The additional cost incurred while producing one more unit of product or service is known as the marginal cost. It helps businesses to determine whether the increasing output is profitable and is also crucial for production and planning strategies.

Business and economics go hand in hand, and a few concepts, like marginal cost, are critical to understand. Whether you have an established business, are creating a new line of product, or just building one, knowing how to calculate marginal cost is crucial.

It helps price products correctly, scale production, and optimize operations and finances, similar to how an accounting package for small businesses helps with overall financial control.

But what even is marginal cost, after all? We’ll deep dive into this concept and learn intricate details about marginal cost vs marginal benefit and other core pillars that shape the business in this blog.

Quick Answers:

- Marginal Cost: This is the extra cost a business spends to produce one more unit of a product.

- Example: A jeans factory produces 100 jeans for $200 ($10/each), then manufactures one more jean (total 101) for $210. Here, the marginal cost of the jean factory is $10 extra amount.

- Marginal Cost Formula: The Change in Total Cost (TC) divided by the Change in Quantity (Q), expressed as MC = TC / Q.

What is Marginal Cost?

In economics, Marginal Cost (MC) is defined as the additional cost incurred while producing one more unit of product or service. Manufacturing a good or producing a service has a certain threshold, and adding one more unit can change the output in its entirety, which is represented by marginal cost. This idea complements understanding tools like accounts payable software for efficient financial workflows.

So you can say that it’s an extra variable cost that is directly tied to the additional product produced. Just like understanding the difference between accounts payable and accounts receivable helps keep finances organized, knowing the marginal cost can keep production profitable.

Thus, calculating MC helps to reduce the chances of loss over the extra units and determine the ideal production quantity for a profitable business.

Now that you’re introduced to the concept, let’s go ahead and understand why it matters.

What is the Importance of Marginal Cost?

Understanding marginal cost is not about learning the definition, but about being informed to make strategic business decisions. It is a vital tool that supports navigating the launch of a product, managing a factory, and evaluating the finances, especially when paired with insights from multi-step income statements for deeper profitability analysis.

Here’s why marginal cost and marginal costing matter at all levels of business:

- Improves Pricing Strategy: Pricing a product too high or too low can push potential customers away from your business, affecting the overall cash flow. Knowing the market’s competitiveness and the value of your product is the key to staying in the game. When you calculate the marginal cost, you can set a price that attracts customers without hurting profits, offer discounts, and change prices based on market movements, similar to ensuring accurate payroll processing for financial stability.

- Streamlines Production: To nail operational management is to know how much to produce, and the marginal cost helps find that sweet spot. Analysing the cost of producing one more unit to the point when the business is no longer profitable allows for scaling the production up or down based on the data.

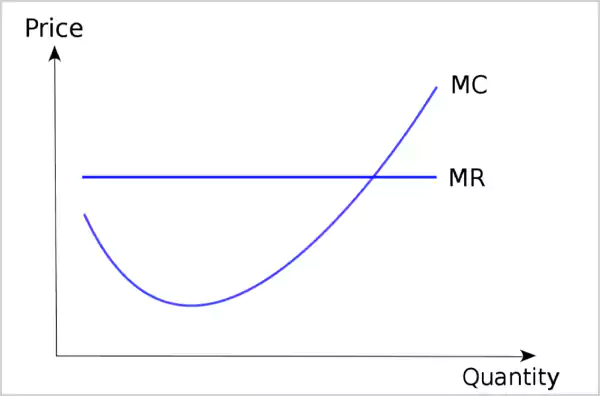

- Access Break-Even and Profit Analysis: Break-even analysis shows a picture when total revenue equals total cost. This allows comparing marginal cost with the marginal revenue (earnings from selling one more unit) and understanding the number of units that need to be sold to break even— a practice also supported by using management accounts services.

- Helps in Decision-Making: MC is helpful, especially in short-term decision-making. It empowers businesses to determine when to halt production, place special orders, and allocate resources in the production line, ensuring maximum ROI.

- Strategic Scaling and Resource Allocation: MC can tell you if the time is right to scale. If the numbers are increasing steeply, it may not be profitable. However, if the cost is decreasing, you hire more staff, expand operations, and even enter a new market for growth. This also helps you decide when and where to invest the resources and allocate wisely for maximum profits.

Thus, the marginal cost curve guides you in how much to produce, when to scale, analyze the profit and loss, and make informed decisions based on real data.

