Just like me, do you also feel scared when it’s finally time for tax season? I mean, it can be pretty overwhelming, and you must be aware that there are penalties when you fail to make payment for your tax obligations.

According to the Hong Kong Guide To Tax Return, “Evasion of tax is a criminal offense. The maximum penalty is a fine of $50,000 PLUS a further fine of 3 times the undercharged amount and imprisonment for 3 years. Well, this is a serious issue, isn’t it?

So, what can you do in such a harsh situation? In my opinion, you should seek professional help. That’s right, in the write-up I’ll you how you can get help from professional tax experts for personal tax obligations in Hong Kong.

So keep reading.

Understanding Personal Salaries Tax in Hong Kong

Hong Kong’s personal salary tax is straightforward but can become complex without professional guidance. Three primary points affect how this surcharge applies:

- Income source and type

- Allowances and Deductions

- Filing Accuracy and Deadlines

Income Source and Type

Income tax in Hong Kong is based on the source and type of income earned. Income from employment, office, or pensions may be subject to different conditions under personal salary assessments. While this sounds simple, variations in income sources can make the reporting process more complicated.

Allowances and Deductions

The personal salaries tax system offers several allowances for dependents or education and other deductions to reduce your taxable income. Eligibility for these exemptions requires careful review, as applying them can significantly lower the total government bill.

A professional monetary advisor can identify qualifying allowances, helping individuals avoid overpaying.

Filing Accuracy and Deadlines

It is essential to keep track of deadlines and ensure precise filing. Missing a deadline or making errors in documentation can result in penalties

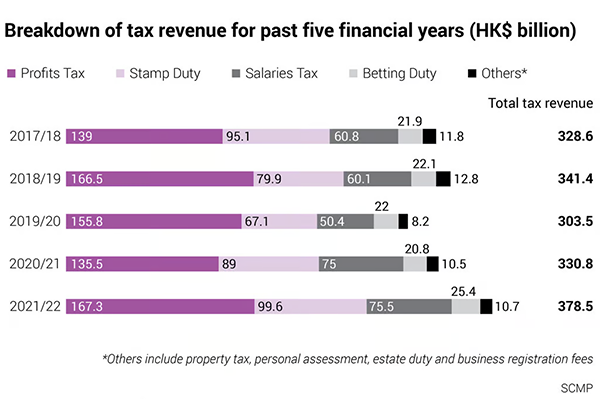

Professionals who offer fiscal preparation support can help organize and verify these documents, keeping the process smooth and on track. In the graph below, I’m adding a breakdown of tax revenue til 2022 in billions.

Benefits of Professional Tax Services

Accounting professional assistance like self-assessment tax return services can streamline the tax preparation process, ensure refund optimization, and provide valuable financial planning insights that can improve both short and long-term finances.

Tax preparation is one of the primary services offered. For many, preparing a revenue return involves complex calculations and gathering detailed documentation, which can be time-consuming.

A financial professional takes over these tasks, reducing errors and helping ensure the return is accurate. This attention to detail can prevent issues with the tax authorities and provide peace of mind during the filing season.

Another benefit is refund optimization. Tax professionals know the deductions and credits available and can identify opportunities that individuals might overlook. By analyzing your financial information and applying eligible adjustments, they can help you maximize any potential refunds.

Overall, the following are the bullet points on how you can leverage professional tax services:

- As a client of tax services, your taxes can be done smoothly that too by experts. It will take almost no time to complete this complex process.

- Tax services can help maximize deductions and credits, which can potentially increase refunds and reduce liabilities.

- You can get a strategic plan for your finances from some market-leading professionals.

Professional tax services can support financial planning. A finance specialist can give insights that help you make informed decisions for the future, such as investment planning and retirement savings.

Choosing the Right Tax Advisor for Personal Needs

Selecting the right tax advisor for personal tax needs involves a few essential considerations. The right specialist understands both personal finances and the specific monetary laws in Hong Kong.

A good tax planner should be experienced with the personal salaries tax in Hong Kong, ensuring they’re well-versed in the nuances of your obligations. They should also prioritize a comprehensive approach to tax planning, ensuring they consider future needs and current economic obligations.

DID YOU KNOW?

In Hong Kong, the tax system was introduced in 1940!

Tax Help in Hong Kong

Professional tax services offer valuable support for managing personal tax obligations effectively. From understanding Hong Kong’s personal salaries tax to optimizing refunds, these processes help simplify the billing process.

Check out the rest of our blog for more great financial insight!

End Note

Finally, tax services are one of the best solutions you can go for if you find it difficult to file your taxes. Also, these services are equipped with experts from the field who can run your operations more efficiently. If you find this article helpful, consider sharing it with your friends and colleagues as well.