It makes no difference if you are earning less and barely paying your bills; saving money is a necessity if you want to achieve financial stability and ensure that in the future you are prepared for unexpected expenses.

I am too aware of the fact that in recent years, the cost of living has been steadily increasing, but that doesn’t mean you are left with no option for saving even a cent.

All that’s needed is to put effective strategies and you can protect your hard-earned money and ensure it continues to grow over time.

Following we have provided you with several effective methods that can help you safeguard your savings and maintain financial security.

Diversify Your Investments

There’s this old saying that ‘Don’t put all your eggs in one basket’, because if something happens to that one basket, there are chances you lose all the eggs, and you will be left with no option.

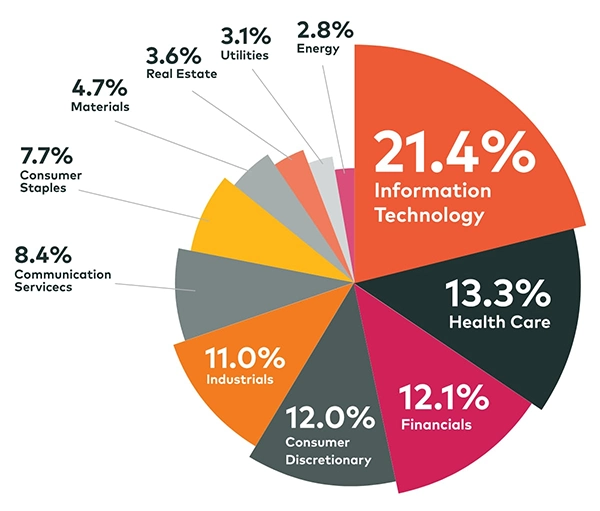

The saying is a piece of advice that suggests you diversify your investments and consider spreading your funds across a range of assets such as stocks, bonds, real estate, and savings accounts. This way, there will be chances of saving more and more.

The strategy is one of the best ways that help you reduce the risk of losing a large portion of your savings if in case one particular investment slips up.

Thus, when you balance your portfolio with a mix of high-risk and low-risk investments, you potentially increase your returns and minimize the impact of market fluctuations.

You can also consider consulting with a financial advisor to help yourself in making the best investment strategy based on your goals and risk tolerance.

Keep an Emergency Fund

An emergency fund is a key component of any financial plan that serves as a safety net to cover unexpected expenses, such as medical bills, car repairs, or sudden job loss, without having to dip into your long-term savings.

Experts say that having at least three to six months’ worth of living expenses set aside in a readily accessible account.

This means when you keep an emergency fund separate from your primary savings, you won’t need to disrupt your financial plans in the event of an emergency.

Also, you must make sure your emergency fund is kept in a liquid, low-risk account, such as a high-yield savings account, so you can access the money quickly whenever is needed. Entrepreneurs from all over Southern California learn from their ORANGE COUNTY BANKRUPTCY ATTORNEY how the most common mistake is allowing that fund to sit untouched for too long without reassessing its adequacy. They also find that reviewing it regularly helps ensure it still aligns with their current financial obligations.

Automate Your Savings Contributions

You are stealing your future self only when you are not consistently saving your money and using your savings and investments in non-emergency situations.

I agree that saving money is challenging, and there might be frequent circumstances that force you to spend the money you have decided to save.

But if you aren’t able to make it, you can never be financially stable in the future and be going to suffer the worst.

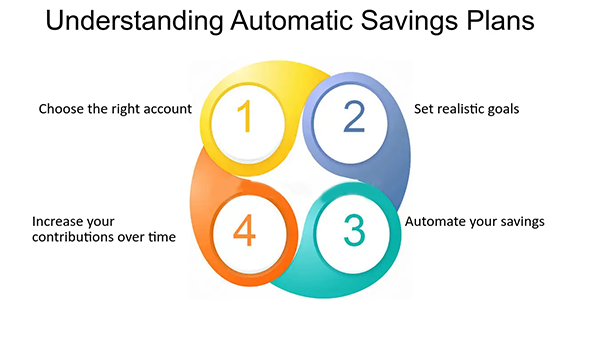

Don’t feel miserable as you still decide to consistently contribute to your goal and automate your savings plan.

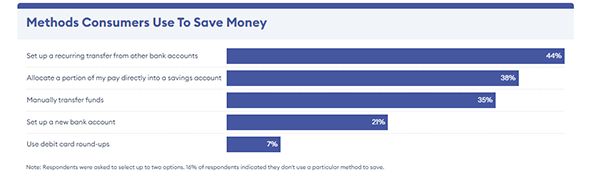

Setting up automatic transfers from your checking account to a savings account or investment portfolio ensures that you’re putting money aside on a regular basis, without having to think about it.

