You can go to the HR portal of your company, log in with your employee ID, and access the payslips easily.

Every month, we check our bank accounts for salary credit, but we often overlook other crucial components of employment — payslips. Though it seems it is just another file or sheet cluttering your email, it holds great value in the financial aspect of life. Payslips not only help in tracking earnings but also play a key role in payroll services, ensuring accurate salary distribution and tax compliance.

So, if you’ve ever dreamed of running your own business, you must know payslips and income statements to identify the complete insight of a business. Proper financial management, including accounting services, ensures that business owners maintain accurate records, which are essential for growth and compliance.

Moreover, managing cash flow efficiently involves keeping track of outstanding payments. Businesses often outsource accounts receivable services to streamline their invoicing and collection processes, ensuring steady revenue.

We have explained all the figures, terms, and importance of this slip in this blog. Read till the end for complete understanding.

What is a Payslip?

Payslips are a record of an employee’s salary for a particular period. It is generated every month after the salary is credited. Payslips are produced either digitally or in physical form after complete verification by the legal team. Ensuring accuracy in payroll processing is crucial, which is why businesses often use accounts payable services to manage financial obligations and maintain smooth cash flow.

It allows the employees to get a full view of their earnings and deductions. Moreover, this record is mandatory to submit as income proof when applying for loans or new jobs. Keeping track of financial records is essential, and many businesses rely on business bookkeeping services to maintain accurate financial statements.

Note that payslips are only given by the employers, so if you are registered as self-employed, you can not get payslips, instead, you get invoices as proof of your service. For self-employed individuals, handling taxes properly is essential, and self-assessment tax return services can simplify the process of filing taxes accurately.

Payslip vs Paystub

Paystubs are similar to payslips; both are considered important to streamline your finances and can be used interchangeably. However, it is shorter in length as it highlights only the main earnings and deductions highlighting the take-home salary. This term is commonly used in the US.

Payslip vs Paycheck

It is often misunderstood that both these terms are the same. However, a paycheck is transactional. This means the money is credited as salary while payslip is a receipt containing information about the transactions.

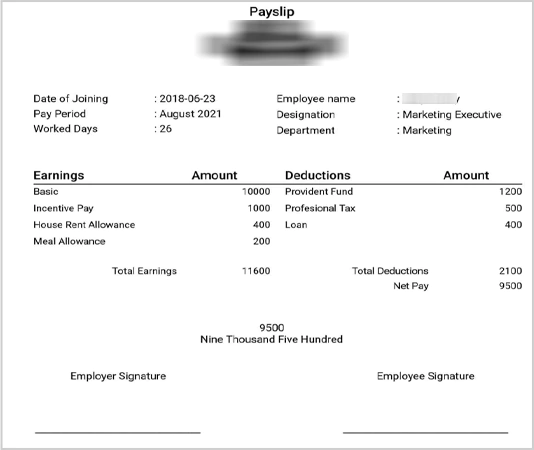

What is Written on a Payslip?

Every organization provides payslips and payroll numbers, and they might differ from one another. However, there’s a payslip template that all the companies universally follow. Here’s what is listed:

| Details of Employee and Employer Employee Name and ID: Name of the person who is being paid. Employer Name & Address: Information regarding the entity providing the payslip. Payment Period & Date: Indicates the timeframe for which the salary is credited (e.g., monthly, bi-weekly, semi-monthly, etc.). Department & Job Title: The designation of the employee and the division of work. |

| Total Earning Basic Salary: This is the set part of an employee’s income and acts as the basis for all additional earnings and deductions. House Rent Allowance (HRA): A segment of the salary allocated to cover rental costs. Dearness Allowance (DA): This is provided in certain nations to compensate for inflation and variations in the cost of living. Medical Allowance: This is offered to cover the employee’s healthcare costs. Transport Allowance: Reimbursement for travel costs to and from the workplace. Performance Rewards & Incentives: Extra compensation tied to personal or organizational success. Overtime Compensation: Payment for additional hours worked beyond standard working hours. Commission: Extra income for workers who earn incentives based on sales performance |

