation to data. For finance teams, the route taken by a piece of data can mean the difference between accurate and unaware, compliant and fined.

In this article we will discuss how Data routing affects financial operations, what the implications are to reporting and risk management, and how teams can help ensure that data has the most secure/efficient route through their tech stack.

Why Finance Teams Should Pay Attention to Data Routing

Finance departments are becoming increasingly reliant on cloud-based accounting software, automated approval workflows, and remote collaboration tools.These platforms transmit financial data through various networks during routine operations.

Knowing how that data is routed—and who has access at each stage—is essential to managing risk.

Incorrect or insecure routing can result in at least 4 major problems:

- Exposure of sensitive data, such as payroll, tax IDs, or banking authentication details

- Breach of voluntary compliance with frameworks like SOX, GDPR, or PCI DSS

- Data silos and synchronization issues due to inconsistent routing between platforms

- Reduced system performance, impacting dashboards and real-time analytics

Understanding routing isn’t just about cybersecurity; it affects the quality and timeliness of your financial decision-making.

The Technical Basics—Without the Jargon

Understanding routing at a basic level doesn’t require being a network expert. Think of it like road traffic: data is a vehicle, routing protocols are the road signs, and the routers are intersections.

Each piece of financial data—like a transaction entry, an invoice approval, or a report submission—moves across various “roads” on its way from origin to its destination.

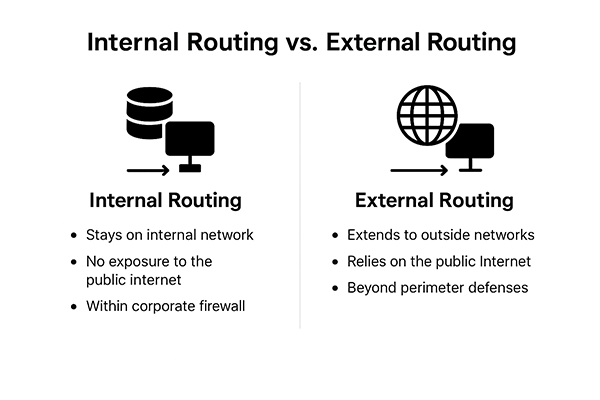

Internal Routing vs. External Routing

- Internal routing happens within your company’s systems—between your fiscal management software, payroll system, and data store

- External routing involves data leaving your network—such as when you report taxes to the IRS, send files to an internal auditor, or sync with a third-party bank feed

Both routes must be secure, logged, and compliant with your organization’s risk policies. Below, you can see the key difference between both of them.

Direct Routing vs. Proxy-Based Routing

Some financial apps route data directly from your device to the service provider, while others use proxy servers or VPNs to reroute traffic through intermediaries. It offers perks like encrypted tunneling, geolocation masking, and load balancing, but also adds layers of complexity.

If your finance team is using tools that rely on proxy routing, you need to ensure:

- You know which proxies are in use

- Logs are available for audit purposes

- The routing doesn’t breach geographic data storage laws

- Routing behavior is consistent during remote access or outside-office operations

To get a clearer picture of your current network behavior, use a proxy checker tool to identify whether your traffic is being handled through a proxy or VPN. This is especially useful in hybrid work environments where employees may use personal handheld devices or off-site internet connections.

Why Proxies Matter in Finance—and How to Handle Them Right

Proxies act as middlemen between your device and the internet, often used deliberately in finance for certain operational tasks. Such as routing compliance reporting through secure endpoints—or unintentionally when third-party platforms or remote staff introduce them into your infrastructure.

Use Cases Where Proxies Add Value

There are legitimate and even strategic reasons to use proxies in finance operations:

- Ensuring regional compliance by routing data through accredited jurisdictions

- Effective load balancing between cloud-based financial dashboards or apps

- Securing external API calls to payment gateways, bank feeds, or tax platforms

- Isolating testing environments from production systems during audits or implementation

But when proxies are unmonitored or unmanaged, they create blind spots and trigger concerns during audits. They can also complicate investigations when suspicious transactions or anomalies are detected, especially if routing logs are incomplete.

Best Practices for Proxy Governance in Financial Systems

To keep proxy use transparent and secure:

- Require vendors to disclose any proxy usage within their service architecture

- Work with IT to establish proxy usage policies and acceptable regions for routing

- Log all proxy connections, including IP addresses, timestamps, and endpoints

- Schedule periodic audits using automated proxy detection and geolocation tools

Proxies aren’t inherently risky—but unmanaged proxies are. Finance leaders must consider them a core part of the tech stack, not just a background convenience.

Common Tools That Route Financial Data

Many platforms finance teams use daily are essentially data routers in disguise. Understanding their role helps you troubleshoot issues and audit data movement more effectively.

Cloud Accounting Software

Solutions like QuickBooks Online, Xero, and NetSuite don’t store data on local machines—they push it to cloud servers and back, often routed through regional data centers. Performance can be affected by latency, time zone shifts, and government rules on data localization.

Payroll and HR Platforms

Gusto, ADP, and Paychex often share data between multiple endpoints: tax agencies, banks, internal systems, and employees. The data routing here includes not only delivery, but also transformation—raw inputs are turned into legally enforceable documents and direct deposits.

API Integrations and Financial Automation Tools

Zapier, Plaid, or custom-built integrations route data between platforms, but often in a non-transparent way. Finance teams need to verify that these connections are encrypted, secure, and properly logged for traceability.

How to Evaluate and Monitor Data Routing in Your Finance Stack

Finance professionals don’t need to manage routing themselves, but they should be involved in how it’s evaluated and monitored. Relying solely on IT or vendors can equate to blind spots—especially when tools overlap or when regulatory requirements evolve.

Key Questions to Ask Vendors and IT

When selecting or auditing financial platforms, make sure to get answers to at least 4 of the following questions:

- Where is our data stored, and through which regions is it routed?

- Do you use third-party proxy settings or routing services we should be aware of?

- Is routing sealed end-to-end, and do we have access to activity logs?

- How is failover or rerouting handled during outages or cyberattacks?

These questions aren’t just technical—they directly impact risk exposure, compliance, and the performance of the finance team.

Use of Monitoring Tools

Certain finance teams now rely on SIEM tools or network observability platforms to monitor and track data flow. These tools can provide alerts when unusual routing occurs, such as large data transfers outside of business hours or access from unexpected regions.

If you’re working with an MSP (managed service provider), request visibility into routing dashboards and periodic audit reports.

Routing and Compliance: What Can Go Wrong

Routing isn’t just about speed and access—it’s also about control. Misrouted or poorly documented data can easily result in compliance failures.

For example:

- A financial controller submits audit documentation through a non-secure file-sharing platform

- Bank transaction data is routed through a third-party service hosted in a restricted country

- Employee salary records are accessed via a proxy that doesn’t meet data residency laws

All of these scenarios can lead to significant financial and legal repercussions.To stay ahead, finance teams must adopt policies that cover not only what data is shared, but also how and where it travels.

Data Doesn’t Travel Alone—Neither Should You

Every piece of routed financial data carries more than just numbers. It holds your organization’s trust, security, and strategic intent—not just numbers. Finance professionals shouldn’t view routing as hidden infrastructure. Understand the paths your data takes, who controls them, and what that means for your role in today’s connected financial ecosystem.

Because in the end, every ledger entry, approval chain, or forecast isn’t just data—it’s a decision in motion. Know its route. Own its journey.