It is an advanced digital software that helps to convert handwritten text into digital text.

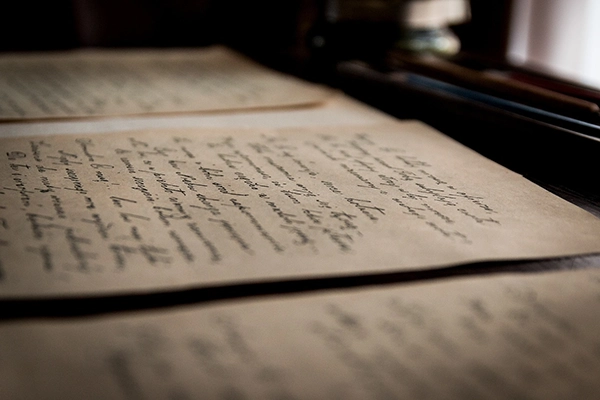

Do you know that traditional accountancy has gone completely digital, and handwritten information is no longer in trend? Whether it is signing the invoices or noting down things during a meeting, most accountants used to rely on handwritten notes only. Relying on such paper receipts, client notes, and signing the papers manually is very time-consuming and chaotic.

This is where the handwritten recognition steps in. It is a tool that helps to convert handwritten text into digital text. It saves a lot of time and makes the process trustworthy with modern effects. Instead of spending hours typing the information, accountants can now just scan to get the same information in editable form.

Want to know more about this technology? Continue reading to explore the 6 major reasons why handwriting recognition is vital for modern accountants. Find out why bridging the gap between old documents and new automation is becoming a requirement to accomplish the same work more precisely and quickly.

Key Takeaways

Handwriting recognition saves time as well as cuts costs to deliver efficient performance.

Facilitated collaboration and effective communication help to make the process smooth and share the information instantly.

It reduces human typing errors.

Artificial intelligence-powered analytics systems, along with cloud automatic systems, will revolutionize accounting in the near future.

The Transition from Paper to Digital

The accountants, over the years, had managed the notes, receipts, and invoices as paper notebooks that had accumulated around their cabins as well as their bedrooms. Even since the introduction of smart technology, the majority of the account details are still retained on paper.

Handwriting recognition has helped to convert handwriting to text and made things easier by allowing accountants to directly scan the documents and access the same information within seconds.

This dependency on advanced tech not only saves your space but also allows accountants to manage information in the best possible way.

Improved Efficiency and Time Management

Accountants need to manage a lot of data on a daily basis, and their always a shortage of time for them. Completing the finance and accounting tasks manually is a slow and repetitive process.

The introduction of recognition handwriting has made it very easy and instant. This saves their time, which can be given elsewhere to more important tasks, such as advising and guiding the clients for long-term bonds.

It is not just about speed, by about managing things more efficiently and moving with the growing technology.

Enhanced Accuracy in Record Keeping

Accuracy is the key aspect of accountancy. There are no chances of mistakes; a small error can cost a lot of charges to the company and its clients. And when the data is entered manually, it is very possible to make some human errors.

Handwriting recognition reduction in errors during manual adding of data entry. This increases confidence and creates a trustworthy image of your company and individual in the market. It is the organized way to achieve accuracy and precision without extra workload.

Facilitating Collaboration and Communication

Whether it is about managing a team or engaging with clients, teamwork is essential. Digital handwritten notes make this process smooth. Once the documents are scanned, the information can be shared instantly.

Everyone can use and edit this same information, which supports teamwork and enables real-time updating. Facilitated teamwork and effective communication allow the teams to complete the projects faster and meet deadlines more quickly.

Cost Savings and Resource Allocation

Above the benefits of saving and facilitating collaboration, it helps to save costs through the right allocation of resources. The amount of money a firm spends on printing, paper, and finding spaces to store files. Working digitally helps to reduce all those costs.

It uses less paper, resulting in lower expenses, and reduces the need for physical storage. Moreover, automation reduces repetitive tasks, allowing accountants to focus on other responsibilities. This overall results in business growth and gives firms the flexibility to invest in better tools and clients.

Preparation for Future Trends in Accounting

Technology has completely changed how accounting firms used to work and grow. It will continue to enhance the working of accounts by the use of AI-driven analytics tools and cloud-based automated systems.

In the near future, handwriting recognition will not be a technology to integrate into your accounting business, but will become the foundation of the firms. Handwriting recognition has given firms a chance to the firms to work more efficiently, reduce their operational costs, and build a position in the market.

This is a simple but powerful technology that connects modern efficiency with traditional notes, turning the chaotic handwritten data into clear and organized data.