Most of us are taught to chase after jobs from a young age. It is rare to hear someone advising their children to start something new of their own. This is because initiating something requires huge investments that are only available to some, and it involves great financial risks.

Because of these two factors, many deserving business ideas never see the light of the day. But venture capital funds can help in such situations. These funds act as a backbone for some capable entrepreneurs, presenting them with the opportunity to build something big.

It not only benefits the new ventures but also helps in scaling up the existing businesses and investors. No matter what side you are on, entering the world of venture capital funds is complex and must be understood well before diving into it.

Read through this guide of seven things you need to know about venture capital funds to understand their impact on both businesses and investors in detail.

What is a Venture Capital Fund?

Venture capital funding is like a pool of investments from multiple investors which acts as a driving force for business ventures. In simple words, VC funds are the money investors commit to a new business venture, and the investors are designated as the limited partners of the venture and the person managing funds becomes the general partner.

Venture capital firms are responsible for providing funds and keeping investors in the loop on the status of their money. Although investing in a new business has some risks, venture capital firms partake in a lot of research to ensure that they are putting funds towards promising and worthy businesses.

Its goal is to generate high returns for investors by staking the funds toward emerging businesses with growth potential. These funds are commonly observed in technology, healthcare, and fintech industries.

Investors can range from wealthy individuals to institutional investors, depending on the type of fund. They collaborate with a venture capital fund to diversify their financial portfolio and increase their wealth.

If this kind of investment interests you, you can research more about how to invest in a VC fund, and where to find more information about your specific investment goals.

Stages of Venture Capital Investments

Venture Capital Funds dealings are not a one-step procedure, it requires certain steps and stages such as

Seed Stage

Seed funding is typically used for research and development and initial market testing. This is the beginning stage when investors meet up with a venture capital firm and decide where they should put small amounts of their capital to receive the best returns.

These small amounts help start-ups to get off the ground or to an entrepreneur in the ideation or prototype stage who needs funds to produce different iterations of their new product or service

Early Stage

This stage occurs after startups have given proof that their product or service has merit and is gaining attention. As they see some success, they will reach out to investors for a higher sum to keep their momentum.

Growth Stage

At this point, a business starts to gain significant revenue and investors observe some returns. Investors put more into the venture capital fund to expand the business across global markets or build new facilities.

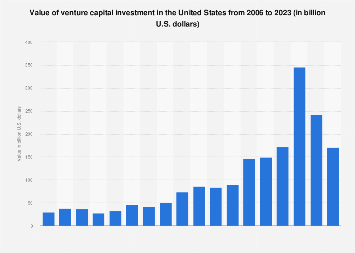

The popularity and demand for capital investment are growing day by day, it can be observed by the following graph depicting the rise in the value of venture capital investment in the United States in the past few years.

Venture Capitalists Look for High-Growth Potential

Investors in venture capital funds are not only looking for entrepreneurs that have excellent ideas, they also want to see a structured plan for growth and scalability.

They want to know that in five, ten, or fifteen years, the business that they invested in will still be growing successfully. They expect the business they invest in to grow fast so that they will see returns as soon as possible.

High Risk, High Reward

Investors are aware of the uncertainties and risks related to the unknown of any global event that can cause success or failure for a business.

They also know that the higher the risk, the higher the reward can be. Despite the risks, investors are ready to walk on thin ice for the businesses that are worthy and deserving in their eyes. They might invest huge amounts considering the probabilities and possibilities of returns.

VC Fund Returns Require Patience

Investors cannot expect instant returns after putting huge sums of money into a venture.

These things take time and an investor must have the patience to follow through the whole process.

Businesses like Facebook, Google, and Amazon took time to become successful and get to where they are today.

VC Firms Provide More Than Just Money

Partnering with a VC firm guarantees that you as an investor will get so much more than just monetary gains.

On the other hand, It guarantees strategic guidance, industry expertise, and much more to the founder or entrepreneur.

Established venture capitalist firms have connections all over the world and can open up all kinds of other investment opportunities. They also have employees who work around the clock researching the next big thing, making them know about business all over the world.

Their research makes them the most qualified to make the best decisions about investors’ money.

The Exit Strategy

The existing strategy for leaving a venture capital fund consists of three different options: acquisition, initial public offering, and secondary sale.

In acquisition, a larger business purchases the startup for a large sum, meaning that investors will get their return.

In an initial public offering, the startup goes public and investors can sell their shares.

In secondary sales, venture capitalists can sell their shares to other interested investors.

TRIVIA

Successive rounds of funding can lead to ownership dilution. The shareholder’s ownership percentage gets reduced due to issuance of new equity shares.

Final Take

Venture capital funds play an essential part in the innovation and growth of the world. When people or institutions use their wealth to invest in a startup, they are contributing to the future.

It is mutually beneficial to both the investor and the founder. The founder can invest his money in a great business idea today and enjoy its returns tomorrow. Similarly, a business venture at its premature stage can benefit greatly from these funds, which will help him to lead his business toward success and build an empire.