The FCRA protects you from inaccurate credit reporting and unfair discrimination as the result of your protected class (race or gender, for example).

KEY TAKEAWAYS

- You can request one free credit report from each agency yearly.

- You have the right to dispute and correct report inaccuracies.

- Always ask for reasons if your credit application gets denied.

- Always ask for reasons if your credit application gets denied.

A report from the Consumer Financial Protection Bureau (CFPB) revealed in 2023 that nearly 45% of consumer complaints regarding credit reporting were related to issues of inaccurate usage or unfair treatment.

To protect consumers from this kind of bias, there are federal laws prohibiting lenders from using race, gender, religion, or other forms of biased information against consumers. Simply put, these laws require lenders to make fair decisions when utilizing credit information.

In this article, we will explore how these protections for consumers work, what you rights are under the laws, and some actions the you can take if you believe you have been treated unfairly.

Being Educated On Your Rights Leads to Fair Treatment

The purpose of credit reports is to show what you have spent your money on, how much you have spent, and the use of your credit cards and loans. In order to prevent any possible mistakes or check if your information is maybe out of date, you can ask for credit reports from the three main collections agencies, which are Equifax, TransUnion, and Experian.

Legally, you have the right to do this once a year. Also, understanding your FCRA rights is important because this way, you will know that with the right guidance, you will get fair treatment from everyone.

For example, if someone rejects your offer because of something in your credit reports, you can correspond with them, find the glitch, and then solve it to make a fair deal or guarantee your rights. When you notice some kind of difference in treatment.

Law Prevents Any Kind of Discrimination

One amazing thing about FCRA is that they are used together with the Equal Credit Opportunity Act, which forbids harassment based on your skin color, religion, gender, or other personal qualities.

As credit reports are usually used for other people to make some kind of decision for you, FCRA makes sure that your credit reports are fair and accurate. If someone claims that there is something wrong with your credit report and turns down any kind of financial request, then you have the complete right to ask for an explanation, to report it, and to ask for amendments.

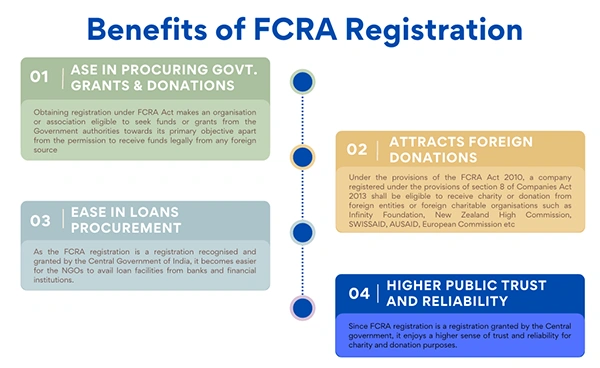

Below, you can see the benefits of FCRA registration.

What To Do When You Notice Unfair Behavior Towards You?

Receiving any kind of unfair treatment can be very inconvenient and hard, but in such situations, it is important to know what to do and stand up for yourself! You can start by asking queries that will maybe explain such a regimen.

Ask why you were refused, if the problem is fixable, and if there is something that you can do. Make sure to check your credit reports to make sure that there is no problem, if someone contends that it exists.

If there is a mistake, ask for it to be repaired, and send a complaint to the Consumer Financial Protection Bureau (CFPB) if necessary. If you face any kind of discrimination, be sure to contact your lawyer.

The FCRA Allows Fraud Alerts

Reviewing your report, even without issues, can help prevent future struggles and obstacles. Besides possible different problems in credit reports that can lead to many rejections in your financial requests, another very harmful situation that can be prevented with FCRA and regular checkups of your reports is identity theft.

If you see any unfamiliar accounts or charges, it may indicate identity theft. The FCRA allows you to put a fraud alert on your file, which will help in preventing others from opening accounts in your name, which is another benefit of the FCRA that you should know about.

Simple Yet Big Steps

You don’t have to know every single thing about laws and credits to protect your rights! It’s enough to know where to seek help, check credit reports, report mistakes, and request explanations.

These simple steps that are, in fact, very big, can create a visible difference in your life, and the most important thing is not to remain silent when something seems unfair! If you have enough courage to stand up for yourself, especially when it is about something that can have an impact on your everyday life, you are not just fighting for yourself and your rights.

You are also making a big impact on a system that can improve for everyone else in the future. The Fair Credit Reporting Act is there to help you and make sure you get the fair treatment that you deserve.