Tax Codes are integral to the UK payment system and have a big impact on the amount of income you end up paying as tax. These codes seem randomly placed but are of high significance.

Failing to understand how tax codes work could have a major negative impact on your financial situation. In case an incorrect tax code is used, you will end up paying the wrong amount of tax.

Join us as we discuss the UK tax code system, learn what it means, and learn how to read yours.

What are Tax Codes?

Governments worldwide use tax codes to determine the amount a person has to pay for tax and the amount they get to keep. These codes are essential for keeping order and properly calculating tax amounts for everyone in a country.

Tax codes consist of a combination of numbers and letters. Both numbers and letters have their meaning and have a big effect on the financial condition of a person. The number of tax codes tells the amount of stipend that you can keep without paying tax, and the letters represent the special circumstances in which your tax is charged.

Issued by the HM Revenue & Customs (HMRC) department, tax codes are essential for reporting taxes for individuals, businesses, and all the transactions that take place in a country.

List of Tax Codes and What They Mean HMRC? (Common UK Tax Codes)

Here is a list of UK tax codes along with their meaning:

| Tax Code | Name | Meaning |

| Tax Code 1257l | Standard Tax Code | The most common tax code used for people with a single job/pension. The 1257 indicates the untaxed income of £12,570, which is counted as a personal allowance. The L refers to the entitlement of tax-free personal allowance, meaning any income below £12,570 will be tax-free. |

| M | Marriage Allowance Transfer | Under the Marriage Allowance Transfer, you will receive 10% of your partner’s allowance. |

| N | Marriage Allowance Donor | Here, you will have to transfer 10% of your personal allowance to your partner. |

| S | Scottish Income Tax | People living in Scotland will have different tax rates from those living in the UK. |

| C | Weish Income Tax | While the UK and Weish have the same tax rates, the C indicates that tax is handled by the country of Wales. |

| T | Adjustments/Calculations Involved | With this tax code included, special calculations & adjustments are usually included while determining your personal income. |

| X | Emergency Tax | This code is applied when HMRC doesn’t have enough financial details about your new job. Under this, you may be charged the basic amount until HMRC finds all the details. |

| K | Negative Allowance | This type of tax is charged when you have a second income that exceeds your tax-free personal allowance. |

| Tax Code0T | No Personal Allowance | Under the 0T tax code, you won’t get any personal allowance. This code occurs in cases when your employer doesn’t have proper information about you, or when you have multiple jobs. |

| BR | Basic Rate Tax Code | All of your income is taxed at 20%. This tax code is applied to people who have more than one job/pension. |

| D0 | Higher Rate Tax Code | Income is taxed at 40%. For high-earning people with multiple jobs and pensions. |

| D1 | Additional Rate | Applying to high-income jobs, this tax code charges a 40% tax to individuals. |

| W1 | Week 1 Emergency Tax Code | Charged to weekly paid individuals when HMRC doesn’t have enough information about you after you have changed jobs. |

| M1 | Month 1 Emergency Tax Code | Charged individuals with monthly pay when HMRC doesn’t have enough information after you have changed jobs. |

| NT | No Tax | You don’t have to pay any tax on your current income. |

These are all the known tax codes that you may get on your check.

How to Find Your Tax Codes?

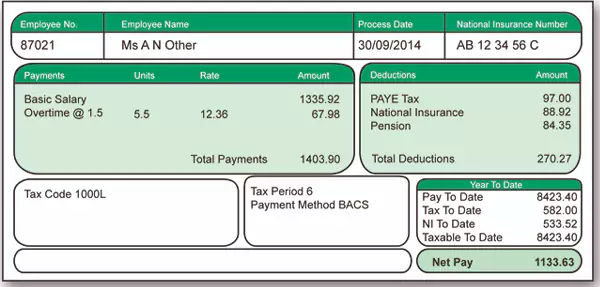

Your tax code is available on your current payslip/check right alongside your pay.

Here is an example of a payslip where the employer has mentioned the tax code. Your tax code also appears in numerous other places, like the P45/P60 document, HMRC online account, etc.

If you have recently changed your job, your previous employer will provide you with a P45 certificate with all the details about your tax code, pay, and much more. Your next employer will then need this document. P60, on the other hand, is an end-of-year document that your employer sends to you to showcase your earnings and the amount of tax deducted.

HMRC also sends you a ‘Notice of Coding’ letter, which includes your tax code and shows how it is calculated.

If you don’t have these options, you can go to HMRC’s official website and check your tax code.

Here’s how to check your tax code online:

- Go to gov.uk.

- Click on Personal Tax Account: sign in or set up.

- Scroll down and select Start now.

- Enter using your Government Gateway user ID and Password and tap on Sign in.

- Now you will be able to see your Tax Code along with other financial information.

That’s all you need to do to become more aware financially. With numerous tax codes to categorize you, knowing which tax code you should be on can be a confusing affair. Thankfully, it is now easier than ever to know these details and be prepared for tax filing season.

What To Do If You Have Filed the Wrong Tax?

Filing the wrong tax is something everyone fears. Something as complex as the tax system demands a high level of commitment, and anyone who lacks it ends up making a few mistakes. If you have unknowingly filed the wrong tax amount, you should contact HMRC right away and let them know of your mistake.

With errors like these, you should act quickly and take the right steps, as each delay can lead to penalties and even imprisonment.

There are various ways to contact HMRC, you can get in touch with them via their official app, website, give them a call, or visit their office. After getting in touch, you should let them know about the error and try to make amendments. You need to provide all the necessary documents and information so that HMRC employees can correct the mistake.

In the case of overpaid tax, HMRC will refund the extra amount to you. In the meantime, if you have underpaid the amount to HMRC, it will look to recoup the amount by sending you a bill or adjusting your next tax code.

Paying the wrong tax amount can have big consequences that can affect your future. To make sure you don’t make any mistakes, it is important to know what your tax code is and proceed with caution. Filing taxes is a tiring task that automatically leads to people making mistakes. Read the next section to avoid paying the wrong tax.

How to Avoid Paying Wrong Tax?

Paying your taxes requires you to be attentive and informed about your financial details. To make sure you’re not making any mistakes, you should know the things mentioned below:

- Your tax code

- Know your tax-free personal allowance

- Know about different tax types

- Disclose your income and personal ventures to the government

- Provide the correct data to HMRC

- Keep all income records

- File your taxes on time and double-check

- Inform HMRC about any job changes

Keeping these things in check will protect you from extra work and ensure that you have filed your taxes the right way. One of the worst grown-up things a person can do is file taxes; the process tires out everyone and also brings out the anxiety of making a mistake. If you are new to adulting and want to make sure you are ready for the world out there, it is required of you to file your taxes properly. You can also consult private agencies to proofread your documents and seek help from your friends.

Wrapping Up

Knowing your tax code will benefit you in the long run, as it provides all the important information you need to file your taxes properly. If you are new to the working world, you need to take notice of your payslip and see what code you need to file under. It is important to consult with your employer about your tax code and communicate with them when changing jobs or when you start earning more.

Now that you know the definition of tax code and how to check it, make sure to use this information properly and pass it on to people who are still oblivious to the UK tax system.