Tokenization replaces your actual credit card number with a unique, encrypted number (token) during transactions, keeping your real details secure.

The way Americans pay for goods and services is evolving rapidly. Nowadays, smartphones are extensions of our wallets, and digital credit cards are stepping into the spotlight as a secure, convenient, and tech-forward alternative to traditional plastic cards.

If you’re still swiping or inserting your old card, it might be time to ask: Are digital credit cards a better option for 2026 and beyond? In short, yes. Digital credit cards offer enhanced security, better usability, and are built for the pace of modern life.

In fact, a recent PYMNTS Intelligence and Elan collaboration report from May 2026 revealed that more than 4 in 10 U.S. consumers used a virtual card in the past six months, with 65% indicating they are likely to do so in the coming year.

Whether you’re shopping online, managing subscriptions, or tapping your phone at a checkout terminal, a digital credit card puts your finances at your fingertips.

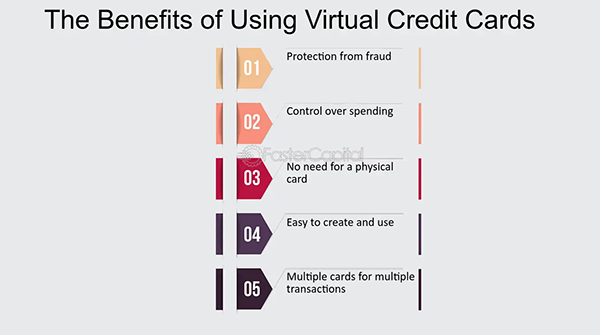

Therefore, here are the top five reasons why you should keep in mind when switching to a digital credit card in 2026, especially if you’re based in the U.S.

KEY TAKEAWAYS

- Digital cards use tokenization and virtual numbers to protect your real card details, significantly reducing fraud risk.

- Get and use your card immediately after approval, avoiding the wait for physical plastic.

- Seamlessly connect with Apple Pay, Google Pay, and Samsung Pay for convenient, secure tap-to-pay transactions.

- Use virtual card features to control spending, manage subscriptions, and easily cancel specific virtual numbers.

- Reduce plastic waste and embrace a sustainable payment method aligned with modern, tech-forward financial practices.

1. Stronger Security and Fraud Protection

One of the best motivators for switching to digital credit cards is the enhanced security features that come baked in. Unlike physical cards, which can be skimmed, stolen, or copied, digital credit cards usually generate tokenized versions of your actual card details. That indicates that your real card number is never revealed during a transaction.

Here in the U.S., card fraud is the biggest concern. As per the Federal Trade Commission (FTC) report, credit card fraud was among the most prominent reported types of identity theft in 2024. Digital credit cards help minimize that risk by:

- Masking your actual card number

- Offering one-time use or merchant-specific virtual numbers

- Enabling real-time transaction notifications

- Allowing you to freeze or cancel the digital card on the sport via an app

If you shop frequently online or use public Wi-Fi, these features provide you with much more control and peace of mind.

2. Instant Access and Faster Card Issuance

In traditional banking, getting a physical credit card may take up to 5–10 business days to arrive. But with digital credit cards, you can often begin using your card instantly after approval.

Many U.S. banks and fintech companies—including American Express, Capital One, Apple Card, and SoFi—offer instant digital card access. So that you can:

- Shop online anytime after approval

- Integrate the card into your Apple Wallet or Google Pay

- Make contactless in-store payments with your smartphone or smartwatch

- Avoid delays imposed by mailing or replacing a physical card

In 2026, when speed and convenience are expected, waiting for a piece of plastic will seem outdated. Whether you are replacing a lost card, traveling, or just want to capitalize on a credit card promotion, digital access is a major win.

INTERESTING FACT

“Annually, the production of 3.5 billion banking cards generates a carbon footprint equivalent to 288,000 passengers flying from New York to Sydney.”

3. Seamless Integration with Mobile Wallets

U.S. consumers are frequently turning to mobile wallets. In fact, according to Statista, over 100 million Americans used Google Pay, Apple Pay, or Samsung Pay in 2024, and that count is still climbing.

Digital credit cards are created to integrate effortlessly with these wallets. This allows you to:

- Pay in retail stores with a tap of your phone or smartwatch

- Store multiple cards safely in one place

- Avoid holding a physical wallet altogether

- Use biometric authentication (like Face ID or fingerprint) to validate transactions

With more retailers supporting touchscreen payment terminals, digital credit cards are not just a technologically advanced option—they’re a present-day necessity.

4. Simplified Online Shopping and Subscription Management

How many times have you logged up for a free trial and not remembered to cancel before being charged? Or did you try to figure out which card you paid with for a monthly subscription?

Digital credit cards—especially those with virtual card capabilities—might help with this. You can obtain unique card numbers for each subscription or merchant, and set:

- Spending limits

- Expiration dates

- One-time use settings

This makes dealing with trial services, online subscriptions, and even recurring bills far easier. It also lets you instantly cancel a designated virtual card without disrupting your main credit line. Tools like Capital One’s Eno or solutions like Privacy.com have made this approach widely available among savvy U.S. consumers.

5. Eco-Friendly and Future-Ready

There’s an environmental advantage to digital credit cards, which is not talked about too often. Traditional plastic cards are manufactured from PVC and often end up in landfills after they expire. With digital credit cards, there’s no shipping emissions, no plastic waste, and no unnecessary packaging.

This is especially significant for younger, sustainability-focused users. In 2026, many Gen Z and millennial users in the U.S. expect their financial services to offer green solutions. Opting for digital-first payment systems is one easy way to minimize your carbon footprint while promoting modern banking.

Beyond sustainability, digital cards are more secure for the future. As more U.S. merchants adopt biometric payments, tap-to-pay techniques, and QR-code systems, having a digital card shows that you’re ready for what’s next in financial tech.

Are There Any Downsides?

While digital credit cards are full of advantageous features, it’s fair to note a few limitations:

- Not all merchants support contactless payments (though most large distributors do)

- In-person payments without a phone or smartwatch can be very difficult

- Some banks may not offer fully automated digital cards, limiting your options

However, these are gradually becoming temporary issues as the U.S. moves toward a more digital-friendly payment ecosystem.

Conclusion: Why Now Is the Time to Switch

You may be missing out on the convenience, security, and control that digital credit cards provide if you’re still relying on a physical credit card alone. In 2026, as Americans continue to subscribe, shop, and pay in increasingly digital ways, performing the switch is not only smart—it’s inevitable.

From strengthened fraud protection and faster access to streamlined mobile payments and eco-conscious convenience, digital credit cards offer tangible, clear benefits for U.S. consumers. Whether you’re a tech-savvy early adopter or just desperate looking for more control over your finances, now is the best time to embrace the shift.