Software and programs have always been there to help when things get cluttered up. In the finance industry, fintech has played a major role in streamlining the processes. Fintech can be seen as an amalgamation of two different domains which are finance and tech.

Hence, a successful fintech project is not only a great coding project but also a thoughtful foundation of finance. Speaking of its current market, the USA has attracted the most fintech investments, accounting for over half of the total global investment volume.

Later in this article, we are going to shed light on its dynamics and how fintech development services are impacting startups. Also, learn about Organizational Software Styles by reading this article.

What are Financial Software Development Services?

In simple words, Financial software development services are all about providing solutions to companies with their fintech needs. Be it accounting software, tailored insurance software, programs that run analysis, etc. everything remains at their expertise.

These services not only include developing software tools, but also apps, platforms, websites, mobile apps, and even back-end data management and integration. It’s a complex process and requires specific skills that are mastered over the years.

And from a business’s perspective, it is much easier and cheaper to outsource the service to a company, rather than developing an in-house team.

The Advantages of Financial Software Development Services in Fintech Startups

At the foundational level, convenience and ease in operations are basic plus points of using FinTech software. However, there’s a lot more that this platform has to offer. Continue reading:

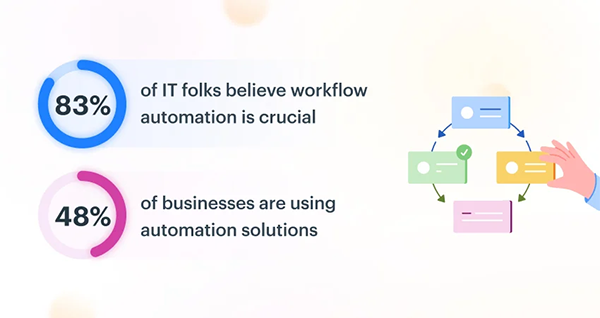

Increased Productivity via Automation

Automation is now a critical part of innovation that must not be ignored. Speaking of top performers who are adopting fintech, China and India tops the list. RPA or Robot process automation helps enterprises automate their repetitive tasks. This leads to a quick responsive work process and also eliminates the risk of potential human errors.

Savings on Costs

Since automation is the key aspect of fintech, it aids in saving time and increasing outputs. All of these things can be supported without the need for human intervention. For tasks like data entry, and some other repetitive tasks, there is no need to have or recruit a human staff. Instead, a software fintech program can perform the same task without error for a minimal monthly or annual subscription.

Regulatory Compliance

Regulatory compliance is not only about restricting operations or limiting freedom. The compliance also assists in establishing a trust factor in the user’s perception. Generally, all the guidelines are made to secure privacy and avoid any kind of fraud or data loss. So, the industry or the government has regulated this compliance to some extent that they are now compulsory for safer operations.

Risk Management

Fintech applications bring some of the best security infrastructure to mitigate as much risk as possible. With their advanced mechanism and sophisticated security infra, everything becomes safe and secure. The government or bodies with authority also keep track on whether the compliance or terms and conditions of the platform meet the requirements or not.

DID YOU KNOW?

According to the 2021 Data Breach Investigations Report, Verizon, 85% of data breaches were due to the “human element”. Hence, it becomes necessary to train employees for information security rather than to rely on computer programs.

Better Forecasting and Planning

Forecasting and planning are all prompted to help the organization make informed and right decisions. For better forecasting, fintech helps by providing real-time data. Fintech provides businesses with the live information on how their funds are being managed, and how monetary moves must be made.

Assistance in Decision-Making

As mentioned previously, a company makes informed decisions with the help of forecasting and planning. Since the honest and real-time data is provided by the software or programs, the team is set have a clear picture of the operations. Then be it any finance-related concern, you will always have insights into what is happening within or outside of the organization.

Streamlined Reporting and Auditing

When it comes to reporting, fintech software follow a particular and consistent format to serve the information. The data is made pretty understandable by the program so that analyzing and comparison becomes easier.

Speaking of auditing, Fintech takes the responsibility for providing detailed records with increased transparency.

Improved Information Security

For information security, the software uses various modern infrastructure such as blockchain, biometric authentication, tokenization, and whatnot. Also, to keep up with the technological trends, modern infrastructure like AI-powered security and behavioral analytics are taken into use.

Better Relations with Vendors and Customers

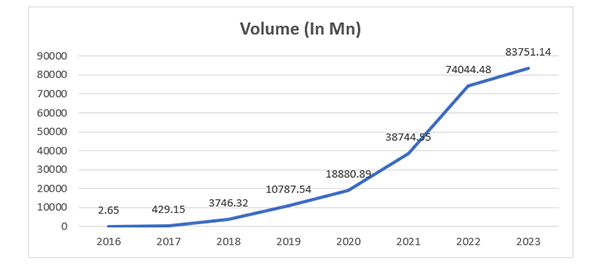

Digital payments, payment interfaces, etc. are all part of the fintech industry as well. As you can see, the digital payments all around the world have increased with great numbers. That is because fintech has helped in establishing a healthy relationship with the vendor and the customer.

Further, digital payments are safer, transparent, easy to track, and fast. So, they have been celebrated by both vendors and customers all around the world.

Scalability

Fintech is scalable to a global reach and can be made compatible for various devices and platforms. When the software is made on cloud-based program, its resources can be extended to a significant extent accommodating fluctuations in demand without significant upfront investments.

Edge Over Competitors

Here are some ways through which fintech helps getting an edge over competitors:

- Enhanced efficiency and cost saving: With the elimination of human interaction in repetitive tasks, you can save on their salary and also make those tasks consistent.

- Better customer experience: You get 24*7 assistance and after-sales customer assistance to solve any issue you are facing.

- Faster transactions: Irrespective to the distance between the vendor and the customer, fintech lets transfer money within a flick.

Conclusion

Finally, these were some benefits financial software development services bring along. From a fintech startup’s point of view, software, and programs play a critical role in helping them sustain themselves in the industry.

So, if you find this article helpful, consider sharing it with your teams and colleagues as well.