Investing has gained a lot of popularity in the last decade due to its low risk, higher returns, and the ideal diversification of all of your holdings. This is a perfect strategy to spread your investment across various classes and sectors to mitigate risk.

But, what happens when the assets within your portfolio start to look all similar? Well, this is right where the concept of a mutual fund portfolio comes into play.

While the diversification of the stocks is crucial, a proper understanding of this overlap is also equally important. To figure out if multiple funds in your portfolio are heavily investing in similar stocks.

For instance, if an investor owns both the S&P 500 and a technology sector ETF, then there would be a large number of stocks overlapping, as some companies contribute to the major chunk of both stocks.

So, this read will be diving deeper into how portfolio overlap can affect your investment journey, along with how you can optimize your portfolio diversification. Also, learn about Venture Capital Funds by reading this article.

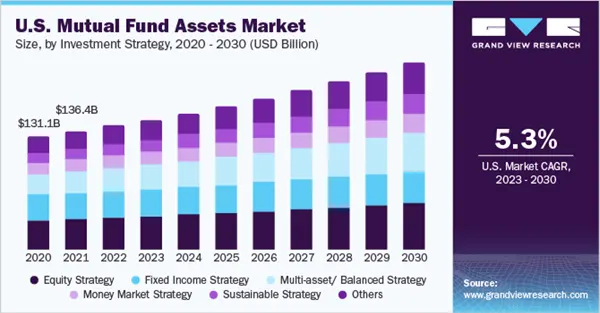

Mutual Funds

A mutual fund is a professionally managed investment program. This is a strategy where shareholders pool money from the many interested investors and invest it further in a basket of different assets, such as stocks, bonds, or even gold.

Diversification of Mutual Funds

The best thing about investing in mutual funds is that it allows you to diversify your portfolio across different industries and sectors to reduce further investment risk. Mutual fund diversification is an extension of the popular saying “Don’t put all of your eggs in one basket”, which aims to reduce the negative impact of any one bad investment.

Components of a Mutual Fund Portfolio

The majority of mutual funds can be classified into three primary categories: Cash, Bonds, and Stocks, here’s a little brief to them:

- Cash: The cash level of a mutual fund is the percentage of total assets that are held in cash For stability and liquidity.

- Bonds: Bonds are debt securities issued by companies or governments when they want to raise money.

- Stocks: A stock investment is when you buy a share of ownership in a company, also known as equity.

What is Portfolio Overlap?

The portfolio overlaps as the name suggests occur when multiple funds from your portfolio are invested in the same underlying securities. This overlap usually happens when there is a significant overlap between the holdings of different funds. It can have unintended consequences on investment returns and risk.

How to Identify Overlap?

There are different ways where you can identify whether your holdings are getting overlapped, here take a look at some of them:

- Analyze your holdings for each fund

- Now, compare the securities held by each fund.

- Use online tools and resources to make the process easier.

But why do these overlaps usually happen, here are a few reasons:

- Investment Strategies and Objectives: Investing in the funds with similar strategies. For example, cap tech stocks – will have similar holdings.

- Market Conditions and Economic Factors: These can influence fund managers’ decisions and lead to overlap in specific sectors or industries.

Do You Know?

In the U.S., the Massachusetts Investors Trust (MITTX) is confirmed as the first mutual fund plan in the world, which was first introduced in 1924.

How to Evaluate Overlap?

So, now that you have a little background on why this overlap is occurring, understanding the impact of the overlap is key to mitigating your risk.

- Increased Exposure: Overlap means increased exposure to specific sectors.

- Concentrated Risk: This can lead to higher volatility during market downturns or sector-specific challenges.

- Better Management: Proper overlap management can give better returns in a bull run.

Managing Portfolio Overlap

Managing your portfolio for better return on investment is always a good idea, and here’s how you can do that:

- Diversify Across Categories: Invest in funds with different strategies and objectives.

- Customize Portfolios: Base your portfolio on your financial goals and risk profile.

How to Minimize Overlap?

There are a range of ways you can use to minimize the overlap of these securities, which include:

- Index Funds: Designed to track specific market indices and reduce overlap.

- Exchange-Traded Funds (ETFs): Lower expense ratios and diversification benefits.

- Tactical Asset Allocation: Rebalance assets based on economic and market conditions.

Fund Managers

Fund managers are professionals who are officially responsible for making investment decisions and overseeing the mutual fund on behalf of their investors. They often use their skills and expertise to make informed investment decisions. Their performance is measured by the fund’s overall return in comparison to a relevant benchmark index.

Long term vs. Short term investments

If you’re into the stock market and stuff, you must have wondered what drives more profit, the long-term investment strategy or the short-term trading. Well, let’s take a quick look at what might be the perfect fit for you:

- Long-term Investors: Overlap may not be critical for buy-and-hold investors.

- Short-term Traders: Overlap is more critical for those with specific financial goals or shorter investment horizons.

Investor Reminders

When you have invested heavily in a mutual fund, it’s important to regularly adjust according to your needs. It is also advised to be up-to-date with the market conditions, fund strategies and your financial goals to rebalance periodically.

Conclusion

Investors who want to get better returns and manage risk must understand mutual fund portfolio overlap. While mutual funds provide diversification, spreading your investments across different asset classes and sectors. But again, the overlapping of the funds can have some unintended consequences on your investment strategy.

Investors can identify and manage overlap in their portfolios by looking into mutual fund holdings and using overlap tools. Investors can reduce overlap by diversifying across fund categories with different objectives and strategies. Proper overlap management will keep the portfolio in balance and aligned with your financial goals.