There are several financial risks that corporations face, including economic downfall, world problems, technology failures, legal liabilities, inflation, natural disasters, and more. These can impact your firm in various ways.

Running a successful commercial operation requires careful planning and preparation of all the major strategies. And, you’re constantly balancing the budget, chasing clients, and trying to stay one step ahead of the competition.

But you know what, in this constant focus on growth it is also crucial to consider whatever “what if” scenarios, as they can lead to a major fiscal crisis. For instance, since cyberattacks are getting increasingly sophisticated, the average cost of a data breach can be around $9.44 million. (Source: IBM)

So, in this read, I’ll be discussing some of the most overlooked financial risks that every business should be aware of. We’ll dive into the potential impact of these risks and discuss the practical strategies to mitigate them.

Let’s start!

1. Technology Failures and Cybersecurity Threats

Technology is like the lifeblood of many businesses. From managing customer relations to even streamlining the payment process, technology plays a crucial role in literally every aspect of modern commerce.

However, this extreme reliance on technology is also exposing operators to a unique set of risks. One such risk involves the significant rise in cyber threats that can cripple a company, leading to major financial loss and reputational damage.

Beyond cyberattacks, some technical failures in the company like Hardware malfunctions, software glitches, and unexpected outages can also disrupt the whole firm’s operations leading to lost productivity and frustrated customers.

2. Compliance Costs and Legal Liabilities

Another major investment risk that often gets overlooked is the potential for compliance costs and legal liabilities. Manufacturers are usually subjected to a complex web of laws and regulations. This can range from data privacy laws like GDPR and CCPA to environmental and labor laws.

These regulations can also vary based on the industry, and if you fail to follow them, it can drain you financially. If you are a manufacturer and have distributed asbestos products to people, and harmed their families, multiple asbestos lawsuits will be filed against your business.

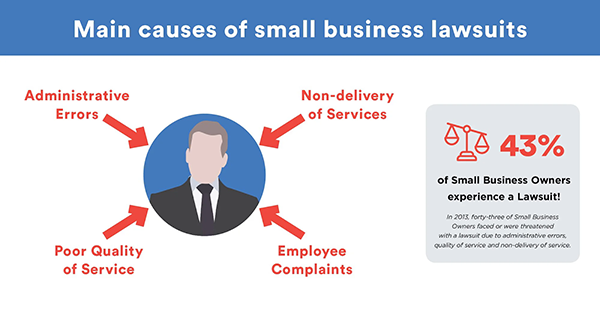

Asbestos is a dangerous material and can cause serious long-term health issues, including lung cancer. The whole mess will result in huge legal settlements and penalties against your firm. In the infographic below, you can see the major reasons for lawsuits in small industries.

4. Supplier and Vendor Disruptions

Suppliers and vendors play a major role as they bring important materials and ensure smooth production, but what if it gets disrupted because of something? At the time of the COVID-19 pandemic, 94% of Fortune 1000 companies faced supply chain breakdowns.

Even multinational companies such as Amazon and Apple were failing to meet the general requirements. Deliveries were getting excessively delayed and there were insufficient supplies for certain products.

This is why you should have a diversified chain instead of relaying only to one single supplier. In case of any unforeseen challenges, you’ll still be able to proceed smoothly, and you’ll be able to meet the market demand.

FUN FACT

Apple was sued by Nokia in 2016 for patent infringement, and reportedly it ended up with Apple paying $2 billion in settlement!

5. Economic Instability

Your nation’s economic stability plays a vital role in the financial situation of your business. Various factors like geographical events, inflation, market fluctuation, sudden and shifts in the global economy can impact your brand heavily.

Let’s take an example from the recent event, which is the Russia-Ukraine war, which started in 2022. Russia was the major exporter of energy like gas and oil and ever since the breakout prices have been breaking records.

This resulted in several problems in Europe along with other parts of the world. Domestic consumption troubles can also cause major downfalls as interest rates will go higher, and companies with debt will face challenges while paying it back.

It’s not easy to be prepared for such things, but you have to make some preparations. Set aside budgets, analyze global conditions to see what new tragedies might arrive, and keep checking the market and political status.

These are the 4 overlooked financial risks every business should prepare for. These can cause serious damage to your firm. Its image can deteriorate, and inevitably you’ll be drained. So, be safe and keep tabs on everything that’s going around.