Have you ever thought about how to earn more without doing anything?

See, I’m a very cautious person when it comes to money. Yes, I do spend it on various things, but I have also created a fixed savings account. But why? Because it is a great way of growing your wealth. I get a specific interest rate, and who doesn’t want some extra cash?

American businessman and investor Robert D. Arnott once said, “In investing, what is comfortable is rarely profitable.” However, a term deposit says otherwise it is also an asset but has low risk, and you can get great returns.

In this write-up, I will tell you about the benefits and drawbacks that you should know about term deposits. Who knows, you might open one of these in your bank account after reading this article. So make sure to read it till the end.

What Is A Term Deposit?

Before we wade too deeply into the weeds, it’s worth giving you a quick idea of what these instruments are. To put it simply, a term deposit is when you set money into an account for a specific amount of time (the duration)) and receive a fixed interest rate as a return for doing so.

While the current term deposit interest rates can vary from institution to institution, they are usually set at whatever value by the central bank of your country. This means that in the current economic climate, you should receive a relatively healthy sum in the 3-5% range if you’re living in a Western country.

However, this is only a generalization, and there can be additional factors that influence the amount you can yield from this type of investment. Factors like market conditions, the bank’s volatility profile, and a myriad of other factors can affect the price you get from placing your earnings in a fixed-rate fund.

Advantages Of Term Deposits

There are plenty of reasons why you might choose this sort of investment over others, but in most cases, it will be due to a reduced risk appetite or a desire to keep your reserve funds safe rather than opting for a greater hazard, higher reward option.

- Safety: Term installments are considered by many experts to be an incredibly safe place to place your cash. While this won’t yield incredible returns, as we will discuss later. You are usually covered by backing from government deposit insurance schemes in many countries. It is this safety that makes it desirable to a particular segment of society.

- Predictable returns: When you place your wealth into a reserve account, you will know precisely how long it must remain and how much you will receive in the form of interest rates. This predictability can make it perfect for those who don’t need the cash immediately but need it to increase in value (relatively speaking) rather than keeping it in their regular savings account.

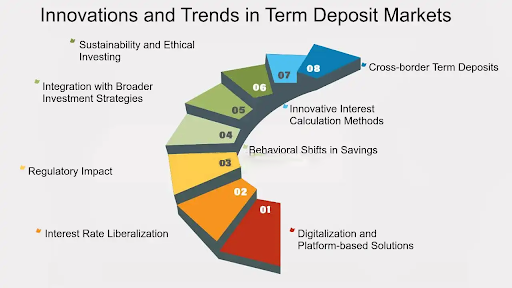

- Discipline: By considering the future, you can set yourself on a path to a stronger level of financial security compared to others. Moreover, a term deposit is an excellent idea if you know that you will be using the money in the future but are worried that it will melt through your fingers if you keep it in a current account. For instance, take a look at this infographic that shows the innovations and trends that are happening in this market.

Disadvantages Of Term Deposits

While there are many upsides, there are also the inevitable downsides that could make a term deposit a poor solution for those with higher risk tolerance and who need to get more from their investment.

- Limited liquidity: As the name suggests, you will place your funds into this investment for a fixed term. In reality, this means that you will be unable to access it even if you demand it. While this might not be a downside to those who have a long-term outlook, for many, this could be a dealbreaker.

- Lower returns compared to other investments: Although a guaranteed 4-5% might sound desirable for some, for the majority, the allure of 8+% gains when investing in something like the S&P 500 is simply too good to miss. Investing in alternate instruments like stocks or crypto offers the chance for considerable gains; it’s also far riskier than a periodical hold, and you aren’t guaranteed to make that amount regularly. Moreover, different options could result in a complete loss of your money, which a time-limited payment will never do.

FUN FACT!

Term deposit is said to have started in the 1600s when European banks started issuing CDs (Certification of Deposits)!

- Impact of inflation: Yes, we indeed mentioned a recurring settlement is a good hedge against inflation earlier in the post, but it’s still a point worth making. If the cost of inflation is greater than the interest amount offered, you will not only still lose out (albeit at a lesser rate than if you just keep it as cash), but you will be unable to do anything about it until the term is up.

Like most financial instruments, such borrowings have both positives and negatives, depending on the direction from which you’re looking. As long as you know what you’re getting into, they are a perfectly safe way to make small profits on your spare cash lying around and if you decide to save for something in the future.