Introduction

When it comes to dividend stocks, there often arises a question as to whether the funds distributed as dividends might be more effectively used elsewhere. It is also important to take into account that each dollar paid out as a dividend means a reduction in the funds available for reinvestment within the company. Besides that, this does not include the extra tax liabilities reported whenever a company or an Exchange-Traded Fund (ETF) distributes dividends. That’s why in this article, I’ll dive into this subject, to determine whether owning dividend stocks leads to superior performance over the long term.

The Dividend Dilemma

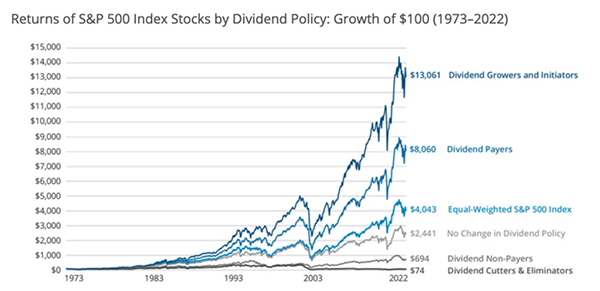

At first glance, we might think that dividends should be avoided at all costs due to the perception that they “affect enterprise value” through their payouts, without talking about the unsustainable high dividend policies implemented by companies sometimes to attract investors (a situation commonly called the “high dividend yield trap.”) However, upon closer examination of U.S. companies that have consistently issued dividends for over 25 years—known as “dividend aristocrats”—the chart below shows that they have outperformed the primary index, the equal weighted S&P 500 index over the period 1973-2022:

Average Annual Returns and Volatility by Dividend Policy (S&P 500 Index 1973-2022)

Empirical Evidence on Dividend Stocks

A study conducted by RBC Global asset Management went even further and noticed a difference between dividend growers (companies which are able to increase their dividends year after year) and dividend payers. Indeed, between 1986 and 2016, the dividend growers acheived a compound annual return of 11,7% while dividend payers saw an annual return of 9,9% in the same period. In comparison the S&P/TSX Composite index had an annual return of 6,6%. These statistics demonstrate the solid performance that dividend growers can deliver over the long run.

Why Dividend Aristocrats Excel

The better performance of dividend aristocrat stocks can be attributed to several factors. Firstly, sustaining a prolonged streak of dividend distribution shows a sense of accountability within the company. Indeed, if the company wants to keep attracting investors, the senior management must remain exemplary and continuously offer dividends year after year, ensuring that dividends are funded without compromising the capital necessary for growth or future investments.

Secondly, dividends are mostly given by well-established, mature companies that may not forecast exponential growth in the upcoming years. Therefore, if these companies are profitable, they are in a position to reward shareholders since they have reached a mature stage where business opportunities for quick expansion are limited.

Conclusion

By reading this article, one might find dividend stocks appealing; however, it is important to maintain critical thinking when analyzing dividend stocks. There have been periods and situations where growth stocks have outperformed dividend stocks. This underscores the importance of adopting a diversified and well-rounded investment approach. For those interested in diving deeper into how I select my dividend stocks, you can read the following article “How to pick the winning dividend stocks: my new strategy based on 27 criteria” on my website.