With the substantial growth and expansion of all businesses and industries, the use of technology cannot be left out, and so it is with accounting.

The emergence of AI has been a game changer in aiding accounting firms to enhance processes, precision of the firm, and client value. Also, learn about ChatGPT for Financial Analysis by reading this article.

In particular, this article investigates the diverse AI Tools that will assist in accounting firms integrating AI technology within their practice in order to enhance their efficiency and attainment of quality in service delivery.

The Evolution of Accounting with AI

Artificial intelligence (AI) is changing the traditional way of handling accounting.

It has influenced the accounting profession whose benefits and challenges are still being assessed.

However, the introduction of AI to accounting services cannot be interpreted as a danger for the accountants in the field but rather a chance for them to grow and prosper.

For instance, taking up AI applications can help accountants optimize their processes, improve accuracy, and change their job description to that of management and ethical supervision.

Though AI might perform some functions on behalf of the professionals, it will never substitute the knowledge, reasoning, and interaction with accounting professionals.

Key AI-powered Accounting Tools for Small Businesses

Automated Bookkeeping Software

Automated Booking Software assists small business owners in saving time, improving accuracy, and reducing costs.

You can understand more about these features with small explanations below.

- Save Time: The software is proficient in handling tasks such as invoicing, reconciliation, and financial reporting, helping set up your account in a quick manner.

- Improve Accuracy: With this software, the owner no longer needs to worry about the risk of errors that occur with manual bookkeeping.

- Reduced Costs: The software can collect payment without any manual process, hence, it eliminates the need for manual labor and data entry.

There are so many other benefits such as remote access, better security, fast data retrieval, and so on.

Invoicing and Payment Processing

No matter if you are handling a small business or a big empire, there are a lot more roles you are required to play to make the workflow seamless.

But sometimes the workload can be overwhelming, and that’s where Invoicing comes in.

Explore the below benefits to understand more about this AI-powered tool.

- Manage Cash Flow: You can track transactions and ensure a steady income, all you need to do is send invoices promptly and follow up on late payments.

- Getting Paid Faster: The software can help customers make fast transactions.

- Save time: Reduces errors, late payments, and missed invoices. This way it saves quite a lot of time.

The other benefits you can take advantage of include maintaining professionalism, showcasing your brand, and so on.

Financial Forecasting and Budgeting

Financial and Forecasting Budget- another transformative tool at a business’ disposal is artificial intelligence (AI), particularly in the realms of financial forecasting and budgeting.

- Quick and Efficient: The software can process data much faster than any human analytics.

- Accuracy: It reduces the risks with financial decision-making and provides accurate outcomes.

- Scalability: This AI tool can easily handle the increased data volume without compromising performance.

So, these were some of the benefits of the Financial and Forecasting Budget AI tool that you utilize to enhance your small business.

Tax Preparation and Compliance

Artificial intelligence is changing and making it quite easier for accounting firms to speed up their self-assessment tax return services.

Here’s how the beneficiary tax automation tools are:

- Time-saving: The software is proficient in operating tax reporting, and computations accurately, thus, lightening the workload for the associations.

- Informed Decision: The software makes it easy to access and generate reports for analysis of the company’s position in terms of indirect taxes such as VAT, GST, etc.

- Real-Time Compliance Monitoring: The software is organized to track regulatory changes and ensure that tax filing adheres to the latest accounting law.

With these advantages of this tool, the business owner can transform how tax compliance is handled.

AI-Powered Financial Analysis

Utilizing AI-Powered Financial Analysis can help you understand the market and customers more readily.

Some benefits include:

- Accuracy: It helps to control manual errors in data processing, data analytics, onboarding, and so on, accurately.

- Efficiency: As AI is capable of handling more than half of the work, the organization can focus on other strategic activities.

- Speed: The tool can process information and find patterns more quickly than any human.

The Benefits of AI-Powered Accounting Tools

The AI-Powered Accounting Tool has simplified the tasks associated with the accounting industry.

Here’s how:

Increased Efficiency and Productivity

One of the primary benefits of AI in accounting is the automation of repetitive work.

The AI-powered accountant tool is capable of handling tasks such as data entry, Invoice Processing, and reconciliation.

It allows the organizers to focus more on the tasks that require human expertise.

Enhanced Accuracy and Reduced Errors

The ability of artificial intelligence to greatly decrease errors and improve accuracy and precision is another great advantage.

This feature of AI allows it to analyze financial data, identify patterns, and extract insights without any follow-up of errors.

Cost Savings

AI operates the work more efficiently and minimizes resource wastage.

The software collects payment without any manual process, hence, it eliminates the need for manual labor and data entry.

Better Decision-Making

The AI-powered tool in accounting is also capable of generating real-time reports and providing stakeholders with up-to-date financial information.

This enables organizations for timely adjustments and course corrections for better results.

To stay competitive and meet growing client expectations, many firms are partnering with a modern AI development company that can tailor solutions specifically for accounting workflows. These collaborations enable firms to streamline repetitive tasks, ensure regulatory compliance, and deliver more accurate financial insights with minimal effort.

Scalability

AI also has the potential to handle large volumes of financial data from multiple sources which leads to being highly scalable.

This scalability is particularly beneficial for businesses that operate in dynamic environments and need to process real-time data to generate accurate forecasts.

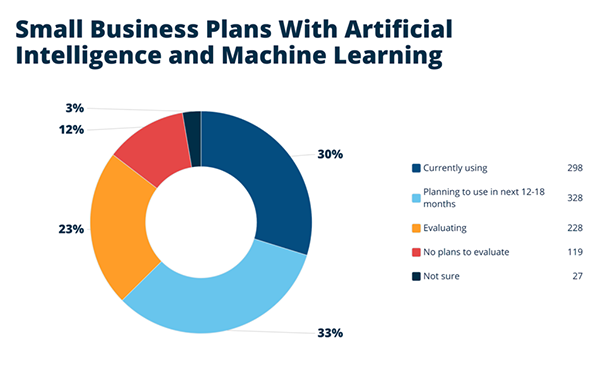

According to the Survey; 71% of accounting professionals believe AI will bring substantial changes to the accounting industry.

Leveraging AI-Powered Tools for Communication

In addition to financial management, AI-powered tools can also enhance communication within your business.

For instance, converting text into speech can be a powerful way to convey information clearly and effectively.

Tools that offer text to speech AI free capabilities can convert your text into human-like speech, making it easier to share financial reports, presentations, and other important information with your team or clients.

Using AI to generate authentic male and female voice narrations can enhance the quality of your communication materials, such as YouTube videos or documentaries.

This not only improves the professionalism of your content but also makes it more engaging for your audience.

Conclusion

AI-powered tools are revolutionizing small business accounting by automating routine tasks, enhancing accuracy, and providing valuable insights.

From bookkeeping and invoicing to financial forecasting and tax preparation, these tools can help small businesses manage their finances more effectively and efficiently.

By leveraging AI-powered tools, small business owners can focus on growing their businesses and making informed decisions that drive success.

As AI technology continues to advance, we can expect even more innovative tools to emerge, further transforming the way small businesses handle their finances.

Whether you’re a new business owner or an experienced entrepreneur, incorporating AI-powered accounting tools into your workflow can lead to better financial management, cost savings, and long-term success.