As we are modernizing, remote work and virtual offices are becoming a major part of any working environment. I’m also a working employee and I too have remote job benefits and I can still access all the important files and data from anywhere in the world.

Alfred Nobel once said, “Home is where I work, and I work everywhere.” With this quote, he stated that you can perform your duties from anywhere, it doesn’t have to be just one place or a small room.

However, working remotely also comes with some limitations and issues, especially in the financial part of the business. But let me tell you that these limitations can be easily overcome by accounting systems.

In this article, I will talk about how virtual offices can benefit from robust accounting systems. So if you are someone who owns a business or earns a living from home, make sure to read this write-up till the end.

Enhanced Financial Visibility and Reporting

A great accounting system increases transparency as employees have real-time insights into the data from their comfort place. This is a crucial part of the remote team as they have access to the cash flow, income, and expenses of the company.

Everyone wants their business image to grow, and you can get a business address in New York City, but this will come with a cost that can be managed by the finance team if they have proper financial visibility.

Such transparency results in better decision-making and overcoming obstacles. So make sure that your system can provide these things without any issues.

Streamlined Invoicing and Payment Processing

To maintain a strong cash flow in your businesses, you’ll have to have streamlined invoicing and payment processing. This could be made a lot easier with a well-integrated accounting system.

Track payment status, automated invoicing, and reminders for overdue payments can save significant time, and it also ensures that all your clients are being paid on time.

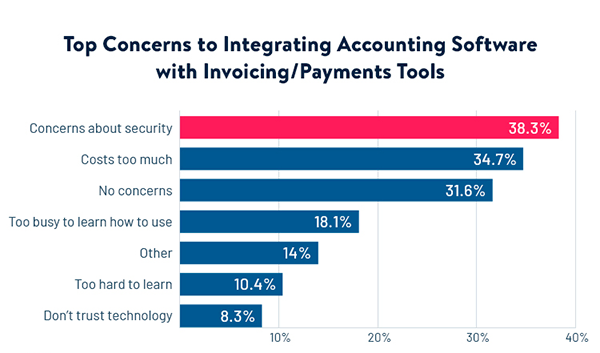

Robust accounting systems, decrease manual error and speed up payment processing. All your data is stored in a safe place for the records. Even though these software programs are helpful and reduce workload, there are still concerns related to them, which are mentioned below in the stats.

Improved Expense Tracking and Management

As I mentioned at the beginning I’m also an employee, I could tell you one thing is that tracking expenses virtually could be challenging. But, accounting systems make the whole process smoother.

Expense tracking becomes seamless because it allows team members to keep tabs on everything digitally from anywhere. They can work accordingly and keep everything in check.

They can ensure that expenses are being recorded, analyzed, and organized. This helps managers as they will be able to control unnecessary spending.

Enhanced Compliance and Risk Management

You might be aware that tax regulations and compliance requirements are an important part of business and if not dealt with properly it could result in costly penalties.

However, a robust accounting system can organize your financial records, and give tax reminders, which reduces the risk of you facing any kind of fines. This even helps in adhering to all the laws and creates a good image for your business.

Facilitating Collaboration and Communication

Active collaboration and communication play a critical role in creating new strategies and decision-making. Enhanced accounting systems that connect with virtual offices provide several communication tools for effective engagement.

These tools allow you to discuss budgets, collaborate on money-making strategies, and share financial records. The off-site team can work without any issues as they are met with real-time data and they can do their job accordingly.

Customizable Financial Insights and Analytics

Digital offices deal with different environments and since accounting systems provide them with analytic insights they are able to operate everything more effectively.

They can set up KPIs, generate custom reports aligning with your financial goal and have access to tailor analytics. This helps the off site team to manage and monitor performance closely.

DID YOU KNOW?

The global accounting system market is estimated to be $15 billion, and it is expected to grow to $30 billion by 2030!

Scalability to Support Business Growth

The web-based office expands as your company grows and this means now the financial burden is going to be increased. However, accounting systems adapt to all the changes.

It can keep up with the increased transactions and keep records. Apart from this, it will also make space for incorporating new team members that will be hired for management. This is important to support the growth of your business.

Better Budgeting and Forecasting Capabilities

A robust accounting system helps with accurate budgeting and forecasting. For maintaining financial stability this is essential because without it a company will mess up with its budget.

Forecasting tools provided by these programs contribute to planning budgets, prepare for challenges, and projecting revenue. I hope by now you understand how the accounting system helps the virtual office.

- Enhanced Financial Visibility and Reporting

- Streamlined Invoicing and Payment Processing

- Improved Expense Tracking and Management

- Enhanced Compliance and Risk Management

- Facilitating Collaboration and Communication

- Customizable Financial Insights and Analytics

- Scalability to Support Business Growth

- Better Budgeting and Forecasting Capabilities