I’ve been a financial advisor for years, and one of the most common things that people look for is capital stability and growth. But how can one acquire it? Well, several tasks can be done, keep reading to know about them.

Canadian-American motivational speaker Brian Tracy once said, “Financial security and independence are like a three-legged stool resting on savings, insurance, and investments.” This is true as these work as the main characters in successful progression.

Based on my experience, I’m writing this article where I’ll mention financial strategies for stability and growth. If you want to increase your wealth for a brighter future, pay attention.

Understanding Your Financial Needs

Before doing anything or making any investment, you must know where you stand monetary-wise. This applies both to an individual and a big corporation. Start by accessing your debts, income savings, and expenses.

This way you’ll get to know which area needs improvement. You have to be straight with your short and long-term goals. If you need to buy a house, buy a new firm, fund the education of your children, or anything else, you should know what you have in mind.

It’s like creating a blueprint that you are outlining everything and this is how the job will be done. Making a strategy would be easier if you have an aim.

Working with Financial Advisors

Sometimes when you are struggling with issues, you can consider seeking help. In this case, a budgeting advisor can give you tailored advice and help you accordingly so that you make the right decisions regarding your tax, investment, and banking planning.

But, you have to go to a certified advisor who has a good reputation and is trusted by people. It is a major step, and you don’t desire it to be messed up. You can easily find good financial planning companies in lancaster pa.

Taking guidance from a third party who has years of experience will give you the right path and boost your confidence. Expert input can turn things around and if you take them seriously you will achieve safety and prosperity.

Establishing an Emergency Fund

Life is uncertain, you can never predict, and you never know what’s coming next. But if you have made some preparations, you’ll be fine, right? There could be any situation when you might need some assistance financially, and during this time an emergency fund can help you the most.

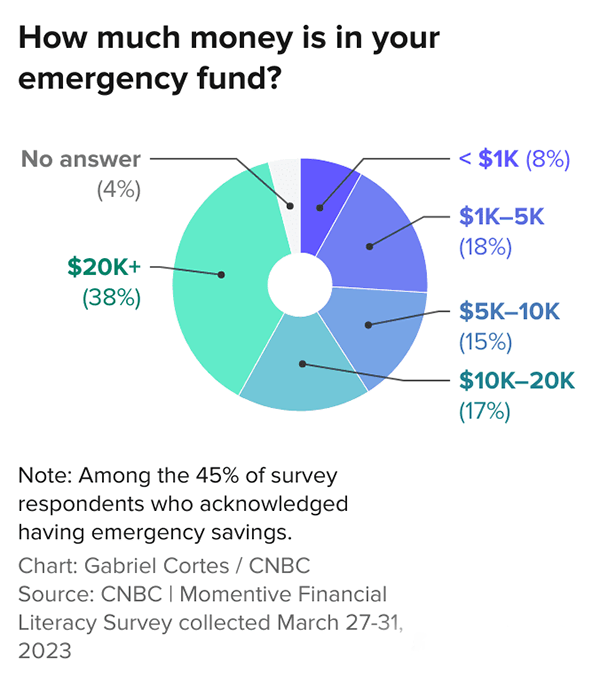

If there are any circumstances like job loss, medical expenses, home repairs, or cover your losses this will help you out so that your pockets don’t get drained. Most people do save money for such cases, take a look at the stats based on a survey below to see how much people usually save.

Financial advisors usually suggest you save at least three to six months’ worth of living expenses. Keep it in a liquid account so you can cash it out anytime. Emergency funds also give you peace of mind as you are aware that even if something goes down, you’ll be fine.

Investing Wisely

One of the best ways to grow your resources over an extended period is by investing in the right places. Investment is not a one-time thing, instead, it’s an ongoing process, and It gives you long-term monetary dividends.

You can start by purchasing stocks, bonds, or real estate. But make sure that you are creating a diversified portfolio instead of sticking to only one thing. This will minimize your risk of losing all your money.

Because even if you sustained damage, it will be covered by other commodities where you invested.

Planning for Retirement

At one point, we all just want to sit back and relax without having to worry about going to a job or making money, right? This could only be possible if you have a proper retirement plan.

Start saving early, so your money has enough duration to grow. You can set up a retirement account like a 401(k) or IRA. The benefit of opening such an account is you’ll get tax advantages, which will enhance your efforts for saving.

But make sure to make changes as your economic situation changes. Review things once in a while and adopt different approaches so you can have more than enough savings for your future.

PRO TIPSet aside a chunk of your income or returns for reinvestment, this will maintain financial stability and accelerate wealth growth!

Regularly Reviewing Financial Plans

Financial stability and success require consistency, this is why you should review all your bookkeeping records from time to time. This is to make sure that everything is aligned with your goals, respond to market dynamics, or apply new changes/strategies.

Learn about the latest economic trends so that you can figure out new investment opportunities. Create a schedule, to evaluate your progress and take advice for better understanding.

These are just a few of the tried and tested financial strategies for stability and growth. By any means, you should follow them. Also, keep in mind that you are not rushing into anything as it can potentially cause damage. Be patient, your wealth won’t increase overnight.