Gross pay is generally considered higher than net pay, as it shows the total earnings of a person before any deductions are made.

If you have been in the accounting profession – you must have noticed that accuracy is paramount here. But still, most of the employees feel overwhelmed when it’s about ensuring they are receiving the right amount from the gross salary. And indeed, the difference between the gross salary and the net salary is crucial.

While the gross salary feels like quite a big amount and the net is affected by the reality of TDS, professional and other taxes – is what truly adds to your life.

Keep reading this article to understand this foundational transformation from the gross salary to the net salary – a crucial reconciliation.

The Foundational Analysis: Modeling Location-Specific Withholding

Before any meaningful budget or valuation can be implemented – one must clearly calculate the primary cash inflow. Relying on a judged “effective tax rate” is identical to forecasting business revenue with a market average it ignores the specific variables that determine actual performance.

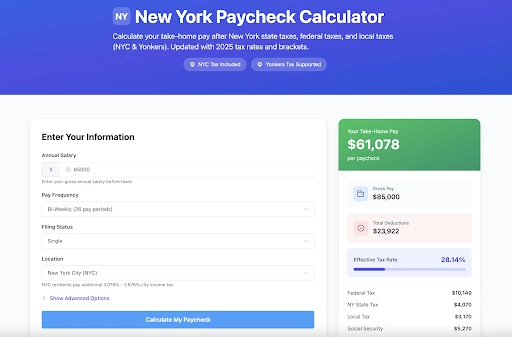

The single greatest variable in the US revenue equation is the state of employment. A $125,000 salary has a vastly different net result in Washington state (no income tax) than in California or New York. The change in annual disposable income can exceed tens of thousands of dollars, fundamentally changing the economic value of the offer.

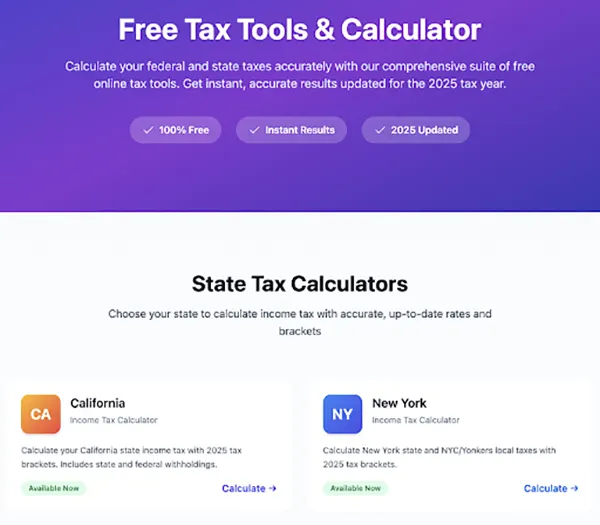

This is where a reliable paycheck calculator serves as an essential analytical tool. It functions as a special financial model, processing gross compensation through the specific, current algorithms of the federal IRS and the destination state’s revenue agency. For professionals looking for a role in California, utilizing a dedicated ca tax calculator is a necessary control step.

It accurately applies California’s progressive state tax brackets, State Disability Insurance (SDI), and any applicable local taxes, providing a clear projection of taxable income.

Building a Strategic Financial Model from Verified Data

With a verified net income figure, one moves from cautious planning to safe and strategic financial modeling. This clarity supports ideal professional and client advisory outcomes.

- Negotiate with the Metrics of a Forensic Analysis. Advising a client or entering your own compensation discussions with a modeled net-income projection for a specific city shifts the conceptual framework. It allows for negotiation based on required disposable income and cost-of-living equity, rather than bargaining over an indefinite gross figure. This allows structuring of compensation packages including equity, bonuses and allowances in the most tax-efficient manner.

- Perform a Comparative Analysis on Opportunities. Is a higher gross salary in a high-tax state truly more important than a competitive offer in a no-tax state? Does the total value of an offer with complex benefits net out positively? A platform with localized calculators allows for running parallel scenarios, comparing the true economic benefit of each offer on a consistent, net basis.

- Reduce Tax Liability and Cash Flow Risk. Interstate or international relocation can create complex multi-state tax filing fees and unexpected penalties. A solid calculation helps identify these exposures ex-ante – allowing for proactive tax planning and ensuring cash flow projections for the transition year are accurate and contingency-backed.

The Professional Standard: Dispelling the “Tax Bracket” Misconception

In our field, we rely on verified calculations. The common anxiety regarding “tax bracket creep” the fear that higher earnings reduce net gain is an accounting error. It ignores the principles of a progressive tax system. A professional-grade tool provides the audit records – demonstrating through itemized withholding that higher gross income always results in higher net income.

For the accounting professional, this process is a logical extension of core competency. It is the application of diligent accounting principles verification, accrual modeling, and accurate reporting to a critical personal or client financial input.

Before finalizing a US career move or advising a client on one, apply professional standards. Do not merely review the gross revenue of a salary; complete the reconciliation to find the true net position. It is the most critical calculation for the personal ledger.

Conclusion

The critical reconciliation from the gross salary to the net salary has been the foundational and fundamental payroll taxation process that has helped employees to easily convert their total earnings (the promised amount) and the actual salary that they can take home (after the deductions, such as tax deduction). Before any differentiation between the budget – a primary analysis should be done to precisely project the primary cash flow.

Just by relying on the reliable calculators and considering the right components of the transitions – common misconceptions can be avoided.