Every business owner or a big manufacturing company wants to save money. But how can they do that? One of the main reasons why they are not able to bring in some extra cash is because they overlook their overhead expenses.

Overhead costs are the direct expenses that occur in the ongoing business, but they aren’t related to the production of the product. According to a J.P. Morgan case study, over 76% of the ongoing business want to save cost on overhead expenses.

But how can you do this, and what are the steps that need to be taken care of?

In this article, we’ll talk about one of the best ways to build up some side cash on overhead expenses, and that is by calculating it. Below, we are giving five reasons why you should always calculate your overhead cost in manufacturing.

Read carefully so you can have better insights and start applying this to your business.

Optimal Pricing Strategy

By doing real-time overhead calculations, you can enable your business to determine the actual cost of the service or product after its creation. The indirect manufacturing costs can impact the overall expense of the process.

When you measure the cost, enforce accurate pricing strategies that will cover all the expenses to support profitability in the production cycle. This way, you can maintain a competitive position in the market.

This cost needs to be measured well; otherwise, you will be covering it with your own pocket. But you have to be careful with the pricing, if it’s more than it should be a customer won’t buy your products.

Cost-Savings Identification

Performing regular overhead assessments can uncover the inefficiencies in the process. This will allow you to find cost-saving opportunities in the manufacturing chain and further increase your profit.

When you have assessed the overhead along with standard costs, you can negotiate contracts or adopt lean practices to optimize resource allocation in your manufacturing business. This will not only benefit you by saving money but also allow you to improve your bottom-line performance.

You can start by breaking down all your expenses and see the areas where you might be overspending, or you might find places where you can reduce cost and save some money.

Effective Budgeting and Forecasting

By including overhead costs in the budgeting strategy, you can enhance the accuracy of your manufacturing business’s financial forecasting. For this purpose, you can utilize automated tools to streamline data processing and budget adjustments for better financial management.

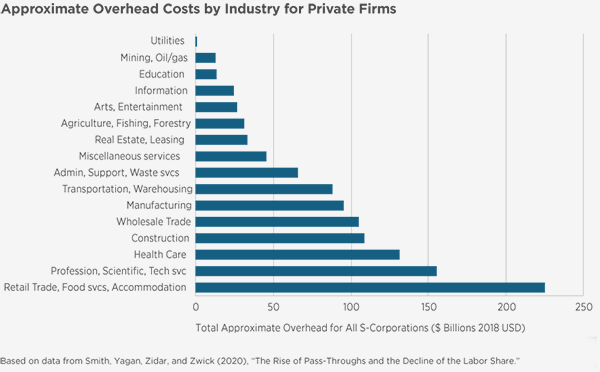

For you to have a better understanding, take a look at the stats given below that is showing approximate overhead costs of different industries:

This way, you can save your business from facing significant losses. Overhead cost calculation helps in accurate budgeting which helps with future investments, expenses, production capacity, and more.

Profitability Analysis

One of the significant reasons why overhead cost needs to be calculated is it allows businesses to evaluate their profitability. With a detailed analysis of the overhead cost, you can identify the lucrative opportunities that will help maximize profitability and spend less on production costs.

In addition, this is an aid in making strategic investment decisions for future projects. Overheard helps you determine what parts of your business are truly profitable and what are costing you sources and money without any outcome.

Once you have the insight, you can make strategies and shit down the lines that are not generating profit or make a new plan to make it profitable. This will help you with managing your losses and maximizing your profit.

Informed Decision-Making

As a manufacturing business owner, you will always find room to expand your business. If you’re planning to grow your operations, overhead cost analysis and calculation can give more in-depth insights into your manufacturing business.

You can also rely on a centralized financial system to get real-time data visibility and analytical capabilities for better strategic planning for the future of your business. This way, you can successfully bring operational excellence to your manufacturing business.

PRO TIP

Start buying items in bulk as it helps in reducing Overhead expenses.

Final Words:

As business evolves, by regularly reviewing overhead expenses, you can enable your business to identify cost increases in the manufacturing process. This will allow you to plan the profits and costs before they impact the profit margins, without getting into your considerations.

Therefore, consider calculating the overhead costs to align your operational strategies with your business goals. Keeping tabs on your overhead expenses is a must, it can save your business from significant losses.

If you decide to overlook this, you will have to face some severe consequences that won’t be good for you or your business. So, make new strategies and include these tips, you’ll be able to see changes in no time.