Yes, you can close your bank account online if you are not overdrawn.

The process of how to close chase checking account is very simple for UK citizens, as they can complete the cancellation through the Chase mobile application. The only condition is that the balance must not be negative.

However, it is not that simple for US-based account holders. They will first have to connect with a bank representative and then proceed further as instructed. For establishing this initial connection, the bank offers three channels: online, in person, and by phone. If you’re dealing with complex banking and financial records, you might also benefit from our Accounting Services to streamline your accounts before closing bank relationships.

This article covers all these methods to connect with a Chase representative for US account holders. Also, the process to initiate the cancellation via the app is included for UK customers, along with other crucial aspects.

What are the Things to Do Before Closing a Chase Account?

Before learning how to close chase checking account, pay attention to the following essential pre-closure checklist that includes tasks, such as transferring the balance, updating direct deposits and auto-payments, downloading bank statements, clearing pending transactions, and checking the minimum balance and fees.

- Transfer the Balance: Go to your Chase account online, and transfer the remaining balance, if any. If you don’t have another account, you can either use the account of a person you trust or open a new account in some other institution before initiating the transfer. Make sure your transactions are up-to-date before closing your account. Our Bookkeeping Services can help organize your records efficiently.

- Update direct deposits and auto-payments: If you have used your Chase account in multiple platforms for direct deposits and auto-payments, don’t forget to change it to the new account to which you have transferred the balance. Otherwise, it might cause failed transactions and personal losses.

- Download bank statements: This step is crucial before considering the Chase bank close account option because the downloaded statements are proof of your recent transactions, and will also help with future references, as access to the account will be denied after closure!

- Clear pending transactions: If you initiate the closure of your current Chase account without completing the pending transactions, the due dates will be over. And, it will cause you to visit the nearest official branch in person to sort out the failed transactions.You may need accurate financial data when filing taxes. Consider using our Tax Return Services before you finalize your accounts.

- Check minimum balance/fees: If your account hasn’t been maintaining the minimum balance limit for months, you are obliged to pay penalty charges before the closure.

How to Close a Chase Checking Account?

There are three ways you can close Chase checking account, namely, online, in person, and by phone. All of these options are explained below separately for maximum clarity on the process and fastest closure! However, keep in mind that Chase is a big name in the banking sector. Hence, it might even take weeks to a few months, under special circumstances, to wind up the entire closure procedure. So, let’s start the process of how to close chase checking account.

How to Close a Chase Checking Account Online?

The Chase close account option is available online on both the mobile application and the website. Just access the account and go to the menu by tapping the three dots in the top left corner. From there, click on the “Close Account” option and follow specific instructions, if any! However, note that you cannot use this feature if your account balance is negative.

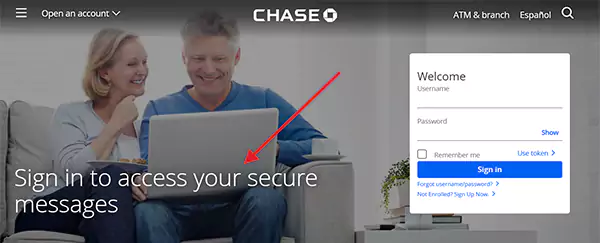

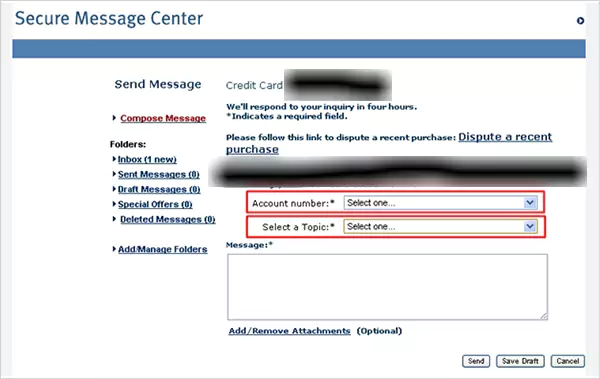

If the above method doesn’t work or isn’t available in your part of the globe outside the UK, consider the option of “Secure Message Centre.” This option is available on the mobile app as well as the website as part of online banking. To access the secure chat, consider the following steps.

- Visit the Chase website or open the Chase mobile application.

- Sign in to access your Chase account.

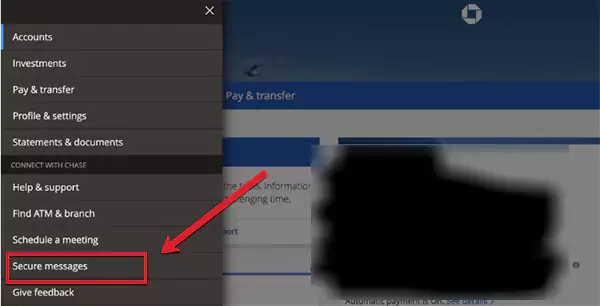

- Go to the “Secure Message Center” option from the side menu (the three-line icon in the top left corner).

- Send a message and inform Chase that you need to close your account.

