Look out for origination fees, early repayment penalties, and various processing charges.

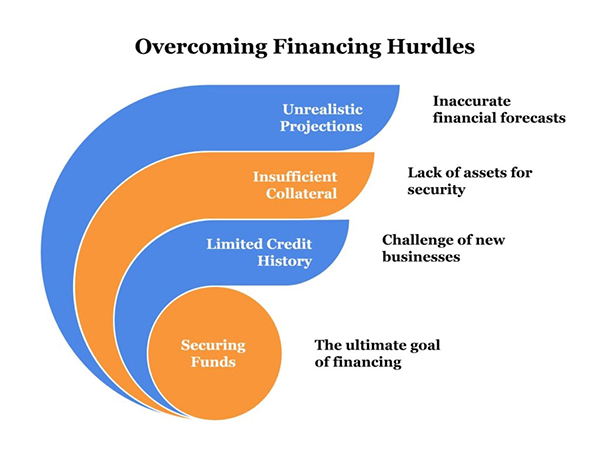

Starting a business comes with many challenges, with some only becoming apparent as the process evolves. However, the one sticking point for many new entrepreneurs is finding the capital they need to bring their dreams to fruition and provide sufficient cash for growth.

This remains true even if you’re an established enterprise and seeking capital to expand or grow into new areas that could require anything from new tooling to a marketing budget. The good news is, while over 71% of Indian SMEs sought external funding in 2024, navigating the complex world of business finance doesn’t have hidden charges.

Fortunately, with a little know-how, it’s possible to secure funding for your nascent or growing business without the usual risk factors that can throw a spanner in the works.

So, let’s understand how to secure business funding without hidden costs!

KEY TAKEAWAYS

- Don’t just go to your bank; explore dedicated business financing firms for potentially better terms and support.

- Always ask for and meticulously review detailed loan terms upfront to avoid unexpected fees and unfavorable conditions.

- Shop around for interest rates from multiple sources to find the most beneficial deal for your business.

- Clearly articulate how you’ll use the funding; a solid business plan can build lender trust and lead to better terms.

Research Lenders For Transparency And Reputation

Finding lenders in the present time’s climate is not always easy, but neither is starting or operating a business and if you can do that, then you can use the majority of the same techniques to help you secure the particular funding you need.

The primary step is to research lenders that are in the business of loaning money to businesses. This might sound obvious, but many business owners will head directly to their bank or other traditional sources of cash and go down the route most traveled.

You will encounter a larger number of hurdles with these options, in that you probably end up with less than you need, and with a less popular contract to boot. Instead, hunt for dedicated business financing firms that make it a priority not just to loan out money, but can at times even offer assistance on the best ways to put it to work most effectively.

According to the team at Office Capital Group, they will probably also be able to connect you with lenders who have been vetted and are most likely to support your endeavors.

The amount of effort you put into this research phase will determine the outcome and might affect the direction of your business for years to come. It is also essential to begin properly, which is to say by contributing the effort to find dedicated business lenders.

Ask For Detailed Loan Terms Upfront

Asking for and examining the details in the loan terms is simply good practice. It doesn’t matter if you’re looking for money as a personal loan or for a business venture. Simply doing so will help you refrain from many of the less desirable conditions that often come with loans and could penalize you down the line.

It is easy to get carried away and overexcited when you finally meet a lender who wants to offer you all the cash upfront, but on closer inspection, you could find all varieties of undesirable challenges like early repayment penalties or other hidden charges that you weren’t expecting.

Although these terms may not be available and not possible to alter, the fact that you spent the time searching through the contract before signing on the dotted line means you will be protected from the worst of things.

This could mean you will have to eschew the loan altogether (particularly if the terms are highly unfavorable), and you will gain in long-term advantage what you lose in interest cash.

Compare Interest Rates From Multiple Sources

In most cases, it will be the interest rate on the principal value that will be the arbiter of whether the loan is worth it. Now, there is no lender on earth (besides perhaps the Bank of Mum and Dad) to be clear about who will offer you an interest-free loan.

But you might find some interesting deals by shopping around. It could be that you can delay the interest payments for a specific time until you start reaping the rewards of the capital injection.

This can be beneficial simply because it reduces the amount you might need to pay before you start gaining a return on the money investment you made.

INTERESTING FACT

“According to a recent survey, over 30% of small business owners reported facing unexpected fees or charges when securing financing, highlighting the critical need for due diligence and transparency.”

Ensure You Can Articulate How You Will Use The Cash Injection

Developing a solid business plan and being able to articulate why you need the money and how it will be put to use can go a long way in acquiring the loyalty of a potential lender. This trust can sometimes lead to them offering a more favorable rate than they might have otherwise been eager to offer.

In most cases, as long as they guarantee that they will receive repayments on time and in full, many lenders are eager to communicate with you to achieve a mutually acceptable situation. Acquiring funding for a startup or to fund a particular type of expansion is definitely not an easy task.

However, you can increase the likelihood of securing the necessary funds with as few downsides as possible with the right attitude and understanding of how financing works.