“ERP systems eliminate the silos between financial functions, leading to improved efficiency, reduced errors, and enhanced financial reporting.”

— Sarah Ellison, Financial Systems Manager at SAP

Finance management is one of the most crucial elements for the success and longevity of any business. But it is nothing less than a Herculean task, managing cash flow, budgets, debt, compliance, taxation, and whatnot. As a business owner myself, I can understand how complicated all this can be.

What if I tell you, I have found the perfect solution to streamline these processes? Well, Enterprise Resource Planning or ERP systems is the answer. 70% of large businesses use ERP technology. (Cavallo: ERP Statistics)

I have been using it in my business for a few months, and trust me, the results are extraordinary. Being the generous person I am, I will tell you all about my experience in this article, so if you are looking for a tool to help you simplify your finances, then this is the place for you.

Understanding ERP Systems

First, let me tell you what ERP systems exactly are, ERP systems started as material requirements planning (MRP) systems that were originally designed to manage manufacturing processes.

Let’s talk a bit about its history, I promise it won’t be boring. In the 1960s, they were used by manufacturers to precisely secure necessary materials. But with time, advancing technology elevated these systems to encompass a broader scope of business processes.

As a result, in the 1980s, they evolved into manufacturing resource planning (MRP II) —systems that were used to integrate finance, human resources, and supply chain management.

Coming back to the modern-day enterprise resource planning systems, these are comprehensive software platforms employed by numerous organizations, including ours, to manage and integrate businesses’ essential components.

I know some of you may be curious to know how they help us, Well, these systems streamline information flow among all our inner business functions. Integrating contrasting processes into one unified framework, to tell you in short, ERP systems simplify processes. Once entered, this data then serves multiple departments throughout the organization.

Moreover, there are also some industry-specific ERPs that offer unique advantages that the standard ERP solutions may not provide. For instance, fashion ERPs are specially designed to manage the complexities of a dynamic fashion industry known for continuously changing trends, seasonal demands, and intricate supply chains.

By including features such as automated expense tracking, comprehensive apparel management software solutions help businesses streamline budgeting and enhance their financial decision-making.

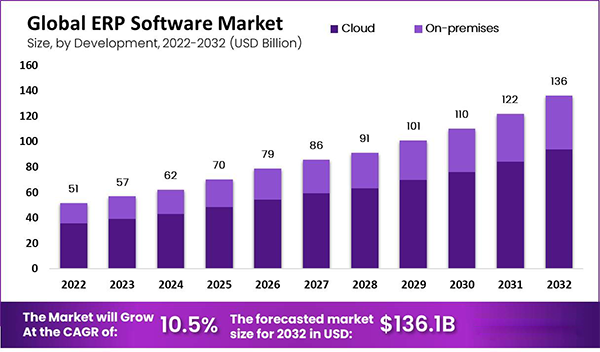

Nowadays, various businesses are leveraging ERP software to manage different business operations, resulting in the growth of the ERP software market, as you can observe from the graph below:

Enhanced Financial Reporting

Enhanced financial reporting was one of the major benefits that ERP systems contributed to streamlining my finances. Want to know how?

Well, you might know that making informed decisions is essential for all businesses. But to make such decisions, we require a certain amount of knowledge and data about what is going on in the organization. Guess what, with access to real-time data, these systems offer immediate insights into our company’s monetary health, helping our financial managers make smart moves swiftly, and they also reduce the lag time inherent in traditional methods.

But these perks do not end here, as real-time data access not only guarantees current, accurate information but also mirrors the latest financial status— that we require for sound financial planning and management.

The work does not finish with making decisions, knowing the result of your actions is equally important, to help with that, ERP systems also enable the creation of customized financial reports.

These tailored documents benefit various organizational stakeholders at our company, ranging from intricate operational reports for managers to high-level summaries for executives. These personalized reports allow us to focus on key performance indicators essential for their strategic objectives.

Customization at this level not only sharpens the clarity and relevance of financial data; it also strengthens the capacity to monitor and gauge fiscal performance against established goals.

Improved Cash Flow Management

Cash flow directly impacts operations, profitability, growth potential, and overall financial health of a company. It does not require a genius to understand how important it is to have an excellent cash flow management strategy.

Leveraging ERP systems substantially enhances cash flow management by equipping organizations with tools for precise and predictive analysis. It enables us to forecast our financial requirements proactively and strategize accordingly, safeguarding adequate liquidity.

Adopting this proactive approach to cash flow management saved us from any potential shortages and permitted the strategic scheduling of investments and outlays. The automation of these processes saved our team plenty of time and effort that they devoted to the areas requiring more strategic actions, resulting in an overall efficiency boost.

Not only that, but automated invoicing also guarantees swift bill delivery, while streamlined accounts receivable ensure timely payment collection. This minimizes delays and errors, thus leading to accelerated cash conversion cycles, and enhancing our overall cash flow with significant degrees.

Furthermore, with the integration of ERP systems, we were able to coordinate seamlessly between diverse financial functions. For instance, connecting the accounts payable and receivable modules with the general ledger offered us a holistic view of our financial stance, creating more opportunities for growth.

DO YOU KNOW?

The global ERP software market is projected to grow significantly, with estimates suggesting it will reach nearly $100 billion by 2025.

Regulatory Compliance

In the initial days of integration, I hadn’t expected ERP solutions to assist us even in maintaining adherence to financial regulations. Another feature of these systems that I found noteworthy is the generation of an audit trail—a comprehensive log including every financial transaction and modification within the system.

This feature helped us ensure transparency and accountability, making our financial activities easily trackable and verifiable. During audits, we were able to swiftly produce accurate documentation; decreasing the risk of non-compliance and mitigating potential penalties.

By automating compliance tasks through these, we minimized the chances of human error and guaranteed the accuracy of financial reports in line with regulatory demands.

ERP systems also empowered us to execute regular internal audits, discern discrepancies, or pinpoint non-compliance areas. By proactively resolving these issues, we could preserve robust regulatory standings and bypass the associated legal and financial consequences of non-compliance.

All in all, I can say that ERP systems streamline financial processes and robustly support regulatory compliance, ensuring that organizations function within the legal framework.

Final Thoughts

After all we have discussed above in this article, it is safe to conclude that ERP systems have revolutionized the way businesses handle their financial operations by centralizing data, automating processes, and offering real-time insights.

The ability to streamline finances is crucial for navigating the complexities of modern business landscapes. By leveraging ERP solutions, we were able to enhance efficiency, improve compliance, and drive sustainable growth.

Looking ahead, I can say that as businesses continue to evolve, embracing tailored ERP systems can be a highly beneficial and strategic move for organizations to maintain competitiveness and attain long-term financial success.