Artificial intelligence is known for automating tasks, boosting operational efficiency, enhancing accuracy, preventing fraud, and complying with regulations in modern accounting.

KEY TAKEAWAYS

- Repetitive tasks have been eliminated with AI.

- Data-driven insights are resulting in better strategies.

- Customer/client satisfaction is being enhanced with artificial intelligence.

- AI helps comply with local and international laws.

Artificial intelligence has made those things come true that were once just a vision. It is changing the world and everything in it. There are thousands of AI-based tools like Undetectable AI Humanizer, and the global AI market is said to reach $1.01 trillion by 2031.

Nearly every sector has integrated it for its day-to-day operation, and the accounting sector is no exception. In the past few years, this sector has managed to achieve greater heights, but how? And what benefits did accountants get with this?

Well, in this article, I’ll mention how AI plays a critical role in modern accounting practices. Let’s get started.

Automation Of Repeating Accounting Tasks

Repetitive tasks aren’t new when it comes to accounting. Tracking down receipts, data entry, invoice mailing, task management, and other such tasks consume a lot of time that could be used somewhere else.

However, ever since AI came into the picture, it has eliminated all these hurdles. There’s no need to do these manually anymore, as AI can handle it by itself. Accountants have more free time on their hands that can be used for strategic work like financial analysis and planning.

Apart from this, artificial intelligence offers other benefits as well, including increased efficiency, reduced human error, improved compliance, cost savings, and better access to real-time financial insights.

Booting Accuracy While Reducing Human Error

When things are done manually, there’s always room for mistakes. This disrupts the accuracy and also causes significant damage to the firm. In the past, there have been many cases that highlight that human-made errors can’t be taken lightly.

AI is known for not making mistakes. Obviously, it’s also not 100% accurate or right all the time, but it is still right in 99.99% cases. AI adapts and learns new things on its own, which gives it the abilities that result in fewer errors.

Accuracy is crucial, and with the implementation of AI, it has been boosted significantly. One of the causes for mistakes can be that the person sitting behind the screen might be experiencing fatigue, distractions, or oversight, but AI doesn’t need any rest and can keep going as long as you want it to.

Real-Time And Detailed Insights Through AI For Smarter Financial Decisions

In accounting, decision-making is vital for all aspects. Whether you want to attract new clients, enhance customer experience, improve your market presence, or pretty much anything but it can’t be done without strategic decision making.

Let’s just say that you did come up with an idea, but the chances of it actually having an impact are going to be low. Why? It can be because you didn’t go through past data, or even if you did, you didn’t go deeper.

With AI, you have this advantage: it can analyze data going back decades and can curate strategies based on current market trends that are more likely to succeed. It can also predict future shifts that can be helpful, as a firm can stay prepared for them.

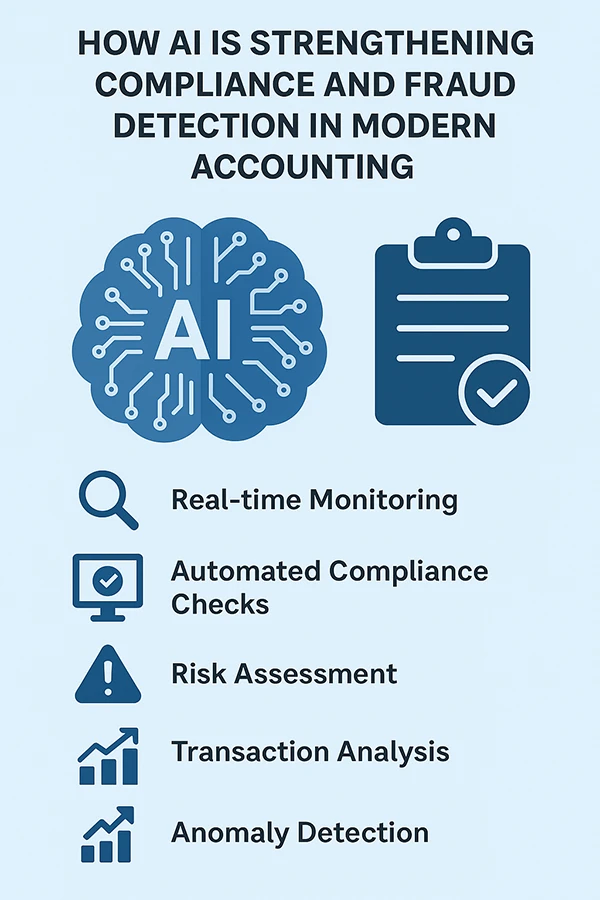

Strengthening Compliance And Fraud Detection

It’s important for account firms and organisations to always comply with local and international regulations. If they fail to do so, they may face legal and financial consequences. But let’s be honest, it’s not easy.

New laws and regulations come and go, and it’s hard to comply with them all the time. Not anymore, AI ensures that you stay up to date and are following all guidelines. When integrated into your system, it also enhances security.

Accounting firms handle sensitive data, and they can’t afford any breaches or fraud. This can damage their reputation significantly, and they can lose tons of customers. However, AI keeps track of everything and sends an immediate alert in case anything seems off. It also tried to get rid of it on its own. Below, you can see how it strengthens compliance and prevents fraud.

Transforming Client Services With Real-Time Reporting

Every successful business has one thing in common, and that is satisfied customers/clients. A business that can make its clients happy is never going to face a crisis. But it’s not easy to obtain.

You’ll have to try various things to see which works in your favour the most. Here, AI has proven to be the game-changer, as it offers enhanced customer satisfaction, boosts operational efficiency, and strengthens client relationships through immediate, accurate data access.

Let’s just say you have to send a report to the client, it can be generated with AI, and further, you can use www.undetectableai.pro/ to give it that human touch. Your client will be impressed, and it can open up new opportunities for your firm.

DID YOU KNOW? In 1952, Arthur Samuel created a checker program that could learn and play the game, making it the first working AI system!

Looking Ahead: Future Of Accountants In An AI-Driven World

While many might say that relying on artificial intelligence is not good, but fact that traditional methods are no longer useful can not be changed. AI is making major changes in all sectors, and that too in a good way.

I mean, organizations are getting great results like increased customer satisfaction, better visibility, and success rates. What else can they ask for? Some manual intervention is still required, but overall, AI will create an ever better future for accountants and firms.

- Automation Of Repeating Accounting Tasks

- Booting Accuracy While Reducing Human Error

- Real-Time And Detailed Insights Through AI For Smarter Financial Decisions

- Strengthening Compliance And Fraud Detection

- Transforming Client Services With Real-Time Reporting

- Looking Ahead: Future Of Accountants In An AI-Driven World