Are you struggling with your customer supper system? If yes, then you must’ve not taken help from conversational AI. It is improving productivity. But what type of AI is this?

According to ResearchGate, “As users demand seamless and personalized interactions, the integration of conversational AI and chatbots has emerged as a powerful solution”.

In this article, I will tell you how conversational AI is enhancing financial operations. It’s an important article, so make sure to pay attention.

The Transformative Power of Conversational AI in Finance

If we think back, the financial sector is one of the early adopters of conversational AI. Bank trends were looking to change, and it was a perfect solution for some of their problems. They implemented AI and it boosted their customer service.

Programmers have innovated new AI branches, making the sector more efficient. This technology is improving financial operations, leading to highly satisfied customers. Financial services provide more than a dozen of varying products.

Whether it’s for loans, payments, transfers, forex, insurance, etc. Conversational AI changed the communication approach and educated customers on why they should buy all these products.

It integrates many technologies like financial services chatbots. This helps companies in this sector deliver seamless interaction. Conversational AI for finance lets banks pervade personalized services. They provide top-notch customer assistance and detect fraud, ensuring safety.

Chatbot for Financial Services and Automated Support

Since technology has advanced, traditional banking isn’t working anymore. Since the embrace of conversational AI, the financial sector has changed quite a lot there’s been upgrades in customer services and automation has become a major part.

Chatbots and AI assistants are making things easier for everyone by giving automated and personalized responses. This model cuts off waiting stresses, creating an environment for instant responses. The technology automates SMS, emails, chats, calls, alerts, reminders, etc.

Chatbots for financial services have improved this sector in many ways. Like:

- Timely and instant transactional conversations.

- Delivering accurate information and personalizing it.

- Keeping visitors engaged by ensuring conversations do not stop.

- Seamless experience with nonhuman customer support.

Using Conversational AI for Banks to Improve Customer Experience

Conventional AI has improved the customer experience in several ways. Such as:

- Virtual assistance and chatbots deliver quick and quality support.

- 24/7 customer care availability.

- Gives tailored recommendations and financial advice.

- Improved operational efficiency.

It’s important that your consumers remain happy because the slightest mistake or discomfort can make them go away. Thanks to these tools, you can use gathered data and guess what your customers need. First-class customer service gets you trust, loyalty, and referrals.

Improved Financial Knowledge and Informed Decisions

Conversational AI in finance is designed to provide customer guidance. Users ask questions concerning certain financial issues. They receive prompt advice or answers to satisfaction. AI recommends specific products that empower users with knowledge.

For instance, they understand financial investments, accounts, and borrowing. These tools equip customers with the latest knowledge. They help them make informed decisions. Customers decide on products to invest in, accounts to open, savings rates, etc.

Generating Content and Identifying Documents

Bank service delivery has improved because of conversational AI. They learn from interaction, and this technology is integrated with content and analytics generation platforms. They can predict the future with analytic help along with communication success and progress.

This helps stakeholders in the financial sector create 100% custom content for markets. Quality content empowers these institutions in educating users and informing visitors. Companies use technology to create new products.

AI algorithms help companies to identify documents like emails, messages, forms, and accounts accurately. This helps the companies manage data safely, allowing them to handle customers better.

Streamlined Workflows and Reduced Costs

Conversational AI saves quite a lot of time in the finance sector. Automated tools like chatbots generate instant answers and barely require any physical input. Wait time for costumes is reduced and they are usually satisfied with the answers. Workflows are also improved by automation.

It removes obstacles that cause pain to users due to delayed responses. Streamlined workflows improve efficiency and reduce operational costs. Automating tasks reduces errors and improves customer satisfaction and flow.

Financial Services Risk Management

The financial sector experiences many risks that could lead to money and data losses. Companies in this sector can lose customer trust and loyalty due to such incidents. Conversational AI for banks is useful for detecting communication anomalies.

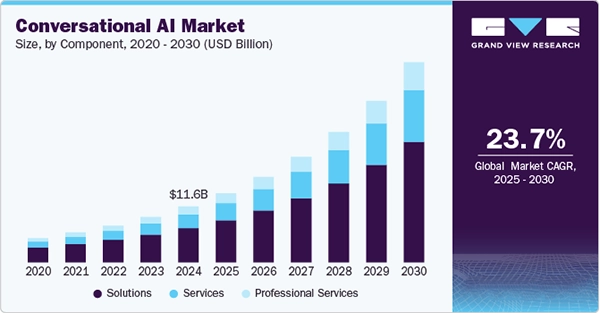

The system quantifies the risks and begins prevention steps. It identifies fraud by learning historical patterns and regulatory compliance. If we talk about the conversational AI market, it is expected to grow even more in upcoming years. And in 2024 it was valued at $11.6 billion.

Service Personalization

Service personalization is something that attracts customers, they want to try things on their own before opting for human support. They only reach out to agents when it’s necessary. Customers ask private questions and expect private answers.

Conversation AI has made this easier, as it understands these questions and sends easy-to-comprehend answers instantly. AI explains simple and hard things to inform people. It warns them if it finds unwanted activities in an account.

Data Storage and Security Enhancement

Banks and other services take every measure they can to protect their data. Whether it’s important or small, they can’t afford to get it out. They can face serious consequences if they fail to keep it confidential.

Court cases and penalties can be applied by compliance boards. This is because if the financial sector can’t safeguard it, they’ll leak the sensitive data belonging to customers. Safety starts with a secure storage that could protect all the information from outsiders.

Conversational AI monitors customer accounts and communication channels. It ensures that only the rightful owner can access the account, and it warns the authorities if there is any breach. AI also encrypts data and automates workflow to increase online safety.

DID YOU KNOW?

The first conversational AI was created in 1966 by Joseph Weizenbaum. It was a chatbot named ELIZA!

Conclusion

Communication in the banking sector is important but requires speed and accuracy. Chatbots for financial services are designed to offer quick and safe communication. It instantly answers millions of questions, making customers happy.

These tools make workflows smooth and improve data safety and control. Customers can use them to learn about money. It helps them make informed decisions for investing and security.

- The Transformative Power of Conversational AI in Finance

- Chatbot for Financial Services and Automated Support

- Using Conversational AI for Banks to Improve Customer Experience

- Improved Financial Knowledge and Informed Decisions

- Generating Content and Identifying Documents

- Streamlined Workflows and Reduced Costs

- Financial Services Risk Management

- Service Personalization

- Data Storage and Security Enhancement

- Conclusion