Technology is growing rapidly, and so are the methods that cyberbullies use to commit financial crimes. This makes it crucial to implement effective strategies to prevent fraud from taking place.

And, since financial institutions are always vulnerable to a range of financial crimes such as money laundering and other scams. These financial frauds are getting so big that in 2023, they caused $485.6 billion in global losses.

So, in this read, I’ll be sharing how financial institutions are implementing a robust system to improve their ability to identify and address irregular activities more easily. Along with that, we’ll also explore how they take proactive measures to minimize the overall risk

Let’s start!

Enhancing Security Through Effective Screening Solutions

Financial institutions have a bunch of options to make sure they can easily identify and prevent any suspicious transactions. And, one such option includes sanctions screening, which refers to the process of ensuring the security and legality of transactions.

With iterative analyses that compare customer information against global sanctions, a list maintained by regulatory authorities. Sanction screening can identify individuals, entities, or countries that are subjected to restrictions due to concerns such as terrorism, corruption, or human rights violations.

This sanctioned list also serves a great purpose for financial institutions, as it helps them minimize the false positives that slow transaction processing or compromise the customer experience. Sanctions screening also serves the purpose of protecting financial systems against sanctioned parties who attempt to access them.

In essence, an effective sanction screening process goes beyond compliance. It offers institutions protection from reputational damage and costly fines while contributing to global efforts against financial crime, reinforcing trust within the system.

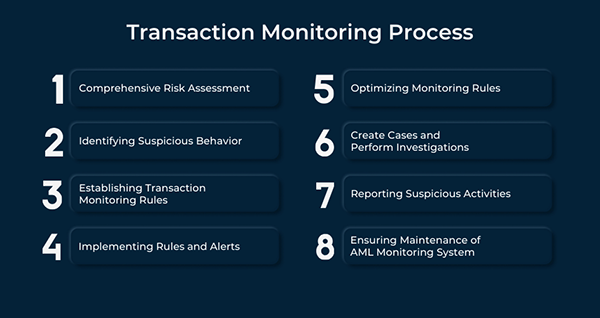

Utilizing Transaction Monitoring Solutions

Transaction monitoring is another essential element in detecting and preventing suspicious activities. Some financial institutions are now utilizing sophisticated software to analyze transaction patterns and flag those that usually differ from how a typical customer behaves. For instance, large transfers or sudden movements across jurisdictions in high-risk regions.

Monitoring systems employ predetermined rules and machine-learning algorithms to detect red flags that require further investigation, like transactions that seem suspiciously structured or structured with the intent of fraud or money laundering.

So, if the transaction gets flagged by these monitoring systems, It will then be reviewed by the compliance teams then review these activities to decide whether they represent valid transactions or require further examination.

Monitoring systems must be regularly upgraded in order to stay abreast of emerging risks and regulatory requirements, and institutions must make sure their compliance staff receives sufficient training in interpreting alerts correctly and making sound decisions based on them. Combining advanced technology with human expertise allows financial institutions to detect suspicious transactions more accurately.

Do You Know?

According to the Future Market Insights, the global market for transaction monitoring is expected to reach US$ 34 billion in 2033, with a CAGR of 14.2% from 2023 to 2033.

Prioritizing the Importance of Customer Due Diligence

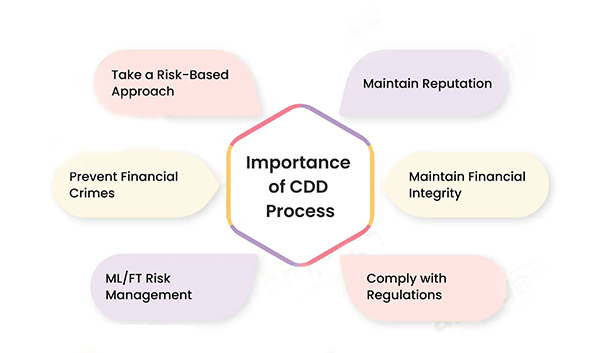

Customer Due Diligence (CDD) is an active measure financial institutions take to prevent financial crimes. CDD involves verifying customers’ identities and risk profiles before monitoring their activities over time.

This ensures institutions know who they’re dealing with while simultaneously being aware of any suspicious behaviors that might indicate misconduct or illegality.

The CDD process starts during the onboarding when financial institutions collect and verify all the major customer information like identification documents and business details.

Institutions then use enhanced due diligence (EDD) measures on high-risk customers, such as politically exposed persons (PEPs) or entities operating in industries prone to money laundering.

So, if you consider every aspect, continuous due diligence monitoring is highly recommended. Financial institutions must regularly review customer records and adjust risk analyses based on changes in behavior or circumstance. This can be done by using automated tools to track the activities of customer accounts that might indicate suspicious transactions.

Collaborating and Following Industry Best Practices

So, in order to prevent any financial crime, organizations must work together in teams. This process includes exchanging information, creating industry standards, and implementing some of the best practices for detecting and avoiding any kind of suspicious transaction.

Public-private cooperation may play an important role in the fight against financial crime. Working closely with regulators and law enforcement organizations allows financial institutions to gather crucial insights and intelligence. This proactive approach helps them to nurture their detection skills while responding more quickly to developing threats.

Technology providers also contribute significantly by developing innovative solutions tailored specifically for the financial sector. From artificial intelligence systems to blockchain-based systems, these tools, enable institutions to stay ahead of emerging risks while streamlining compliance efforts.

Well, adopting a culture of compliance within the financial institution is important. And, the leader also emphasizes ethical conduct while allocating enough funds to maintain an effective compliance program. By developing an atmosphere that emphasizes integrity, institutions can form a united front against financial crime.

Wrapping Up

Financial institutions face the responsibility of detecting and preventing suspicious transactions. And, this is why it is often suggested that by employing tools like sanctions screening, transaction monitoring, customer due diligence, and collaboration between regulators, peers, and technology providers, this task becomes simpler.

In addition to that, proactive compliance not only meets the regulatory requirements but also protects the reputation and stability of the financial institutions. With financial landscape changes coming at us fast, keeping vigilant will become essential in safeguarding global financial system integrity.

Institutions with accurate processes in place as well as an atmosphere conducive to compliance should be well-equipped to navigate through these challenges successfully and contribute towards creating a safer, more transparent ecosystem.