Next, you will get the reply, along with specific instructions if any, from a representative at the bank within 2 business or working days. In case you don’t get the reply within the said time limit, consider the other options available for how to close chase checking account. If you’re closing an account for business purposes, make sure your records align with your business type. Explore our Small Business Services for tailored support.

How to Close a Chase Checking Account In Person?

The next method about how to close chase account is by visiting the nearest branch and taking the help of a bank representative. Discuss your closing needs with them, and they will guide you through the process. Don’t forget to take your valid ID and account details with you in the hard-copy format, for easy access to the crucial information while filling out forms. For UK business accounts, closing savings or current accounts might affect VAT reporting. Our VAT Return Services can help manage compliance.

How to Close a Chase Checking Account by Phone?

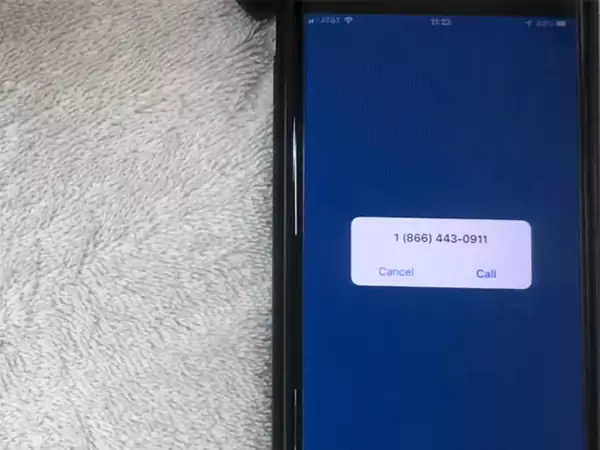

Closing the Chase bank savings and checking account is also possible by making a phone call. Although Chase might change its service numbers from time to time, 1-800-935-9935 is the number now for customer help and technical support. Simply, connect and convey your bank account closing requirement with the representative on the other end of the line.

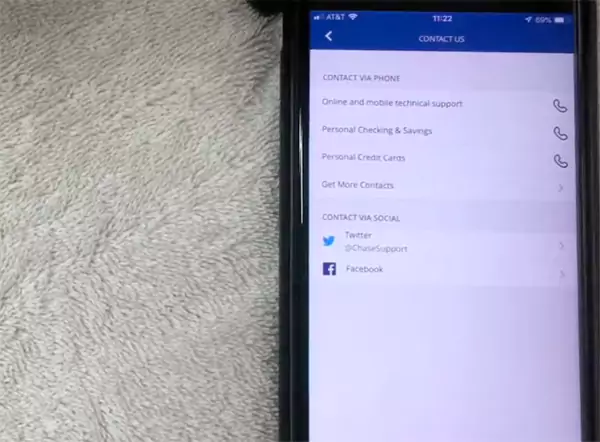

Go through the following steps to access the updated contact information whenever you require. This is the third method of how to close chase checking account:

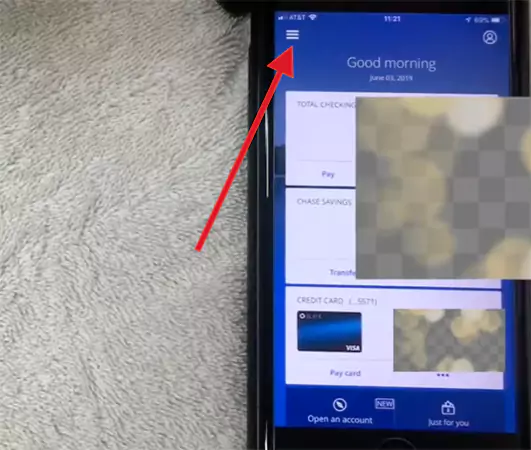

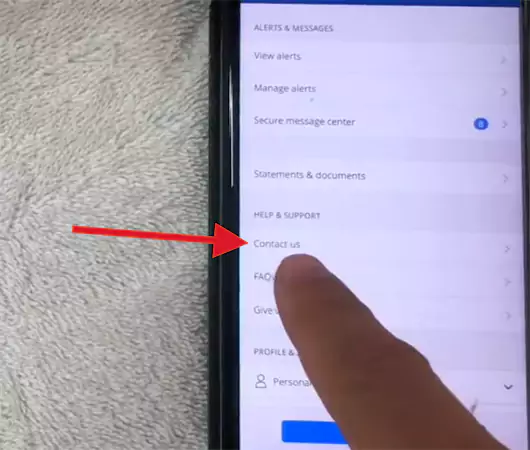

- Open the Chase mobile app.

- Go to Menu.

- Find HELP & SUPPORT.

- Select any of the calling icons, and it will provide the number on your phone directly.

