Do you know about the OTC crypto exchange? It has been getting quite popular these days, especially among businesses and individuals with high income or wealth. But what is OTC and what does it do?

If we talk statistically, recent data shows that the global over-the-counter (OTC) market has experienced a 106% increase in 2024. This means that people are opting for this service a lot.

In this article, I’ll tell you everything that you need to OTC and will also help you choose the right crypto OTC trading platform.

What is OTC Crypto Trading?

OTC crypto trading is done between a buyer and seller with a mediator (broker) who lets this happen. Over-the-counter or OTC trade is more flexible than traditional cryptocurrency exchanges.

This is usually used to buy crypto in bulk and since you are doing it with the help of a third party it’s easy to negotiate, and you save money. These are perfect for institutional investors, companies, and high-net-worth individuals who want to avoid slippage and get access to deep liquidity pools.

You don’t have to be concerned about anything as these specialized platforms offer better privacy, confidentiality, and security to their users.

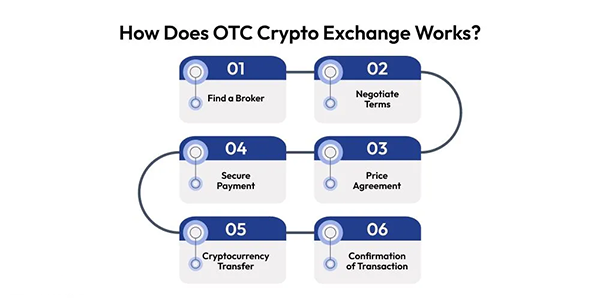

Also, these platforms often provide tailored solutions and expert guidance, which makes sure that clients receive the best possible execution for their trades. In the infographic below you can see how OTC crypto exchange works.

How to Choose the Best OTC Crypto Platforms

There are several options available in the market for OTC trade, but how can you choose the best one? You need to keep these few things in mind:

- Liquidity: A good OTC platform should have deep liquidity to process big trades without moving the market.

- Reputation: Go online and check reviews of previous users, to learn what services they offer and if they are genuine or not. You’ll also get to know what issues you might face with the platform.

- Compliance and Security: It’s your job to ensure that whatever site you are using to exchange offers multi-signature wallets, AML/KYC compliance, and encryption.

- Fees: Compare fees across platforms to find one that fits your trading volume and frequency.

- Customer Support: Make sure that you are met with 24/7 customer support so that even if you face any issue, it gets resolved quickly.

Top 5 Global OTC Crypto Exchanges & Brokers

To make things easier for you, I’m going to tell you about the top 5 global OTC crypto exchanges and brokers. This includes:

Cryptoprocessing

Cryptoprocessing is a secure and easy-to-use crypto OTC trading platform. With deep pools and advanced security features, it’s perfect for businesses and institutional clients.

Users get AML/KYC compliance along with competitive fees, making it one of the best OTC players. Apart from that, it has a simple UI which makes it easy to use. Cryptoprocessing stays up to date with its tech so that it stays ahead in the fast-paced crypto space.

Binance OTC

If you are looking for deep liquidity, then Binance OTC is perfect for you, and it supports over 100 coins. You don’t have to worry about security as it is 100% safe for investors. Competitive pricing is also a plus point as it is the focus for both retail and institutional clients.

Global presence means seamless transactions across regions. 24/7 support and integration with other Binance products make it a versatile platform for traders. Binance is always innovating and expanding its services and user experience.

Coinbase Prime

Coinbase Prime is an OTC platform for institutional investors. High-touch trading, deep liquidity, and storage solutions. Integration with the Coinbase ecosystem means reliability and ease of use.

Advanced analytics to help you make informed decisions and best in class regulatory compliance. Coinbase Prime has a reputation for security and transparency and is a favorite among institutional clients.

CoinFlip

CoinFlip is an American-based OTC platform that has been in the game since 2016. You can buy up to seven different types of currencies here, and it has managed to create a reputed presence in the market.

You can buy Bitcoin and other crypto with cash itself, but for that, you’ll have to find its ATM. They offer online service as well where you can use cards, and they provide same-day settlement on almost every transaction. It has even been featured in Forbes and the Wall Street Journal.

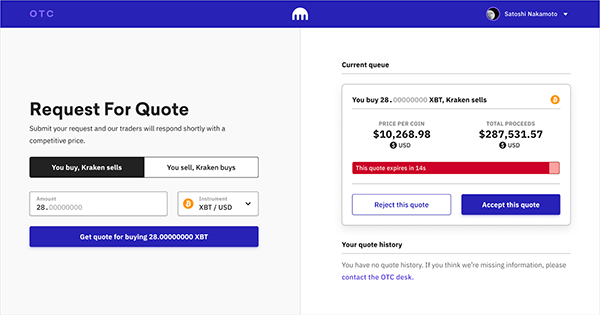

Kraken OTC

Kraken OTC offers bespoke trading, and deep liquidity, and supports over 20 fiat currencies. Security and transparency are the focus for high-volume traders looking for privacy and fast execution.

Advanced trading tools and market data to help you. Kraken’s commitment to high security and regulatory compliance makes it a trusted OTC partner

Pros and Cons of OTC Trading

Here are a few pros and cons that you need to know about OTC trading:

Pros:

- Privacy: It’s more private since it’s off the public order books.

- Reduced Slippage: Big trades on OTC platforms move the market less.

- Personalized Service: You are met with personality-tailored trading solutions along with a dedicated account manager who makes things easier for you.

Cons:

- Higher Fees: It’s mandatory to pay a premium charge to the OTC platforms for using their services.

- Limited Access: Some OTC desks are only for institutional investors and high-net-worth individuals.

- Counterparty Risk: Direct trades involve trust in the counterparty.

DID YOU KNOW?

The over-the-counter (OTC) crypto exchange market is expected to reach $264.32 billion by 2023!

Conclusion

OTC crypto trading is reliable and executing big trades becomes easier with it. It gives you the flexibility, security, and overall nice experience that you are looking for. If you can find the right OTC platform, you can use it to boost your crypto portfolio.

As the market grows, choosing a good crypto OTC trading platform is even more important to stay ahead in the digital game. So don’t make any rash decisions and do your research first so you don’t suffer any heavy losses or get scammed.