This strategy helps you save finance for your future in a much easier way and helps you avoid the temptation to spend money on unnecessary purchases.

Moreover, when implementing this strategy, you will leave with peace of mind, as you know that you’re continuously working towards your financial goals with minimal effort.

Additional Tip:

You can try the 50-30-20 budget rule – a budgeting plan where 50% of your income is spent on needs, 30% on wants, and 20% goes into your savings.

Use Secure Savings Accounts

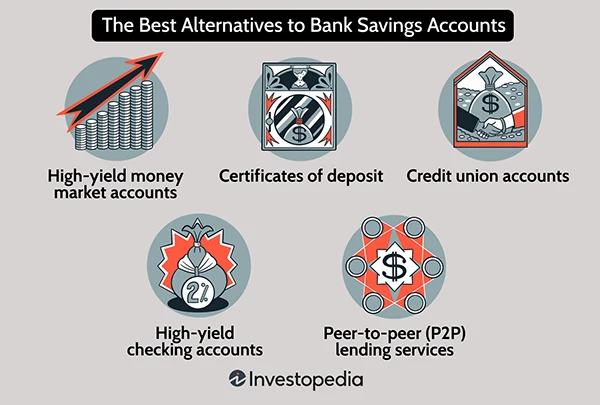

Another effective way you can save your money is to choose secure accounts that not only protect your money but also offer reasonable returns.

One such popular options that you can take on are High-yield savings accounts, money market accounts, and certificates of deposit (CDs).

These all are perfect yet a safe place for your savings and offer interest to help grow your balance.

Also, these types of accounts can help you build your savings steadily over time and minimize risk.

In addition, when choosing such an account, make sure it is insured by the Federal Deposit Insurance Corporation (FDIC) or its equivalent, as it guarantees your deposits up to a certain amount in the event of bank failure.

This added layer of protection ensures that your money is safe, even in uncertain economic times.

Avoid High-Interest Debt

High-interest debt can be a blockade between you and your oath to save money.

The longer you carry a balance on high-interest debt, the more money you’ll spend on interest payments, which can take away from your ability to save.

That’s why you must prioritize wiping out high-interest debt on a timely basis, and swiftly, so you can free up more funds for your savings.

This way, you’ll have more control over your finances and the ability to allocate additional resources toward your savings goals.

Regularly Review and Adjust Your Financial Goals

With time, your financial situation, and goals might take a turn or make frequent changes, thus, you must regularly review and adjust your savings strategy.

Be it you’re saving for a down payment on a home, retirement, or your children’s education, when you timely analyze your progress, it helps you to stay on track.

Also, in case your income or expenses change, you can still consider adjusting things accordingly.

Staying flexible and revisiting your financial goals will allow you to respond to changes and make adjustments to safeguard your savings in the long term.

Protect Against Inflation

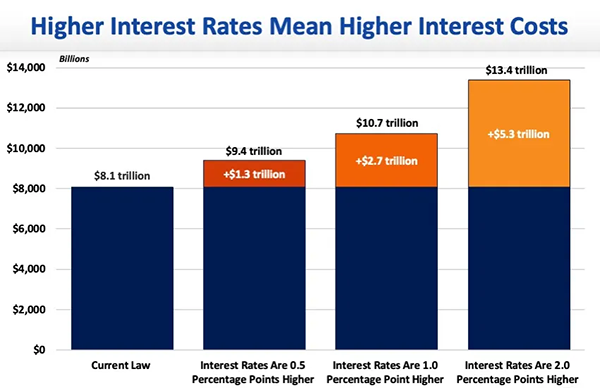

It has always been challenging to predict inflation due to its complex process that depends on various changing factors.

Although it can be another barrier to your goals, you can still protect your savings against inflation.

For this, you can consider investing in assets that tend to outpace inflation, such as stocks, real estate, or Treasury Inflation-Protected Securities (TIPS).

These investments have the potential to grow in value over time and provide a hedge against the rising cost of living.

Also, you must ensure that your savings accounts are earning interest at a rate that keeps pace with or exceeds inflation.

In this, the above-mentioned High-yield savings accounts and other inflation-resistant investments can help preserve the value of your funds.

Coming to the end, safeguarding your savings is much more vital than ever so you better maintain financial security and achieve your long-term goals.

Be it by diversifying your investments, automating contributions, or keeping an emergency fund, you can effectively protect and grow your savings over time.

These strategies, along with staying debt-free and adjusting your financial plan as needed, will help ensure that your savings remain secure and continue to grow.