Every business, especially small businesses, at one point, needs funding or loans so they can get their work on going. Getting funds is not easy, entrepreneur has to do and try several things to attract investors. But what is the other reason for financial assistance?

Titus Maccius Plautus once said, “You have to spend money to make money.” So if small businesses are running out of capital, they have to get it somewhere, right? This is when they move towards business loans and financing agreements.

In this article, we’ll understand the legal implications of business loans and financing agreements. How they work, what is their structure, and everything else that you should know about it.

Why Your Legal Structure Matters

One way to think about the ethical implications of business funding is to consider different venture capital formulations. Simply put, the approach you choose for your business can have a major impact on the funding possibilities available to you, and may even affect the legal avenues at your disposal.

Sole Proprietorship and Partnerships

For example, many small business owners decide to run their business either as a Sole Proprietorship (in which they make all the decisions and claim all the profits themselves) or as a Partnership (in which they split ownership and revenues with one or more company partners).

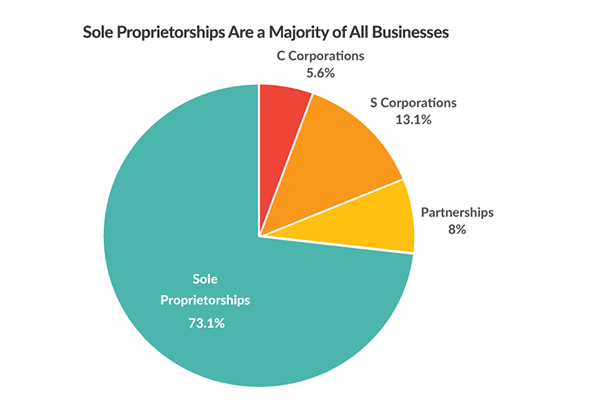

In the graph below, you can see that most of the businesses are under sole proprietorship. This means people are more into making a profit for themselves.

This is a popular option among business owners because there’s so little regulatory overhead associated. Here’s the rub, though: When you run your company as a Sole Proprietorship or a Partnership, your business is not its own distinct legal entity.

This limits your ability to procure any kind of meaningful source of funding, as you’ll likely have to rely on your personal credit history to take out a personal loan. And there is simply no regulatory mechanism for bringing in third-party investors.

Limited Liability Companies (LLCs)

Another option is to register your business as an LLC. Doing so actually does distinguish your company as a separate legal entity, distinct from its owner. Because an LLC is its own standalone tax-exempt entity, you’re able to apply for business loans and lines of credit, which may not be available to Sole Proprietors.

And, because the LLC format gives you a certain professional credibility, it may also allow you to secure more advantageous rates. However, an LLC does not allow you to sell ownership shares in the company, which may make it challenging (though not impossible) to recruit external investors.

The steps for forming an LLC can vary by state, but in brief:

- You’ll need to have a Registered Agent who has a physical address in the state where you’re registering; so, when forming an LLC in New York (for instance), you’ll need to find a New York agent.

- To officially register your LLC, you’ll need to file a document called Articles of Organization with your state, and also pay your state-specific LLC registration fee.

- Though it is not legally mandatory, you may benefit from clarifying your business structure with an Operating Agreement.

Another important note about the technical dimensions of business funding: The LLC structure provides a high degree of personal liability protection, which can limit your risk exposure in the event of a legal or financial calamity.

This may provide a bit more peace of mind when seeking a private loan, both for you and for your lender.

PRO TIP: Since LLC doesn’t have residency restrictions, you can partner up with other people outside your country!

Corporations

A final legal formulation to consider is the Corporation. A Corporation is governed by a Board of Directors, and ownership is determined via the sale of ownership shares.

The ability to sell shares in the company makes this legal structure your best bet for bringing in investors and venture capitalists, though it also requires you to give up some of your control over the company and its direction.

Corporations can also secure business loans and lines of finance, often for very favorable terms.

When it Comes to Financing, Legal Structure Matters

There are plenty of ways to secure funding for your business but remember: There are also some important legal considerations to make. The correct formulation you choose for your business has particularly big implications for the types of financing you can access, so choose wisely.

LLC is a better option as it provides better liability protection and loan access. But again, they might struggle with attracting investors if they fail to sell shares. On the other hand, corporate offers the best external investment, but you’ll be giving away some of the control of your business to the board of directors.

Both have their pros and cons and if you only want money go for corporate and if you want to protect your liability choose LLC. But make sure you make a decision that you don’t regret later.