| Brief of Deductions Income Tax: The sum withheld according to an employee’s wage bracket and governmental taxation regulations. Provident Fund (PF) Contribution: A retirement savings contribution that is frequently compulsory in numerous nations. Professional Tax: A minor sum withheld by state authorities in certain areas. Health Insurance and Additional Benefits: Withholdings for medical or life insurance plans offered by the employer. Repayments for Loans or Salary Advances: If an employee received a salary advance or a loan from the organization, the deductions will be shown here. Pension Fund Payments: Payments made for pension plans or retirement benefits |

| Net Salary The amount that is left after all the deductions is the take-home salary, which is credited to the bank accounts. |

This is the payslip template that you will find in almost every organization. Now that you’ve got the idea, let’s go ahead and look at the types of payslips in the next section.

Types of Payment Slip

Payslips are classified into three types based on the format in which they are produced. Let’s take a look at it:

- Printed Payslips: This is the traditional method where the employers hand over the printed payslip every month to each employee. Many employers and small businesses still use this method as it does not cost much.

- Electronic Payslips: New technologies help produce payslips electronically. Employers use certain apps or software that generate and distribute digital issues seamlessly. These are easily accessible on the HR portal.

- Custom Payslips: Multinational companies or large enterprises develop their own payslip with a custom design. These are designed based on the company policy and internal regulations.

What is the Importance of Payslip?

A payslip is not just another document; it is an important one that contributes to the individual’s professional and financial aspects, and explains the profit and loss statements. Proper financial documentation, including AP & AR outsourcing, ensures that businesses maintain accurate records of incoming and outgoing payments. Here’s why it is important:

- Proof of Income: Payslips serve as income proof, which is needed when the employee applies for a loan, credit card, rental of a house, or even a purchase. It showcases that the person has a steady source of income and is capable of paying the amount on time. Keeping financial statements well-organized is essential for both employees and business owners, making year-end accounts & CT returns services crucial for accurate reporting.

- Taxation and Compliance: Employees use payslips to apply for tax deductions and payments. The government asks every citizen to submit their payslip for compliance, claim deductions, and to ensure that they follow labor laws and tax regulations. In such cases, be informed about tax reference numbers too. Businesses and individuals can benefit from tax outsourcing to streamline their tax filing and compliance processes.

- Transparency: The payslips are presented in a well-documented format to ensure transparency between employers and employees. It gives employees confidence in the company they work for.

- Employee Benefits and Retirement Planning: Employers put a portion of employees’ earnings in employee benefit programs, pension schemes, and provident funds. The payslips highlight all these components clearly, which helps individuals keep track of their savings.

These are the benefits of payslips. In case your employer does not issue one, ask them to generate it for you so that you can keep a record of your income and professional life.

Understanding the Components of Payslip

Payslips contain many professional and legal elements that are hard to understand for ordinary people. However, reading and understanding the terms listed on the payslip is highly crucial. Here’s the solution: we have explained all these terms in a simple way in this section.

- Base Salary: The set sum disbursed prior to any bonuses or deductions.

- Allowances: Comprises housing rent allowance (HRA), cost of living allowance (DA), medical benefits, travel reimbursement, and performance-related rewards.

- Overtime Compensation: Payment for additional hours worked beyond regular working hours

- Income Tax (TDS): The tax withheld at the source according to government guidelines.

- Provident Fund (PF): Worker contributions for their retirement savings.

- Professional Tax: A small fee imposed by certain state governments.

- Health Coverage: Deductions for health insurance and life insurance plans offered by the employer.

- Loan Repayment: Any withholdings for salary advances or corporate loans obtained by the employee.

- Net Pay or Take-Home Salary: This is the ultimate sum an employee gets after all deductions. It is deposited into the employee’s bank account on the day of payment

Now that you know what the terms mean, it will get easier to read and understand your payslip. Please note that your payslip must contain all the information accurately, including the calculations, numbers, and name.

So this is all about payslips, their template, their importance, and how to read them. We hope this blog will help you read and check your monthly or annual payslip in a better way moving forward. Share the info with your friends and family to educate them too!