Do you know what Mergers and Acquisitions (M&A) are? It happens when you are making a major decision like transferring ownership of companies, assets, or business units. But do you know if you want it to succeed, you must learn about financial due diligence it works similarly to transaction advisory services.

A case study explains it as “It involves investigating the accuracy of the information related to a prospective investment or business decision and evaluating the future potential of the subject of the transaction.” (ResearchGate: Due Diligence).

I’m writing this guide to conduct financial due diligence during mergers and acquisitions so that you can know what steps you have to take. Read carefully.

What is Financial Due Diligence?

Financial Due Diligence means when an in-depth investigation takes place in a company regarding its liquidity situation. This goes beyond going through your fiscal statements. It would cover other aspects related to tax risks, legal risks, and more.

1. Financial Risks

Financial risks usually include inadequate cash flow, debt potential debt, and customer concentration. These aspects impact your label negatively, and due diligence analyzes these risks and what harm they can cause.

2. Tax Risks

Tax liabilities, exposure to tax audits, and tax liabilities can mess up your profitability. However, due diligence can identify these threats and aware you so that you can take steps accordingly.

3. Market Risks

External factors like fluctuations in exchange rates, changes in demand, increased competition, and interest rates cause market risks, which ultimately affect your company’s operating performance.

In such cases, you can make new strategies as due diligence would point out all the things that might affect your business.

4. Legal Risks

Legal risks can’t be ignored as they can result in losing your business’s reputation in the market. It consists of regulatory violations, intellectual property disputes, and lawsuits.

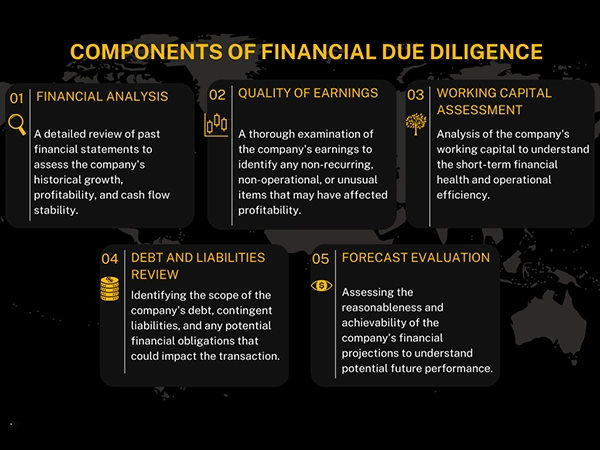

If you have conducted due diligence it will indicate the issue that you might face, that way you can be prepared in advance. In the infographic below, you can see the crucial components of financial due diligence.

Best Practices and Tips for Conducting Financial Due Diligence

Financial due diligence can benefit you in numerous ways. That’s why I’m going to tell you the best tips and practices that you can do to conduct it:

1. Obtain all essential documents from your target company

Your first step would be to gather all the essential budgeting documents, such as contracts, legal documentation, tax returns, etc. They have to be official so that details can be accurate.

2. Set the right metrics for valuation

Use the right tools to determine the value of the company. Methods such as Discounted Cash Flow (DCF) will help you predict future earnings. Another useful tool is Comparable Company Analysis, by using it you can compare the targeted company with other publicly traded companies to check if their stock prices are aligning with financial performance.

3. Review all financial statements and tax documents

Review every document carefully and look for red flags that include rapid revenue growth without profit growth. Also, look for any large or unusual, non-recurring items. All the past transactions should be cleared, so no conflicts could arise in the future.

4. Evaluate the target company’s current internal controls

Look at the company’s current internal control system this is to ensure the segregation of duties, this will also get you access control over financial records and the system. You can also review different reconciliations like inventory and bank.

DID YOU KNOW?

The financial due diligence market was worth $36.07 billion in 2023 and is expected to reach $63.65 billion by 2031!

5. Assess the target company’s quality of earnings, profit potential, and liabilities

Take a deep dive into the target company’s quality of earnings. Check if they can make a good profit and what potential they hold in the future. Also, take help from business consultants in the UAE they’ll be able to give you better insights.

This is how you conduct financial due diligence during mergers and acquisitions. These are the essential steps that you have to follow. You will get the assurance that you aren’t making a bad decision and if the aimed company has been transparent with you or not.