“In the future, we’ll see a greater blending of finance and technology to deliver a faster, more secure, and highly efficient financial ecosystem.”

– Hassan El-Temamy, CEO of Fintech Egypt

Everyone would agree that a significant change in accounting and bookkeeping methods has been observed in the past few years. We no longer need to rely on inefficient paper and manual calculation-based practices to execute the essential functions of the finance sector.

Last year, around 60% of top executives reported using AI in their finance and tax departments, with 99% calling it ‘the next frontier.’ (Forbes: AI In Accounting And Bookkeeping)

While managing an accounting service, I have observed this radical transformation closely and can say that there is much more to come in the future. Curious to know more? Let me walk you through some of the emerging trends in the finance sector that are reshaping the future of accounting and bookkeeping services.

Intelligent Process Automation: Reinventing Operational Efficiency

There was a time when we had to perform the same routine tasks on our own, wasting both our time and effort, but not anymore because now, intelligent automation technologies are here to save the day.

Robotic Process Automation (RPA) effectively carries out repetitive manual tasks that once took the major chunks of human resources. Automating time-consuming processes like report generation and data validation frees up human talent, allowing us to pay more attention to strategic decision-making, and complex analytical work.

Not only that, but RPA implementation also helps us reduce human error probability, abstracting our minds from tedious data entry tasks and making the overall reporting process more reliable and consistent.

With this technology, our teams are now able to free up their time and concentrate on value-added activities like strategic planning, financial interpretation, and organizational growth initiatives.

Artificial Intelligence: Beyond Traditional Analysis

Most of you must have heard of Artificial Intelligence, the trending topic of the time. It has transformed various industries, so how can the finance sector remain last?

From what I have observed, AI proves to be a complete rethinking of financial analysis capabilities. Financial professionals, like myself, are experiencing the beginning of a new era in data interpretation with AI-powered tools revolutionizing the interpretation of financial landscapes.

To help you understand it better, I’ve listed down some key AI applications in the finance sector :

- Fraud detection systems are at their most heightened point.

- Some sophisticated risk assessment algorithms.

- Predictive financial forecasting models.

- Data analysis that would normally take weeks of human effort, just in a few minutes.

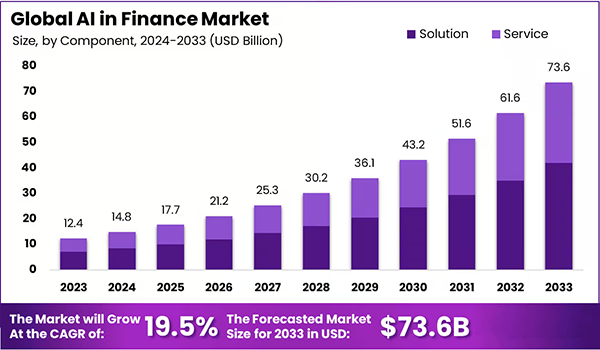

Due to the significant assistance AI technology provides in the finance sector, the global AI in finance market is on the rise, as you can notice in the graph below.

Cloud-Based Financial Management: Redefined Flexibility and Accessibility

After the pandemic, all of us have learned the importance of flexibility in various business operations. Cloud accounting solutions offer just that, and now have become game-changers in the field of financial management.

These platforms offer unprecedented flexibility, allowing us to access critical data wherever, and whenever, we need to. It has integration capabilities with a number of business tools that allow us to integrate automated workflow and also enhance collaboration.

Some other features that modern cloud platforms have provided us are:

- Scalable infrastructure.

- Enhanced data security.

- Real-time collaborative abilities.

- Real-time financial reporting and analysis.

Blockchain: Revolutionizing Transactional Transparency

Blockchain technologies have revolutionized the recording and verification of financial transactions. The following points will help you understand how its decentralized nature assists us.:

- It ensures transaction transparency like never before.

- Improved security protocols.

- Immutable record-keeping.

- Efficient contract management and execution.

Business intelligence and Data Analytics Software

We have also started utilizing powerful visualization tools, like Tableau or Power BI, which help us turn raw financial data into actionable strategic insights. Such platforms assist us in the following ways:

- Simplifies complex data visualization.

- Enables trend identification.

- Facilitates predictive modeling.

- Supports strategic decision-making.

Cybersecurity: The Critical Foundation

No question that cybersecurity is a must-have in the current era, but it has become especially essential in the finance sector. Due to the increase in cybercrime, implementing comprehensive security strategies like the following has become a necessity for us.

- Multi-factor authentication.

- Techniques of advanced encryption.

- Regular security audits.

- A comprehensive threat monitoring system.

Navigating the Future: Continuous Learning and Adaptation

From all we have discussed till now, you might have gotten an idea of how things change with time. With the advancement of technologies and evolving environment, it can be said that change is inevitable, and that is why the future of financial management belongs to those who demonstrate:

- Technological adaptability.

- Continuous learning mindset.

- Willingness for innovation.

- Thinking outside the box in terms of strategic thinking.

DO YOU KNOW?

By 2026, 80% of banking services are projected to be offered digitally.

Conclusion: A Dynamic Technology Driven Ecosystem

After all that we have discussed above, it is safe to say that a technological revolution is unfolding in the financial management landscape like never before. Modern technologies like automation, artificial intelligence, cloud computing, blockchain, and advanced analytics are not just trends; they are restructuring mechanisms in the most basic sense.

By approaching and implementing emerging technologies, professionals come a step closer to capitalizing on this dynamic ecosystem.

But also keep in mind that just technological proficiency is not sufficient, whether you are on the journey ahead or the journey already traveled, you need a macro-level approach to financial management that relies on human insight and technological capability.

- Intelligent Process Automation: Reinventing Operational Efficiency

- Artificial Intelligence: Beyond Traditional Analysis

- Cloud-Based Financial Management: Redefined Flexibility and Accessibility

- Blockchain: Revolutionizing Transactional Transparency

- Business intelligence and Data Analytics Software

- Cybersecurity: The Critical Foundation

- Navigating the Future: Continuous Learning and Adaptation

- Conclusion: A Dynamic Technology Driven Ecosystem