“The best accountants are not just number crunchers; they’re financial storytellers.”

– Jessica Turner (Author, marketing strategist)

When I listed my business across various online shopping platforms, my only thought was that it would help me reach a wider audience and connect better with my potential buyers. Which it did, but something I did not expect was that it would complicate the accounting operations to this degree.

Combining data from different platforms and tracking their finances was becoming a headache for me. Not to mention the biggest challenge, as mentioned by more than 50% of firms, remaining compliant with the ever-changing laws (Content Snare: Accounting Statistics).

Fortunately, with time, I was able to find the perfect solution for all these setbacks. If you wish to learn what they are, stay tuned as I tell you everything that helped me overcome the accounting challenges.

Core Accounting Challenges for Multichannel Sellers

Before delving into solutions, let me first share some of the major accounting challenges that I came across in multi-channel selling on online platforms.

- Fee tracking: It is quite a struggle to manage different fees across multiple channels. Tracking sales and combining the fragmented data from different sources, often led to huge confusion for me, which proved to be a major issue on certain occasions and resulted in poor decision-making.

- Revenue Management: Even small amounts of data from different channels can combine to form something complex and overwhelming to address, making it significantly harder to manage and consolidate revenue.

- Returns and Refunds: Returns and refunds are already a bit complex to process—especially for a dropshipping business, where tracking refund policies from third-party suppliers adds another layer of complexity.

- Inventory Accounting: Since my business was operating across different channels, it was difficult for me to share real-time insights about the stocks from each of those platforms, which often led to misjudgments resulting in overstocking, overselling, and artificial stock outs.

FUN FACT

The word accountant originated from an old French word ‘compter’ derived from the Latin term ‘computare’ meaning ‘calculation’.

Essential Reports for E-Commerce Accounting

It is obvious that accurate records and reports are essential for various effective accounting and finance management. Some of the reports that I consider the most important are:

- Financial Reports: These are definitely among the most critical reports for any business, be it offline or online. These include profit and loss statements, cash flow statements, and balance sheets.

- Inventory Reports: Keeping accurate track of inventory helps me manage the stock availability and understand the specific product performance. This also saves me from overstocking or artificial stockouts, which can lead to huge financial losses.

- Product analysis: Understanding the performance and popularity of specific products among my customers supports me in meeting their demands and earning maximum profits.

- Tax Reports: Non-compliance with certain tax laws can result in severe consequences, like legal troubles and expensive fines. Tax reports help ensure that all the required tax laws are being adhered to in my business, saving me from any unnecessary troubles.

Simplifying Processes with Multichannel E-Commerce Software

The common challenges I listed above might seem like small concerns at first, but they can surely lead to huge problems and disrupt other business operations. So, is there any solution that can effectively help overcome the various challenges associated with managing accounting across multiple platforms? Well, yes, there is.

Using the software recommendations from the best multichannel e-commerce software significantly helped me simplify accounting processes in the following ways:

- Automated syncing across different sales channels by connecting all of them to one accounting software.

- Some software can act as all-in-one solutions for inventory management, order fulfillment, and product analytics.

- Leveraging accounting software that offers routine updates helps me remain compliant with the changing tax laws and regulations.

- It also enhances accuracy by automatic calculations, bringing data from different platforms to one and reducing the chances of manual errors.

- It also helps me predict future demands based on past sales and manage inventories accordingly, increasing profits.

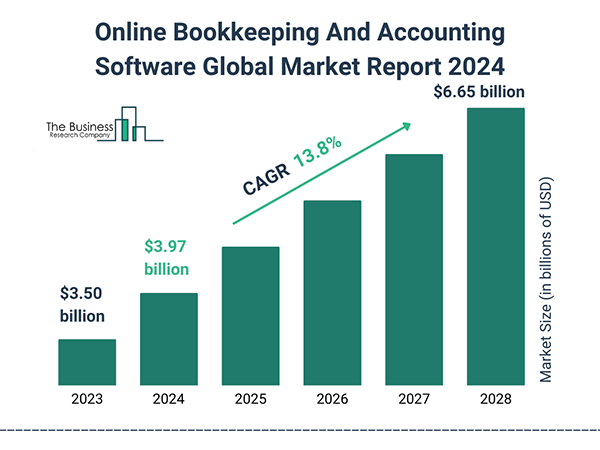

Since accounting software offers numerous advantages and proves to be extremely useful for businesses, an increase in their demand and market size has been observed in the past year, and it is expected to rise even more in the upcoming years.

Best Practices for Multichannel E-Commerce Accounting

Though employing the right accounting software has significantly streamlined various accounting operations for me, there are a few best practices that help me enhance the outcomes even more. Some of those are as listed:

- Automating Routine Tasks: Automating routine tasks like tax calculations, and transaction categorization not only saves plenty of time to focus on other important aspects but also reduces the chances of human error and improves work efficiency.

- Centralizing Data: Combining data from different platforms into a single place helps gain a better picture of my business’s financial health, no matter where the sales occur.

- Regular Accounts Reconciliations: Regularly reconciling accounts prevents errors from accumulating, keeping my records accurate and getting early alerts in case of any discrepancies.

- Using Real-Time Insights: Real-time reporting keeps me updated and helps me stay updated and make informed decisions.

Simplifying E-Commerce Accounting for Growth

Expanding an e-commerce business across different channels can you with better opportunities to capture more customers, but at the same time it also brings various challenges with itself. Especially when it comes to accounting operations, it can be really complicated to collect and combine data from different sources or to form conclusions based on these fragmented data.

But leveraging a suitable accounting tool or software can significantly help you tackle these challenges and assist in essential tasks like revenue consolidation, fee tracking, tax compliance, and inventory management.

Following the best practices and considerations I shared above will definitely help you expand your business effectively across different platforms and manage the operations related to it.