Installment loan can be lowered by increasing the repayment time, making frequent payments, by paying off the loan before its due and by applying for debt management services.

KEY TAKEAWAYS

- Installment loans provides financial assistance with its structured repayment plans.

- These loans can take care of any needs one might have without putting any burden on them.

- Make sure to compare different loan terms and interest rates before getting any.

- Timely repayment is important to avoid penalties.

- Installment loans should only be taken when necessary.

Debt is the slavery of the free man. – Publilius Syrus (Latin Writer)

Financial crisis always come unannounced and can mess up with a person’s mental health if they don’t have money to deal with some kind of situation. I’ve been there and can relate to how it feels, but in such circumstances installments loans can be quite helpful.

According to IDFC First Bank, “An installment loan is an agreement in which a loan is repaid over time through periodic payments.” It is a safe and flexible option that can cover short term expenses.

To give you a better understand on the topic, I’m writing this article mentioning why installments loans are the perfect solution for short term expenses. So, let’s get started.

How Installment Loans Work

In installment loans, individuals get the necessary amount that needs to be paid in a fixed repayment period. When the repayment is made, principal amount along with interest both are given together, this structured approach manages debt effectively.

These come under various names like personal loans, car loans, small business loans etc., and can be availed by anyone who meets the eligibility criteria. Tenure can go from few months to years, making the repayment affordable and interest isn’t that high either.

Why Installment Loans Are More Flexible

Not every loan is the same, they all serve different purpose and can only be obtained under special circumstances. Installment loans are usually easy to get and have low cost repayment, making them ideal for a diverse range of expenses.

It gives high and low loan options and individuals can select them according to their needs and whether they’ll stand up to this financial debt obligations.

Best thing about this is you don’t have to repay the whole amount borrowed along with interest at the same time. Suppose you took a small loan of $6,000 on the interest of 2%, for 6 months now each month you’ll pay $1000 along with 2% interest. This reduces the burden and given you plenty of time to save up money.

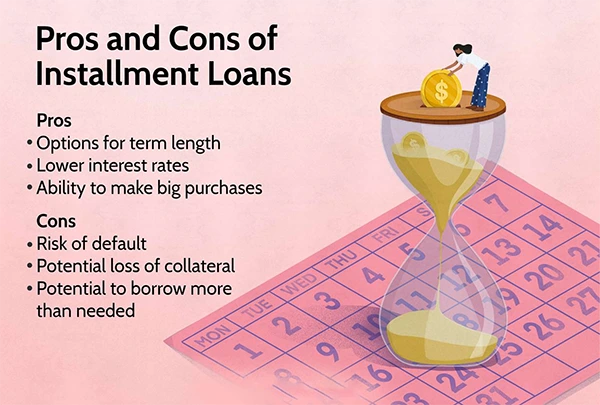

Sure, it’s not perfect either and does have some downsides, which can be seen in the infographic below.

Situations in Which Installment Loans Are Appropriate

These loans shouldn’t be taken until and unless necessary; you can’t just wake up one day and decide that you should take a loan. Installment loans should be taken out when someone is in need or is in any financial crisis.

If someone wants to buy a car, get their home renovated, or pay medical expenses, these are some of the situations when it can be taken. It’s coming at a cost and needs to be repaid, you are in debt until it’s paid, so be mindful while availing it.

If you find yourself in such a situation and are looking for a short-term loan, My Jar Loans can prove to be the perfect solution for you. They provide loans from 100 Euros to 5,000 Euros, with a minimum loan term of 1 month and a maximum of 36 months. You can choose the one that suits you the best.

Selecting the Appropriate Installment Loan

There are several options available from where people can take out installment loan, but they need to consider several factors before settling for any of them. This includes:

- Interest Rate: It wouldn’t be the same on every platform or service and some might be charging way higher interest then it’s required, so It’s important to compare different interest rates and see which one is perfect for you.

- Fees & Hidden Cost: Loan’s affordability matters that’s why It’s important to check if there are any hidden fees, usually they’ll charge a processing fee which shouldn’t be much. Apart from that, learn about prepayment penalties and late fee charges.

- Go for Verified Lenders: When I say the web is filled with such services, I mean it, but almost 60% of them are going to be fraud. It’s important to read customer reviews and ratings to check if it’s legit or not. For example, CreditNinja, is trusted by thousands of people and has managed to make a great reputation as certified installment loans provider, you have to find services like this.

No decision should be made without considering above given factors. Don’t fall for traps and insert your personal details on any unknown website. Do proper research before settling for any service.

DID YOU KNOW?The global public debt was estimated to be $97 trillion in 2023!

Flexible Financial Solutions

Installment loans are very helpful and can be proven lifesaver. These can be obtained easily as long as you meet the eligibility criteria and money if created within 2-3 working days. However, this should only be availed when someone is in great need and not when you do have money but don’t want to spend it.

Going in debt is never good and failing to make timely repayment can impact your CIBIL score negatively which is not a good thing and in future you might not be able to take benefits from loan services. So, think carefully and take the right step.