“The future of tax lies in the use of data analytics, artificial intelligence, and automation to enhance decision-making, improve accuracy, and ensure compliance.”

— KPMG

I am sure the majority of you would think of complex tax-related calculations as soon as you hear the words ‘business tax management.’ This is the image even I had in my mind before I started my own business and worked closely with the tax accountants of my company.

Making the observations myself, I can say that the way businesses handle taxes is transforming. Because these days, self-assessment tax return services have started leveraging technology to simplify complicated tax operations. The tax management market is flourishing and is expected to grow at a CAGR of 10.8% between 2024 and 2031. (SkyQuest: Tax Management Market)

Companies like Advise RE provide valuable accounting services for businesses aiming to streamline their tax operations without the stress of manual tasks. Let’s take a deeper dive into this topic and discuss the role of technology in business tax management in detail.

Experts Use Technology for Perfect Tax Management

Managing taxes is not the same as it used to be, it has become easier with the help of advanced technological tools. Experts in our firm use these smart tools to handle all tax-related work, which helps them ensure minimum or no mistakes.

These tools help in understanding tax rules, calculating amounts correctly, and filing taxes on time. This reduces the risk of errors and keeps businesses safe from fines or other problems.

With these tools, experts provide smooth and reliable tax services for businesses. They make sure everything is done right and help save money while following the law. This way, businesses can focus on growing while experts take care of their taxes.

Making Tax Filing Faster

Filing taxes used to be a time-consuming process for us, especially when juggling multiple responsibilities. With digital solutions, the process has become much quicker. The automated features help us compile reports and organize data, saving hours that would otherwise be spent on manual entry.

Businesses also benefit from features like real-time calculations and auto-generated summaries, which reduce the chances of errors and speed up the filing process.

Reducing Human Errors

The possibility of human error is always there when calculating taxes manually. But even the smallest of errors can result in fines or missed deductions, which can lead to legal troubles.

Digital tools are designed to prevent such issues. By automating calculations and offering checks at every stage, they ensure the accuracy of financial data.

Businesses find it reassuring to rely on platforms that minimize errors and help meet strict tax deadlines with confidence.

Keeping Up with Tax Laws

Another major challenge that these advanced tools help us overcome is, keeping up with the ever-changing tax laws. Digital platforms now come equipped with regular updates to reflect the latest regulations. This feature removes the guesswork, ensuring compliance without the need for constant research.

Such tools are particularly useful during busy tax seasons when accuracy is critical.

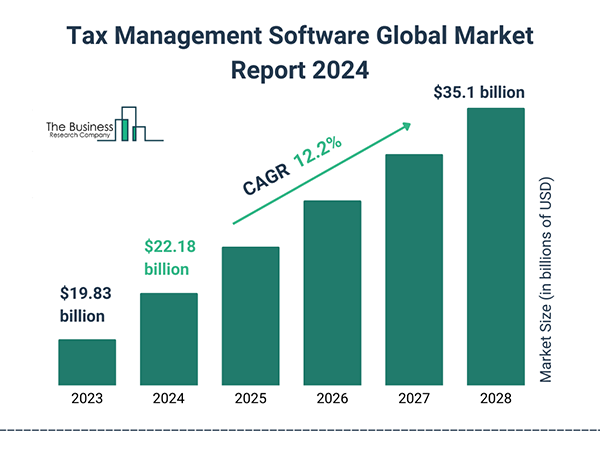

These days, an increasing number of businesses are trusting advanced platforms for effectively managing taxes in their business, resulting in a surge in the tax management software market. The market is expected to reach from $22.18 billion in 2024 to $35.1 billion in 2028, growing at a CAGR of 12.2% in the forecast period.

Other Benefits of Using Technology for Tax Management

Now that we have discussed the most prominent benefits of using technology for tax management, let me tell you about some additional perks that come with it.

How Automation Enhances Tax Efficiency

Automation in digital tax tools eliminates repetitive tasks like data entry and report generation. This allows businesses to focus on strategic planning rather than tedious paperwork.

Cost-Effective Solutions for Every Business

Digital tax platforms offer scalable solutions that cater to businesses of all sizes. These cost-effective options ensure even small businesses can access advanced tax management tools.

Building Long-Term Confidence in Tax Processes

By using reliable digital tools, businesses can establish long-term confidence in their tax operations. Consistent accuracy and compliance build trust and reduce stress over time.

FUN FACT

More than 85% of businesses now rely on tax software to streamline their tax management processes.

Conclusion

It has become a necessity for businesses of all sizes to utilize advanced technology, to manage the complex tax work. The advanced tools simplify processes, save time, and reduce risks associated with manual tasks.

The shift toward digital tax solutions is helping businesses tackle tax processes with ease. By reducing errors, saving time, and staying updated with regulations, these tools are transforming the way taxes are managed.

In the end, I can say that, as technology continues to evolve, these platforms are expected to offer even more refined and progressive features, making tax management less stressful for everyone involved.