An accounting service is responsible for portraying the real financial health of the company/organization. Hence, it must be efficient enough to record all the necessary transactions effectively and transparently.

According to a U.S. Bank study, 82% of businesses fail due to cash flow problems. So, it becomes highly pivotal for organizations to precisely monitor and control the cash flow.

Diving deeper, there are numerous other kinds of nuances as well that only experienced accountants and professionals can clear out. So, this article is going to give a clearer picture of that, in super-easy language.

Keep reading to know more.

Specializations

Accounting is not just about maintaining balance sheets. it includes various domains such as:

- Bookkeeping

- Tax Preparation

- Financial planning, and more.

The more you research the topic, the more it will get cleared. However, coming back to the point, specialization or focusing on the right aspect of the domain you want to opt for is necessary.

Apart from that, services also provide some additional services like financial or business consultancy that can ease your planning to a significant level.

Likewise, Appfolio is just the right destination for you to get amazing balanced sheet solutions that include property management business, consultancy, accounting, taxes, audits, etc.

Experience and Reputation

According to the Association of Certified Fraud Examiners (ACFE), businesses that lack professional accounting services are twice as likely to fall for fraud.

Along with that, if you are a small business owner, it gets more necessary as the annual median loss through fraud costs them around $200,000 whereas $140,000 for large businesses.

This is why you must look out for how much experience a service provider has in the field. You must look out for their client reviews, online testimonials, etc.

Also, experience comes into use when there is any situation of complex money tracking. To be honest, balancing the sheet might not be as simple as you think. So, this is where an experienced service can be of great help.

Communication and Accessibility

Effective communication is definitely a key aspect that you must ensure with the service. The accountants and professionals must be always available on the call to solve your queries.

When selecting the service provider, you can start by asking for after-sales services like 24×7 call support, etc. Since accounting services are in direct contact with the company’s funds, it becomes essential to stay in touch with them at every moment.

78% of businesses consider the real-time availability of their accounting service providers critical for decision-making, especially when unexpected issues arise.

Not only does it keep the management updated with the funds, but a proper sharing of information may also help in rectifying any possible mistake or forecasting any mishappening.

Pricing and Services

The financial service must be opted for with the aim of finance management, not as an additional financial burden. So, figure out how much you can afford to pay for the service. The money you are going to spend on the service is also going to reflect in the financial statement, hence, make a wise decision while making the choice.

Also, it must add equal value to the price you are going to pay. Consider all the factors like customer care, service options, investments to be made, etc. and then figure out whether it is going to be of your kind or not.

Cultural Fit

The accounting service is also going to be a major part of your team. The more healthy it is to communicate with them, the more it will be good for you. So, keep track of whether the accounting team is accommodating well with the surrounding team or not.

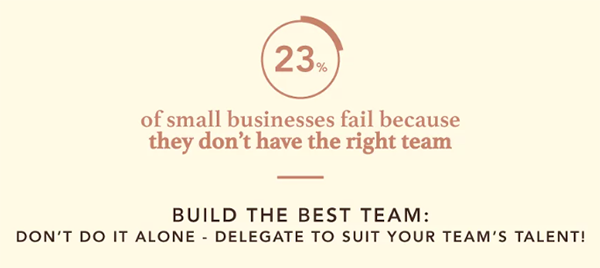

In this infographic, you can see that the right team is crucial for a business like anything else. In the case of accounting professionals, they also need to stay in touch with different departments for better efficiency. Hence, it becomes a major tool too.

Technology and Innovation

Lastly, adapting to technology and innovation is the key to all problems. With such development in different fields like artificial intelligence and machine learning, your service must not be lacking in any way possible.

Accounting professionals are also integrating modern cloud solutions in the operations to make the functions more safe, secure, smooth, and quick.

Various tools, software solutions, websites, etc. are always there for professionals to help them manage complex numbers and statements.

Getting Help From Professional Accounting Services

Finally, this article covered all the necessary details about why opting for the right accounting service is a must for you. It not only helps you maintain your financial track records but also gives you a clear image of how things are going within the firm monetarily.

Otherwise, if you find this article helpful, consider sharing it with your friends and family as well.