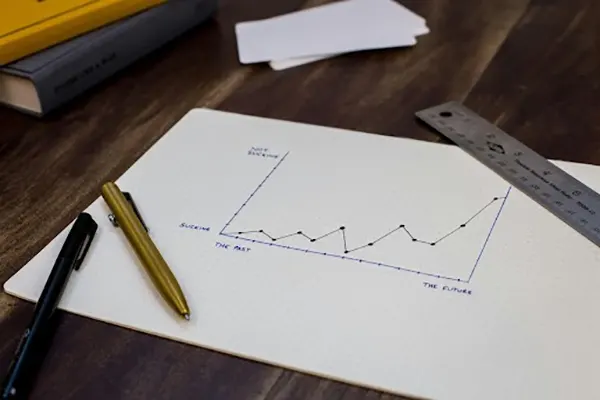

A smart investment reflects your financial goals and business strategy. If your priorities are aligned accordingly, it shows signs of smart equipment investment.

Businesses that understand the true value of planning before investing in equipment have often seen an increase in long term savings and streamlined growth. Buying necessary tools and equipment for your business operations might seem to you like an obvious but heavy investment. But, in reality, they are stages where smart business planners typically save capital.

But how to invest smartly? Investing in the right equipment at the right time and having a robust plan before an equipment failure is how you can ensure long term business growth. This strategy will neither force you to compromise with your operations nor put you at risk.

To understand better, keep reading this article that shares how you can adopt smart equipment investments and ensure your long term business growth.

Equipment Quality and Operational Efficiency

Productivity rides on routine. Teams operate freely when tools are reliable. Work slows down while problems are resolved or replaced when they are not. Even short breaks eat into billed hours.

Most people may at first think that less expensive equipment is more cost-effective. However, regular repairs, early replacement, and reduced production can quickly surpass any initial savings. A tool that lasts twice as long and performs effectively often provides a better financial result than one that needs ongoing attention.

This principle applies across industries. In skilled trades where profits depend on speed and accuracy, solid equipment cuts rework and cuts project timelines. The financial impact is measurable. Fewer interruptions translate into higher capacity and more consistent revenue.

Safety as a Financial Variable

Workplace safety is not only a compliance issue. It is also a financial one. Medical costs, insurance claims, mistakes, and in certain situations, harm to one’s reputation are all effects of injuries. Security equipment plays a direct role in limiting those risks.

For instance, suitable head and eye protection has an impact on long-term health and instant safety in work environments. Equipment that can handle heat, waste, and heavy use is essential for field welding employees who work in harsh environments. When protective clothes fit poorly or fail to provide proper coverage, tiredness increases, and errors follow.

Investing in well-constructed safety equipment reduces the risk to averted incidents. OSHA regulations for fusion, cutting, and welding stipulate that workers must wear the proper protective gear to protect them from dangerous radiation and material. Over time, that certainty protects both people and profit.

Long-Term Value Over Short-Term Savings

Growth-oriented businesses tend to evaluate purchases differently. Rather than asking how little they can spend, they ask how long an investment will serve them.

Equipment that withstands harsh conditions, requires minimal maintenance, and supports precise work creates predictable costs. Predictability matters in planning. When owners know how long tools will last and how they will perform, forecasting becomes more accurate.

This mindset shifts spending from reactive to strategic. Instead of replacing failed tools at inconvenient moments, businesses schedule upgrades on their own terms. That shift alone reduces disruption.

A Practical Example from the Field

Pipeline welding offers a clear illustration of how equipment affects performance. Field welders often work outdoors, in variable weather, and in positions that demand mobility. Head protection must allow visibility while remaining durable enough to withstand rough conditions.

Pipeliner welding hoods are designed for this type of work. Many professionals prefer the even viewing environment that their small size and fixed lens setup provide for high-focus tasks. The structure matters. Poorly built hoods can crack, warp, or require frequent adjustment, slowing down work and increasing frustration.

Suppliers such as ridgeproductswelding.com provide access to pipeline welding hoods built for trade professionals who depend on reliable protection in the field. The purchase in this case is not motivated by brand devotion or design. It is more about maintaining a steady pace of work under demanding conditions.

When equipment supports concentration rather than distracting from it, output improves. Over weeks and months, that difference shows up in job completion rates and client satisfaction.

Reputation and Client Confidence

Clients may not study every tool a contractor uses, but they notice professionalism. Clean work, efficient timelines, and safe practices build trust. Equipment contributes to all three.

Businesses that invest in quality tools tend to deliver more consistent results, and that consistency ultimately influences referrals and repeat work. In competitive markets, reputation often drives growth more than marketing campaigns.

A contractor who regularly delays projects due to equipment problems risks short-term revenue and the loss of future contracts. On the other hand, one who completes work smoothly earns credibility.

Planning Equipment as Capital

From an accounting angle, equipment is a capital asset. It decreases over time and contributes to revenue generation. Treating it as such encourages disciplined planning.

Smart operators track replacement cycles and allocate funds accordingly. Rather than rushing to cover unexpected failures, they integrate equipment updates into annual budgets. This approach spreads cost over time and prevents operational shock.

It also supports expansion. When a business plans to add crews or look for larger contracts, equipment availability becomes part of the equation. Growth cannot outpace tool capacity for long without friction.

The Compound Effect of Better Decisions

Single equipment purchases rarely transform a company overnight; the impact is more likely to get collected slowly through reliable tools that reduce downtime and improve productivity. Productivity supports stronger margins, allowing reinvestment.

Conversely, repeated decisions to minimize cost at the expense of durability create a different pattern. More breakdowns lead to more stress and reactive spending. Over time, that pattern limits capacity and stalls progress.

The difference between these paths often comes down to mindset.

Closing Perspective

Going with the most expensive choices and thinking that you have made a smart choice is unattainable. Ending on smart equipment requires analyzing how the tools will influence your routine operations and long-term stability. And then investing in them.

A well-planned IT strategy tunes technology investment with business goals, ensuring long term efficiency and growth while minimizing costly decisions.