Do you know that sole proprietorship is the most common form of self-employment? And, I’ve also been running my own business for almost five years now. During this time, I’ve realized that the most important thing for running a business smoothly is the money it requires for the initial investment.

I personally had to take a few small business loans to help expand my venture. Around 20% of the businesses are failing each year due to the lack of funds (Source: Go Yubi)

So, in this read, I’ll be sharing my personal experience with business loans as a sole trader along with some tips for you to get one.

Let’s start!

Understanding Business Loans for Sole Traders

As a sole trader, we’re often juggling multiple tasks, be it about managing the company’s finances or handling the customer’s interactions. However, securing a business loan might seem a difficult task., As you might wonder, “How can I, as a one-man show, convince a lending company to give me a business loan.”

Well, I’ve personally used a business loan to expand my venture to new heights. This usually works as a financial product that is designed specifically for businesses to enhance their operations and make sure that it runs smoothly.

Types of Small Business Loans for Sole Traders

So, if you’re also running a business on your own, there are a variety of loan options available in the market. Here take a look at some of them:

- Term Loan: It is probably the most common type of loan in which a lump sum amount is provided upfront. And that is to be repaid by the taker over a fixed period of time with the interest.

- Working Capital Loans: As the name suggests, Working Capital Loans are designed to cover the day-to-day operations and short-term business needs.

- Equipment Financing: This is another type of loan that allows the taker to acquire all of the new machinery, tools, vehicles, or technology that are essential for business operations.

- Business Credit Lines: Just like a credit card, a business line of credit allows borrowers access to a predetermined credit limit that can be drawn upon as needed.

- Government-Sponsored Loans: This is launched by governmental agencies to support small businesses and promote economic growth. They often come with some favorable terms like relaxed eligibility criteria, lower interest rates or longer repayment options.

Eligibility Criteria for Small Business Loans

When I first thought of applying for a business loan, I was also a bit nervous about the eligibility criteria. However, after the process, I realized that it wasn’t as challenging as I thought it to be.

So, speaking of my personal experience, lenders typically looked for the four major things to check my eligibility for the loans. This includes the total age of the business, what’s my credit score, what’s the collateral (This is an asset that you pledge as a security of the loan), and the total revenue of the company.

How to Apply for a Business Loan as a Sole Trader

So, if you’re thinking of applying for a loan, the right approach for that would be to first identify your business objectives. This will help you determine the amount you need to borrow and also to pick the right kind of loan type.

After figuring out the amount and loan type, all you need to do is gather your documents and start reteaching about the lenders that might be a perfect fit for your company.

In addition to that, it is often suggested to properly understand the terms and conditions of the loans. This includes learning about the interest rate, repayment options, and any additional fees.

Benefits and Risks of Taking a Business Loan

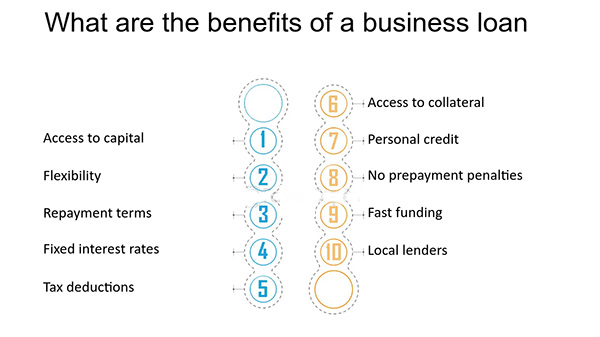

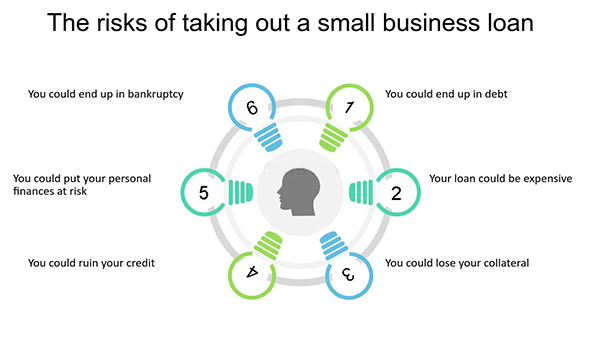

As someone who has experienced the both benefits and drawbacks of taking business loans. I would say it is important to weigh these factors carefully before making a decision.

While the benefits may include that by taking a business loan, you would have the necessary capital to expand your business. This can also help you bridge the all cash flow gap, especially when you’re facing some unexpected expenses.

On the other hand, the risks might include the increase of the financial burden and the risk of business failure as you might struggle to repay the loan.

Tips for Maximizing Approval Chances

So, based on my personal experience and the research that I did for this article, here are some fine tips to increase your chances of getting approved for a business loan:

- Build a strong credit history to showcase your financial responsibility.

- Create a well-crafted business plan that clearly demonstrates all of your objectives.

- Choose a right lender that specializes in small business loans and offers the best terms in the market.

- Be honest during your application and interview process.

Conclusion

In closing, going for a business loan as a sole trader can be a powerful decision of yours. This will provide you with enough finances to run your business smoothly, and also help you expand and establish your authority in the market.

However, you must always remember that a business loan can be a big commitment for you, especially as a sole trader. So make sure you’re considering all the major benefits and risks to make an informed decision.