“The tax code is a labyrinth of complexity, but good tax management turns it into a map for financial success.”

As someone who does not belong to the finance industry and never got the chance to learn about all the related operations, tax management always seemed like an uphill battle to me.

Many people would agree that managing and calculating tax oversights can be complicated and puzzling. But this isn’t an excuse to let it slide and ignore this matter, after all, no one wants to end up in legal trouble.

So, while looking for an effective tool for this job, I came across digital tax management solutions that are nothing less than a magic tool to manage your tax operations.

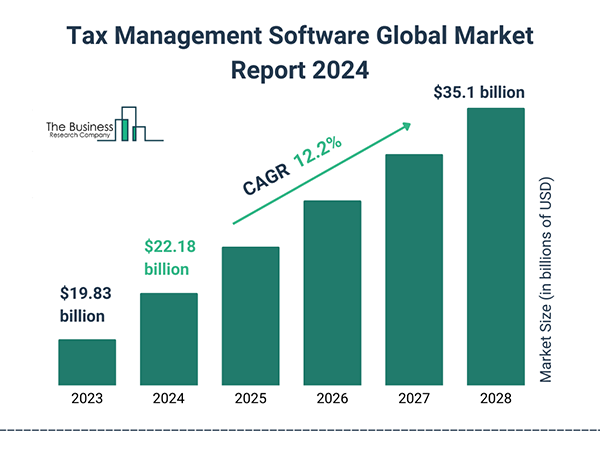

Nowadays, businesses have also started incorporating technology and modern solutions in various operations, tax management being one of them that utilizes self-assessment tax return services. Due to this increase in demand, the global tax management market size is expected to grow at a CAGR of 10.1 % from 2023 to 2030. (Grand View Research)

In this article, I’ll discuss with you how modern tax management works and how it made everything much more simple for me.

Understanding Modern Tax Management

Whenever I tried to administer my tax processes manually, I would often end up getting stuck in the tangled mess of numerous deductions, exemptions, and credits. Due to my lack of knowledge in this matter, I would often miscalculate or leave on the opportunities of reducing tax liabilities.

This is where modern tax management systems come into play. By using advanced tools and technologies. It automates all the calculations, provides real-time updates on tax laws, facilitates the filing process, and even generates a comprehensive report for tax liabilities, refunds, and the overall financial picture.

Benefits of Simplifying Taxes

I have already shared some of the benefits of simplifying the whole procedure with tax management software, but those are not the only ones. In this segment, I’ll share with you some more benefits it can provide to individuals, businesses, and even governments.

Automate Your Tax Process

Who wouldn’t like their time and effort to be saved? Automation of processes helps in just that and that too with many other additional perks such as improved accuracy, reduced risks of human error, faster filling, and streamlined compliance.

This automation of operations can provide significant help to individuals and even businesses to easily pay self assessment tax.

Track Expenses With Ease

Another aspect that I’ve seen people struggling with is tracking their expenses. Modern tax management tools can simplify this as well. By syncing my bank accounts, credit cards, and other financial platforms, I was able to track all my transactions in real time.

Also, there are solutions available that only require you to upload receipts and do the rest of the work on their own, by automatically extracting the information from there and making a transaction for you to review.

Stay Compliant With Tax Laws

I understand how challenging and frustrating it can be to stay compliant with the ever-changing tax laws. Using tax management tools saves me from all the irritation and annoyance, by providing regular software updates, including the latest tax code changes. This provides me with assurance and confidence that I am filing taxes based on the most current laws.

Save Time on Tax Filing

With these tools, I do not need to spend time calculating or tracking everything, this already saves a significant amount of my time, but these aren’t the only factors. It also enables faster data transfer between integrated systems. This results in quicker tax return preparations and saves time on filing taxes.

Minimize Errors in Tax Returns

Humans are known to make mistakes, but any errors in such sensitive transactions can lead to penalties, audits, or missed deductions.

Tax solutions significantly reduce such possibilities by minimizing the risk of human error and also offering an error check feature to the users to cross-check everything before submitting the final draft.

Protect Your Tax Information

With the increasing number of cyber crimes, security has become paramount, especially when dealing with financial transactions. Modern finance tools understand this and offer protection through elements like data encryption, secure cloud storage, and multifactor authentication.

This enables you to carry out safe and secure transactions and also safeguards your tax information from any unauthorized access.

Learn More About Digital Tax Solutions

As I shared in this article, tax management tools are an all-in-one solution for handling all your tax-related tasks. It offers a variety of features that can make tax filing simpler, faster, and more secure for you and take off the burden of doing everything manually from your shoulders.

If you wish to learn more about this topic, feel free to visit our website to read more about related topics.