In today’s world, there is no doubt that the job of a CPA is pretty important. Whether you’re a successful business or a salaried employee, we all need the help of a CPA at least once in our lives.

So, if you’re thinking of making a career in accounting or any related field, you might have heard from many that you need to get a CPA certification.

But getting this certification is a challenge, too. After all, it signifies that you know your way around numbers and have worked hard to become a top professional in finance and accounting.

In this blog post, we will take a look at what CPA certification really means and why it is so important for accounting professionals. Also, learn about Highest Paying Accounting Jobs by reading this article.

What is CPA Certification?

A CPA certification is one of the professional certifications any accounting professional can get their hands on. It is proof that you’ve worked hard to get to the top.

And you know what?

Getting this certification is no walk-in-the-park either. You need to jump a lot of hoops and put in a lot of work to become a certified accountant.

Out of all the people who took this exam, only about 10% passed it on the first attempt.

Besides, these exams are overseen by different government agencies in each country.

In the United States, the AICPA and the National Association of State Boards of Accountancy (NASBA) see to it that the exams are held fairly.

DID YOU KNOW?

CPA certification is a universally recognized professional designation that signals authority and expertise. And, according to the Bureau of Labor Statistics, employment for people with a CPA license is projected to grow by 22% between now and 2028.

So, Why Should You Become a CPA in the First Place?

If you think of it from a financial point of view, certified public accountants are pretty invaluable for any business. They are experts in helping you with accounting, taxes, auditing, and financial reporting.

Besides, we all know just how tough it is to handle the complicated matter of finances on your own, and with all the strict laws and regulations in place, you might just as well hand over all your money to the government.

But there is so much more to having a CPA certification, you know.

Here are some of the reasons why getting a CPA certification is a good idea for any aspiring accounting professional.

1. Enhanced Career Development

CPA is a pretty specialized certification that tells everyone that you can do what a plain regular accountant is not able to or is not allowed to do.

So, while your accountant can file, audit, or review your financial statements, only when a certified CPA signs that document will it really be deemed credible.

While accountants make up a dime a dozen, only half of them are CPA holders. This means that no matter what industry you choose to specialize in, job opportunities will be waiting for you.

Plus, there is literally no industry out there that does not need CPAs.

2. Increased Employer Demand and Better Compensation

The CPA course will give you in-depth knowledge of core accounting principles and know-how in tax handling, auditing, and financial reporting standards.

This means that your certificate is held in high esteeme globally. No matter which industry you step into or what country you travel to, you can find a managerial or higher position job.

In fact, many businesses give have put in place an employee recognition award program to keep employees motivated as well as giving out higher-standard salaries to attract competent CPAs to their companies.

3. Expanded Job Opportunities

You know, having a CPA certification on your hands gives you specialized knowledge and credibility on most financial matters.

This means that if you are interested in another career path, you can easily pivot and change your job.

Here is a list of the types of jobs you can get as a CPA-certified professional:

- Personal Financial Planning

- Information Management and Technology Assurance

- Forensic Accounting

- Valuation

- Taxes

- Audit and other Attestation Services

- Government

- Nonprofit

- Environmental Accounting

- International Accounting

- Financial Accounting and Reporting (FAR)

- Regulation (REG)

4. Professional Independence

Getting this certification opens a world of opportunities. The CPA certification is recognized globally, and if you hold it, you are regarded as one of the leading experts in the fields of accounting and finance.

With this certification, you can expect to get jobs in top financial firms, in the government, or even in private practices.

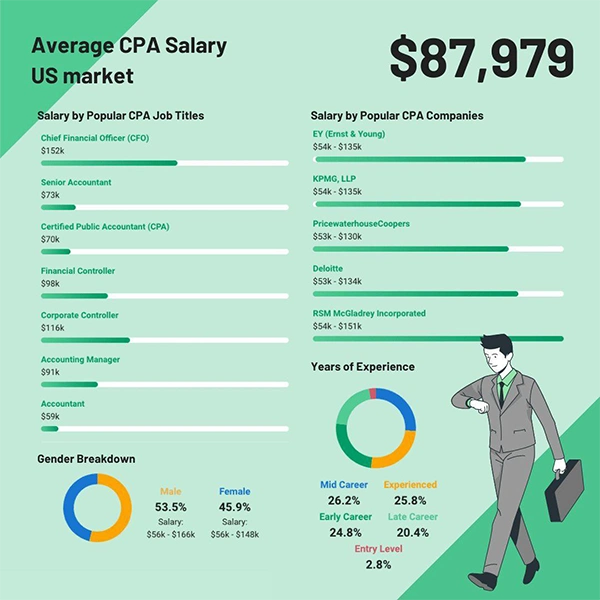

The average salary for a Certified Public Accountant (CPA) in the United States can range from $60,000 to $150,000 per year, depending on experience, company size, and geographic location.

Conclusion

If you’re thinking of a career in accounting and finance, getting a professional accounting certification can open up a world of possibilities.

CPA certifications are one of the toughest accounting certifications to get, and a few professionals have passed the exam in one sitting.

This certificate proves that you are the best accounting professional and have the knowledge, skills, and integrity to handle financial matters.

Besides, with certification in hand, you can get a job anywhere in the world, and in any field or industry you desire. After all, there is no business out there that has no need for CPAs.