Yes, these types of cash advances are legal, even though they are not like typical loans.

Merchant Cash Advance (MCA) can be defined as the next best alternative for businesses looking for quick and easy funds. A merchant cash advance is a kind of financing in which a company receives a large sum of cash in exchange for a percentage of future sales.

Unlike traditional loans, MCAs are based on a company’s credit card transactions rather than its credit score or collateral. It is also commonly known as a daily or weekly debit loan.

Blursoft is one such prominent MCA provider, and in this article, we will discuss Merchant Cash Advance Blursoft in detail.

Merchant Cash Advance Blursoft: Overview

Blursoft is the leading capital solution provider for businesses looking to expand. Merchant Cash Advance Blursoft provides a lump sum of cash in exchange for a percentage of future sales, which enables companies to access the funds they need without the stringent requirements of traditional loans.

Some people get confused between MCAs and traditional loans. There is a huge difference between them, as you don’t require any credit score or collateral to avail of an MCA. With the added benefit of offering traditional business loans for bad credit, Blursoft stands out as a comprehensive capital solution provider.

Unlike traditional loans, the MCA’s amount depends on several factors so let’s understand how it is calculated.

How is MCA Calculated?

The process is quite simple, where MCA firms analyze your sales report to calculate the amount of loan you are eligible for.

Based on that data, they give you a lump sum payment that you return with a certain proportion of your daily or weekly credit sales. The credit amount could be as low as 50% of your recorded monthly sales, and it could go all the way up to 250%.

To repay the amount, retrieval fees are calculated, which could be anywhere between 20%-50%.

By now, the calculation of MCA must have been clear to you. Moving on, let’s find out what makes Blursoft the best and most preferred option for MCA in the market.

Why Use Blursoft for Merchant Cash Advance?

Blursoft promises to provide quick and fast loan approval with as low as a 1.2% factor rate. Merchant Cash Advance Blursoft is meant to assist businesses with emergency cash flow needs, allowing them to meet operating expenditures, engage in new prospects, and overcome financial obstacles.

It is a trusted partner for businesses looking for accessible and effective financing solutions that promote productivity. The offerings of MCA are not just limited to businesses but to various professions as well.

- Contractors: Contractors may require finance, and options for a variety of professional undertakings, such as acquiring equipment and materials. However, obtaining a loan from a bank might be difficult for a contractor. In such scenarios, Blursoft Merchant Cash Advances comes in handy.

- Uber Drivers: Blursoft provides easy financing options for Uber drivers as well, who are in desperate need of cash and cannot afford to avail of payday loans. This is a unique service that MCA’s firm rarely offers.

- Startups: As mentioned earlier, there are no certain requirements to avail loan in Merchant Cash Advance Blursoft. Even startups can avail of their services.

Furthermore, they also offer invoice factoring to their customers. Invoice factoring is not commonly seen as being provided by firms. It lays off the burden by taking into account receivables at the discounted rate. These exclusive services make Blursoft a unique MCA firm.

Now let us take it a step further and talk about how to get in touch with them.

Blursoft Merchant Cash Advance Contact Information

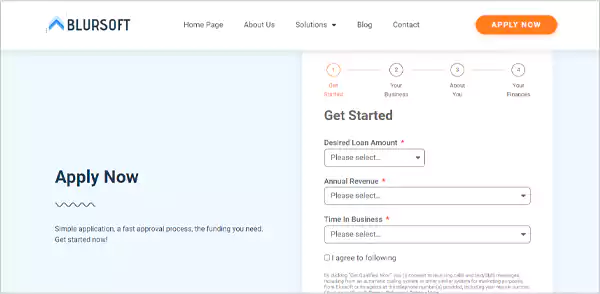

These steps will help you if you want to apply for a loan from Blursoft. Click on the Apply Now link and fill out the form, which looks like the image shown below.

After you have filled out the necessary information, a customer service representative will contact you shortly, and your MCA will be approved within 24 hours. If you have any queries regarding your current loan, you could either send the mail to support@blursoft.com or visit the website and call them directly.

You can also visit their office, which is situated at 1180 6th Ave Floor 8 unit 50 New York City, NY 10036.

So this was the hassle-free method to contact Merchant Cash Advance Blursoft. But if you are wondering if it is worth using their service, here are some advantages to help you make an informed decision.

How to Apply for Merchant Cash Advance Blursoft

The process to apply for the capital injection at Blursoft is quite straightforward and would require you to present a few documents.

- Bank Statement

- Ownership Information

- Basic Business Details

There is also a small number of eligibility criteria that need to be fulfilled:

- Minimum monthly revenue of $8,000 to $15,000

- Business operation for at least 3-6 months

- Not the major requirement but a credit score of more than 550 might make your firm a viable option

After that as mentioned above visit their website and apply for the cash advance and provide the necessary details. You may also be required to provide a clear statement of monthly revenue, average daily credit card processing volume, and any existing debts.

Blursoft will examine your eligibility after you have reviewed and submitted your application. This procedure is frequently quicker than traditional loans. Once your application is approved review the terms carefully while negotiating may be limited, you may be able to clarify certain issues or inquire about potential changes.

Once confirmed, Blursoft normally releases the advance cash often within 24 hours. The repayment will be done automatically and Blursoft will continue to deduct the amount until it’s fully paid.

Benefits of Merchant Cash Advance Blursoft

Blursoft has been helping businesses succeed for years and has a reputation for providing great service. Here are some exquisite benefits of MCA Blursoft:

- By comparing the services of other providers, Blursoft offers fast fund approval with minimal requirements.

- Another key benefit of Merchant Cash Advance options is the flexibility they provide. Unlike typical loans, you have no restrictions on how you spend the money.

- Compared to traditional loans, MCAs do not require collateral, making them available to enterprises with modest assets.

- Merchant Cash Advance Blursoft is known for its excellent customer service. Their team is available to guide you through the process, answer any questions you may have, and provide support throughout the repayment period.

- Their criteria focus more on your business’s daily credit card sales than your credit history, increasing the likelihood of approval.

Due to these benefits, many organizations prefer opting for an MCA loan from Blursoft. However, just as every coin has two sides, there are some precautions that a rational businessman should take. Moving on, let’s take a look at some disadvantages of Merchant Cash Advance.

Precautions for Using Merchant Cash Advance

Availing MCA might be the most feasible option for businesses with low credit scores. However, they usually ignore some of the drawbacks that could have a severe impact on their business operations.

One of the major issues with MCAs is that they have high fees that range from 10% to 50%. Additionally, Merchant Cash Advance requires businesses to pay daily which impacts the cash flow and even if you repay the amount on time, it will have no positive effect on your credit score.

Businesses cannot also ignore the potential of falling into a debt trap where they need to take out additional advances to cover previous ones. This can lead to a dependency on MCAs and further financial instability.

Considering these drawbacks and taking these precautions can help ensure that the decision to use an MCA is according to the requirements. Furthermore, businesses can explore various options, such as crowdfunding, invoicing, private equity debt, and a lot more.

By thoroughly understanding the terms, weighing the costs, and exploring alternative options, businesses can make a choice that supports their financial stability and growth potential.

Conclusion

Loans from Merchant Cash Advance Blursoft stands out in the financial business for its focus on providing rapid, straightforward financing choices that can be customized for the unique needs of the organization. However, it is also important to evaluate the possible adverse outcomes of MCAs, such as increased fees compared to regular loans and the possibility of getting trapped in a debt cycle.

Before deciding on a Merchant Cash Advance, it’s critical to carefully assess your company’s financial status and evaluate all available financing choices to guarantee it’s the best fit for your company’s development strategy.