The small-scale business can work with one person managing both accounts receivable and accounts payable. The larger organization might need two people holding each account to avoid errors in transactions.

Accounts payable vs accounts receivable are two financial concepts that are the core of any company. But what does it mean?

Running a business means that at one moment, you have to track bills from the paying customers, which is accounts receivable. Accounts payable, on the other hand, means checking what you owe to the vendors. Both of them are crucial aspects that are interconnected and keep the business up and functional. For companies that seek expert handling of these transactions, opting for AP & AR outsourcing is becoming an increasingly popular strategy.

Let’s learn about accounts receivable vs accounts payable in detail so you can use them properly for a seamless accounting process.

Accounts Payable vs Account Receivable: Understand the Difference

Accounts receivable and payable are two core accounting concepts that hold great value and are opposite to each other. Understanding the difference between the two helps navigate easily.

| Key Aspects | Accounts Payable (AP) | Accounts Receivable (AR) |

| Meaning | It is the money you owe to the vendors and suppliers. | It is the money you receive for your service. |

| Accounting Category | Liability | Asset |

| Impact on Cash | Outflow | Inflow |

| Record | Liability section in the balance sheet. | Asset section in the balance sheet. |

| Role in Company | The business is the debtor. | The business is the creditor. |

| Financial Outcome | Increases liabilities. | Increases assets. |

Now that you know the difference, let’s go ahead and understand each of the concepts in detail.

Accounts Payable: Overview

Accounts Payable is the total amount that you have to pay to your vendors or suppliers for the goods and services they provide for your business. This may include raw material, labor, or transportation. You can think of it as a short-term loan which is needed to be paid within 30–90 days (depending on the agreement). For businesses struggling to maintain this consistently, incorporating business bookkeeping services can help streamline and track these obligations more effectively.

Characteristics of Accounts Payable

These are the key characteristics of accounts payable that make it different from the other in the account receivable vs payable debate:

- Liabilities: They represent short-term obligations that a company must settle within a specified period.

- Credit Acquisitions: Businesses use AP to acquire goods or services through credit deals.

- Record on Balance Sheet: It is written in the liabilities section of the company’s accounting report.

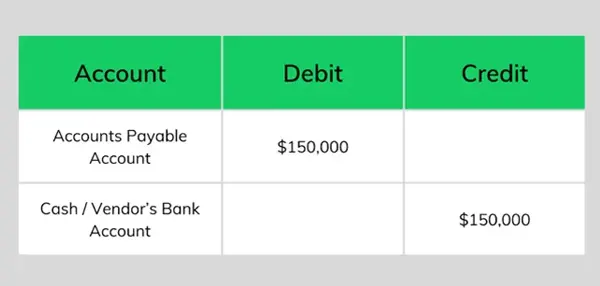

Example of Accounts Payable

Let’s say you own a fast food outlet: Fresh Baked Foods. For the inventory, you order buns, breads, and coffee beans worth $7000 and have a credit repayment term of 30 days. The supplier will generate an invoice, and the pending payment will be recorded in the liabilities section till the time you clear the payment.

Accounts Receivable: Overview

Accounts receivable, in the concept of accounts payable vs. receivable, refers to the amount received by the business for the services it offers. These are generated from the sales and are settled within a certain period of time. Some companies opt for professional accounting services to manage these figures and ensure accurate asset reporting.

This amount is an asset for the money as they keep on gaining capital in exchange for the service, and is counted in the revenue model.

Characteristics of Accounts Receivable

These are the key characteristics that define accounts receivable and make it different from accounts receivable vs payable.

- Assets: They are considered short-term assets as they indicate potential future cash flow for the company.

- Credit Sales: Accounts receivable are generated when products or services are sold on credit.

- Record on Balance Sheet: It is written in the asset section of the accounting report for the particular period.

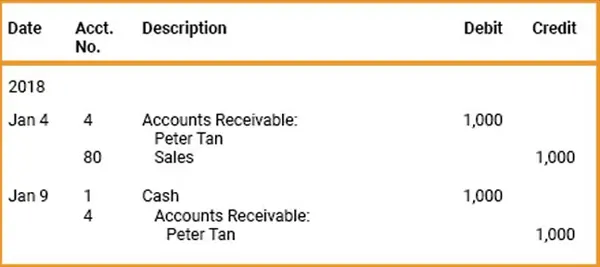

Example of Accounts Receivable

Let’s say you run a digital marketing agency, and you are currently working with two clients for their website development and content creation. You complete the project worth $4500 each and send the invoice to both parties, giving them 45 days to pay.

Until the client pays the amount, you will have to write it in the asset section of your accounting sheet and move it to the cash account once paid.

Smart Ways to Manage Accounts Payable and Accounts Receivable

If you do not want to run out of cash, accumulate debt, and ruin healthy business relationships, you must learn how to manage accounts payable vs receivable properly. Let’s learn about it here:

Managing Accounts Payable the Correct Way

- Negotiate the payment term with the vendor to keep up with the last date. This will create a harmony with your cash flow cycle.

- Install and include accounting software in your system to streamline the payment process.

- Make sure to make payments before the due dates to maintain a healthy relationship with the vendors. This helps in the long run for all the businesses.

- Create a habit of routine checkups where you go through all the pending obligations and complete them to avoid fines. Incorporating organized financial practices such as management accounts services can also aid in real-time decision-making and payment planning.

Managing Accounts Receivable the Correct Way

- Make sure to generate proper invoices, drafting clear charges to avoid conflicts with the customers.

- Create a payment reminder system to automatically remind customers of the pending deposit.

- Include net banking, cash, card, and other payment modes like crypto to give people multiple mediums for seamless transactions.

- Keep a track of late payments and implement recovery methods to maintain the revenue.

Why is it Important to Track Accounts Payable vs Accounts Receivable?

Understanding accounts receivable vs accounts payable is not just an option but a vital part of bookkeeping and managing financial health. Every business gives out money and receives money, it’s the core concept that lets you prepare accurate financials for taking up business loans. Overlooking either of the two can lead to loss, debt, and delay in operations. Additionally, services like year-end accounts and CT returns ensure proper compliance and summarization of your financials, reducing the risk of oversight. Overlooking either of the two can lead to loss, debt, and delay in operations.

Thus, as a business owner or an accounting manager, you need to evaluate both the accounts wisely and set up recovery plans, crisis strategies to sustain in the cut-throat competition of the market. Plus, it also helps to spot challenges like bad debt, duplicate invoices, and fraud.

Wrapping Up!

Understanding the differences between accounts receivable vs accounts payable is crucial to sustain your business financially. While the former helps to track the inflow of cash, the latter helps to keep track of the money you owe. Knowing the key aspects of both helps you strike the right balance of handling money flow and building a strong relationship with customers and suppliers.

For businesses navigating taxes and returns related to these functions, tax outsourcing can help reduce the workload and avoid filing errors.

We hope this blog has cleared all your doubts regarding what accounts payable vs accounts receivable are and how they work. Share the info with your friends and family, too!