Read More: Best Accounting Package for Small Business 2025: Manage Your Business Finance Like an Expert

How to Calculate Marginal Cost?

Every business should spot the time when the marginal cost becomes lower, so that it can gear up for expansion. Here’s the marginal cost formula to get started:

Marginal Cost Equation: MC = Change in Total Cost / Change in Quantity

Where,

- Change in cost is determined from the difference between the total cost of producing one more time and the total cost before producing extra.

- Change in quantity is the number of units added to the original production.

Marginal Costs Example

Let’s see how to find marginal cost using an example:

A bike tire manufacturer produces 1,000 tires at a total cost of $50,000. Producing 1,100 tires will increase the total cost to $55,000.

- Using the marginal cost equation, the first step is to determine the change in cost.

Change in cost: $55,000 – $50,000 = $5000

- The second step is to find the change in total quantity:

Change in quantity: 1,100 – 1,000 = 100 units

Thus, Marginal Cost = $5000/100 = $50 per unit

So, it costs $50 per unit for every tire produced between the quantities of 1000 and 1100.

Note that the marginal cost applies to all levels of production, and the values change every time. Thus, businesses should utilize the equation as a guiding tool, much like referencing salary vs hourly pay for compensation decisions.

How Marginal Costs Compare to Other Key Concepts?

The marginal cost formula goes in harmony with other key business concepts to supercharge the business and strengthen the core of the operation. Here’s the complete breakdown:

Marginal Cost Vs Average Cost

| Aspects | Marginal Cost | Average Cost |

| Definition | It is the cost of producing one more unit in addition to the original quantity. | It is the total cost of products divided by the number of units produced. |

| Formula | MC formula = Change in Total Cost / Change in Quantity | AC = Total Cost / Total Quantity |

| Focus | An increase in cost with every added unit, depending on production. | It tells about the overall cost per unit. |

| Pricing Variation | Quickly rises and falls depending on the production level. | The total cost per unit remains steady. |

| Decision | Helps to decide if producing one more unit is profitable or not. | Determines the overall efficiency of production. |

From a business perspective:

- If MC < average cost, producing more units can lower the average cost further.

- If MC > average cost, producing more will increase the cost further.

Marginal Cost Vs Marginal Price

| Aspects | Marginal Cost | Marginal Price |

| Definition | It is the additional cost incurred in producing one more unit. | It is the price received for selling that one extra unit. |

| Formula | MC formula = Change in Total Cost / Change in Quantity | Marginal Price = Value of unit sold |

| Stands for | Internal costs for the business operations. | External money received from the customer. |

| Focus | Profitability in production | Revenue generation |

From a business perspective:

- If MC<MP, the business is making profits.

- If MC> MP, the business is making a loss.

Marginal Cost Vs Marginal Benefit

| Aspect | Marginal Cost | Marginal Benefit |

| Definition | It is the cost incurred in producing one more unit. | It is the value gained from consuming one more unit in the production line. |

| Focus | It focuses more on the supply side. | It focuses more on the consumer or demand side. |

| Role | It tells how much a company should produce. | It tells how much the customers are willing to pay for the product. |

| Production Goal | Stop the production at the point where MC = MB | Consume to the point of MC = MB. |

From a business perspective:

When the value of marginal cost equals marginal value, it shows that efficiency is achieved. Also, this basic principle tells us when to stop, the number of units we should produce, and how much to price. From a business perspective, just as understanding benefit in kind helps set employee compensation, marginal cost clarifies production choices.

What are the Pros and Cons of Marginal Cost?

Marginal cost helps businesses in making improved short-term decisions, better cost control, simplified accounting, and clearer performance evaluation. However, its cons include ignoring fixed costs, difficulty in separating costs, making it less useful for overall financial reporting, and more.

Below, we have illustrated these factors in a more simplified way. Read them out attentively.

Bottom Line

Marginal cost is more than just a number; it is a financial support tool that guides your business from pricing to scaling. When you know how to calculate marginal cost, its core uses, and how it aligns with marginal benefits and average costs, you can supercharge your business with a data-driven strategy.

Wrapping it up! We have explained how to figure out marginal cost and its importance in this blog. Let’s do a quick recap:

- Marginal cost is the extra cost that you have to bear to produce one more unit of a product or service.

- Marginal cost equation: Change in Total Cost / Change in Quantity.

- The marginal cost curve shows the progression of MC as production varies and emphasizes the efficient areas.