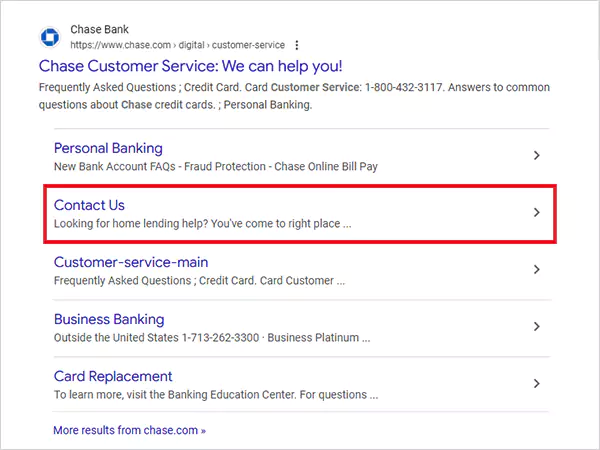

Besides, the contact numbers can also be found on the official website of Chase through the following search: Chase contact us. From the cluster of official links, locate and click on Contact us, and you will access the helpline numbers.

How to Close a Chase Savings Account?

The process of how to close chase savings account is similar to the process of how to close chase checking account, as discussed in the heading above. If you are a citizen of the UK, you can easily do it from the comfort of the Chase mobile app, with just a few simple clicks.

- Open the Chase mobile app.

- Go to the menu.

- Tap “Close Account.”

Please note that the closure will only get activated if your account balance isn’t negative.

However, outside the UK, you will have to consider the following options for the closing service:

- Using the “Secure Message Center.”

- Visiting the nearest local branch.

- Connecting with a Chase representative through a phone call; numbers are available 24/7 on both mobile apps and websites.

If you have skipped to this section directly—from the table of contents—and thus, need elaborations, refer to the heading above this section, which provides elaborate explanations on how to close chase checking account.

Can You Close a Chase Account Online?

Yes, you can close a Chase account online through the mobile app with a single click. The only two mandatory conditions are that, first, the account balance has to be positive, and second, you are located in the UK; in other words, you have a UK Chase account.

However, learning how to close a Chase bank account outside the UK isn’t that simple. The online facility is provided through “Secure Message Center,” but that is just for the sake of an initial interaction with a bank representative without having to visit a local branch in person. Through this online option, too, it might take 2 working days for the Chase representative to respond and get to your concern.

Besides how to close chase checking account, let’s also learn about other key aspects in the following sections.

Are There Any Fees & Charges for Closing a Chase Account?

There is no particular fee or charge that the Chase levies on an account holder who seeks the closure of the service.If the account balance is negative, you must clear the outstanding amount before closure. A zero balance does not automatically incur penalties, provided minimum balance requirements were previously met.It is because almost all banks have a minimum balance criterion, the limit of which varies from one financial institution to another.

Hence, in short, if your Chase account balance is positive and fulfills the minimum limit well, just focus on learning how to close chase checking account, as there are going to be no additional charges for you to pay.

How to Close a Chase Credit Card Account?

Learning about how to close chase credit card account requires you to consider mainly two methods: by using a customer service contact number and through the Chase app.

- Customer Service Contact Number: Find out and call the number on the back of your credit card or the customer service number available on the Chase mobile app under menu > support, or on the Contact Us page of the official website.

- Chase App: Mostly, direct closure is only available for UK-based Chase account holders, but you must always search for the “Close Account” option on the app before proceeding to contact the bank representative directly.

Although a third option also exists by mail, it can be cumbersome and time-consuming. Under all circumstances, the above-mentioned options are sufficient to meet your account closing needs.

What are the Common Problems When Closing a Chase Account?

The most common 4 problems that occur when you cancel chase account are related to pending transactions, negative balance, linked accounts, and reopening confusion. These must also be learned along with how to close chase checking account. Explanation is provided below.

- Pending Transactions: If any transactions are pending, make sure that they have first been completely sorted out or cleared by the bank before you initiate the closing process. Later, once the account closure is started, such unfinished transactions will be either delayed or cancelled altogether.

- Negative Balance: You cannot close your account if its balance is negative. For the closure to happen smoothly, the first requirement is that you must not be overdrawn. However, don’t worry, if that is the condition, make sure that you pay off all the outstanding amount before closure.

- Linked Accounts: If you have used your Chase account anywhere, e.g., to autopay for subscriptions, direct deposits, or otherwise, make sure to change the Chase payment method to the details of an active bank account. After the closure, the bank will not be able to facilitate any form of recurring payments, and in the absence of any other provided means, transactions will fail, causing increased financial burden.

- Reopening Confusion: Once the closure has been effected, it is permanent, meaning that you cannot reopen your closed account. Thus, be mindful in the beginning whether you really want it to be closed or not.

Final Thoughts

The process for how to close chase checking account is pretty straightforward for UK citizens, as there is the option to cancel it with just one click directly from the comfort of the mobile phone screen via the Chase App. However, for others, they first have to connect with a bank representative through the “Secure Message Centre” online and then proceed with specific instructions as communicated. Before you close your account, make sure all financial data is in order. Our Accounting Services can help finalize records without hassle.

- What are the Things to Do Before Closing a Chase Account?

- How to Close a Chase Checking Account?

- How to Close a Chase Savings Account?

- Can You Close a Chase Account Online?

- Are There Any Fees & Charges for Closing a Chase Account?

- How to Close a Chase Credit Card Account?

- What are the Common Problems When Closing a Chase Account?

- Final Thoughts